Nvidia Corp.’s monetary chief causes that the efficiencies companies want usually are not from spending much less cash, however from spending extra on applied sciences like synthetic intelligence, whilst chip gross sales dry up.

“AI is in an inflection point,” Nvidia’s

NVDA

Colette Kress informed Morgan Stanley’s Technology Media and Telecom Conference on Monday. “We’ve now incurred a point in time with generative AI, in particular with [OpenAI’s] ChatGPT, that folks understand, and just some of the most simple cases how this can benefit them — benefit them from a use case as a consumer, or an enterprise on thinking about how they can develop AI within their universe as well.”

In that vein, Kress made the pitch that tightening the belt was not at all times one of the simplest ways to economize, seeing that the latest soar in curiosity in ChatGPT taxed many public servers’ capability.

“When you think about these economic times, it’s both a time for folks to focus on their budgets or focus on what they’re spending on,” Kress stated. “However, they’re still working on efficiencies of how they’re using their money, how they’re using their capital.”

“The focus on accelerated computing, no matter how you look at it, is always going to be an improvement of efficiency and the use of their money,” Kress stated. “The amount of money that they save in terms of moving to accelerated, not only is it more efficient just from a computing standpoint, but you’re spending less.”

Read: Nvidia provides to AI hype with new cloud-based service, inventory jumps on forecast

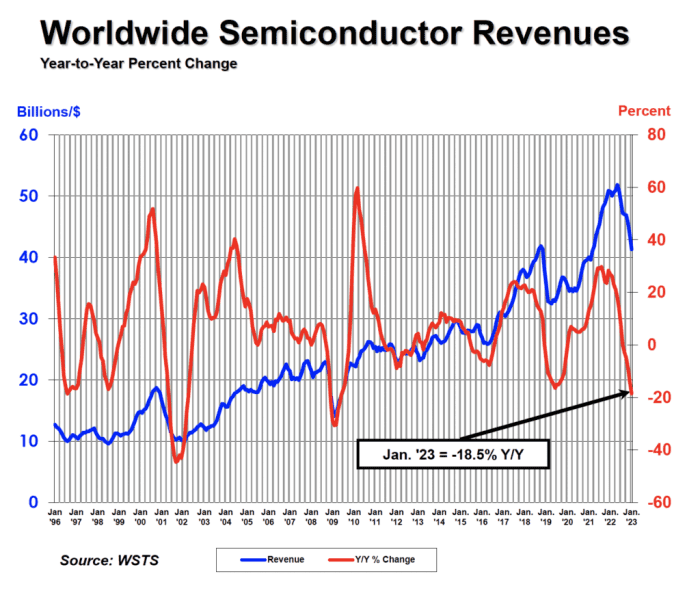

But clients are already spending much less. The Semiconductor Industry Association stated Friday that international chip-industry gross sales for January fell 18.5% to $41.3 billion from a yr in the past and 5.2% from December 2022’s $43.6 billion.

“Despite record-high sales in 2022, the global semiconductor market cooled considerably during the second half of the year, and that trend continued during the first month of 2023,” stated John Neuffer, SIA president and CEO. “Despite the current short-term cyclical downturn, the long-term outlook for the semiconductor market remains strong due to the ever-increasing role of chips in powering the critical technologies of today and tomorrow.”

SIA

Looking at SIA knowledge, Bernstein analyst Stacy Rasgon famous that month-over-month knowledge was worse than typical seasonality and that memory-chip gross sales — these from corporations like Micron Technology Inc.

MU

— fell 58.6% year-over-year.

For Nvidia, “opportunities around data center, software and auto remain early, and large,” Rasgon stated, even with gaming headwinds and near-term China sentiment; Broadcom “has a good narrative & margin of safety with semi revenue visibility, software offering support, cash deployment, superb margins & [free cash flow], & attractive valuation;” and Qualcomm struggles in opposition to “a weak market and channel flush … impacting near-term trajectory, however the shares stay very cheap and setup into 2024 appears to be like good as issues normalize and Apple Inc.

AAPL

enterprise hangs round.”

For AMD, “the server story is working, though PC weakness (and potentially damaging behavior from their competitor) is weighing, and margins may face headwinds,” and Intel’s “long-term structural issues have finally broken to the forefront,” Rasgon wrote.

Rasgon has outperform scores on Nvidia, Qualcomm, and Broadcom, market-perform score on AMD, and an underperform score on Intel.

Read extra: The world is shopping for fewer gadgets, and inventories for PCs, telephones and tablets are constructing

Citi Research analyst Christopher Danely wrote in a word final week that “half” of the chip glut — PCs and wi-fi — has been labored by means of, evidenced by the large stock fees taken by chip makers like Intel Corp.

INTC,

Advanced Micro Devices Inc.

AMD,

Nvidia and Qualcomm Inc.

QCOM

in latest earnings studies. Qualcomm’s forecast predicted that stock points would persist into June.

According to Danely, that different “half” — the more and more necessary data-center market, sustained by public-cloud suppliers like Amazon.com Inc.

AMZN,

Microsoft Corp.

MSFT

and Alphabet Inc.’s

GOOG

GOOGL

Google, and the auto and industrial markets that have been starved of chips throughout the pandemic, those equipped by Texas Instruments Inc.

TXN

and NXP Semiconductors NV

NXPI

— are due for a correction.

The PHLX Semiconductor Index

SOX,

which tracks 30 parts of the semiconductor {industry} and counts Nvidia and third-party fab supplier Taiwan Semiconductor Manufacturing Co.

TSM

amongst its largest, final peaked on Dec. 27, 2021, when it closed at a file 4,039.51. Slightly greater than a yr in the past, the sector then dropped from these file highs to inside bear-market territory in a month — and are nonetheless 26% off these highs — as fears of a glut started to set in with Wall Street.

Over the previous 12 months, nevertheless, the SOX index is barely down 8% — given 2023’s sturdy yr out of the gate, with an 18% acquire — whereas the Dow Jones Industrial Average

DJIA

has slipped lower than 1% over the previous 12 months, the S&P 500 index

SPX

has declined 6.5%, and the tech-heavy Nasdaq Composite Index

COMP

has fallen 12%.

Source web site: www.marketwatch.com