Stocks appear like ending the week on the again foot after a current batch of stronger-than-expected financial information triggered additional hawkish Fed chatter.

This isn’t a terrific situation for the “pessimistic bulls,” the title Gavekal Research’s chairman and chief economist Anatole Kaletsky provides to these buyers who contemplate themselves “cautiously pessimistic because they anticipate an early U.S. recession.”

In reality, he provides, they’re really “wildly bullish” as a result of they hope any financial contraction will assist to swiftly trim inflation and permit the Federal Reserve to start out slicing rates of interest by the summer season. This in flip will spark a rebound in each bonds and shares to the vary loved earlier than Russia invaded Ukraine.

Unfortunately for this tribe, a U.S. recession within the subsequent few months is sort of inconceivable, reckons Kaletsky, and if something the economic system is prone to decide up velocity later in 2023.

Here are the ten causes he believes this to be the case. It’s an extended checklist, so presenting a few of Kaletsky’s textual content as bullet factors is important.

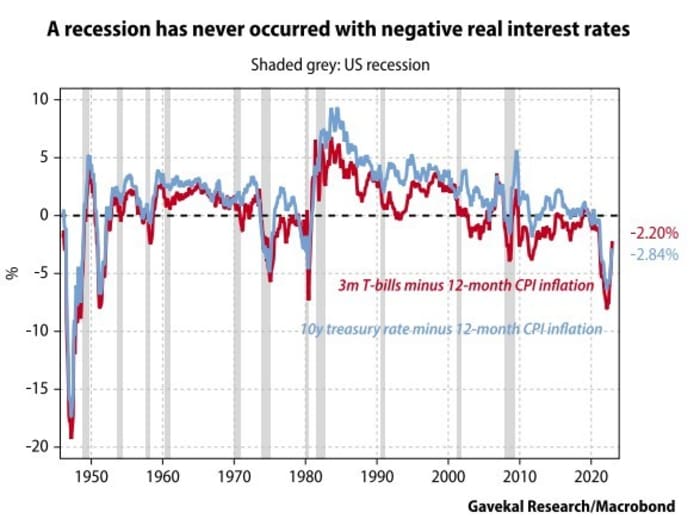

- In the post-war period, a U.S. recession has by no means begun with actual rates of interest deeply unfavorable throughout the yield curve. If we concentrate on the extent of rates of interest as an alternative of the speed of change, this financial tightening remains to be the mildest in any cycle because the Nineteen Fifties.

- Real lengthy charges will stay unfavorable even after the Fed funds price reaches 5%. The U.S. yield curve is so deeply inverted that actual lengthy charges will stay unfavorable even when inflation falls under 5% — except the curve quickly disinverts. Neither of those occasions is probably going within the months forward.

- Yield curve inversion isn’t a helpful recession indicator. Inversions preceded all U.S. recessions since 1970, however there have been a number of false or very untimely predictions (in 1966, 1978, 2006 and 2019, except you imagine that COVID got here from Wall Street, not Wuhan).

- The U.S. labor market is just too robust for a recession.

- Aggregate actual revenue has grown even whereas common actual wages have fallen. That’s as a result of “rapid employment growth has more than offset the decline in real wages.”

- Real wage progress will quickly flip optimistic. With the labor market nonetheless extraordinarily tight, wage features ought to proceed above 5% for the following few months whereas value inflation ought to ease to under 5%, except there’s one other oil shock.

- The inventory of private financial savings remains to be far above regular, because of authorities COVID handouts and cutbacks in consumption throughout lockdown. The order of magnitude is mostly agreed to be $1-2 trillion, equal to between 5% and 12% of U.S. family consumption.

- Housing is now stabilizing. Today’s 30-year mortgage price is decrease than at any time in U.S. historical past earlier than the 2004-07 housing bubble.

- Activity is shifting from items to providers. Big losses in manufacturing are compensated by smaller features within the a lot bigger service sectors. The internet result’s that the economic system continues to develop.

- A U.S. recession in 2023 is “too good to be true.” If a light U.S. recession occurs this 12 months, as most buyers now count on, it can show that Goldilocks, the Magic Money Tree and “immaculate disinflation” are severe economics, not simply myths and fairy tales. If so, we’ll all need to rethink what we thought we knew about fiscal prudence, sound financial administration and tough political trade-offs.

Source: Gavekal Research.

So, in abstract: no recession, Kaletsky thinks. “This means that the real question about monetary policy in the U.S. this year is not when the Fed will start easing. It is whether the Fed will decide in the summer to tighten substantially further, or to accept permanently higher inflation—in either case precipitating a second plunge in bond and equity prices,” says Kaletsky.

Markets

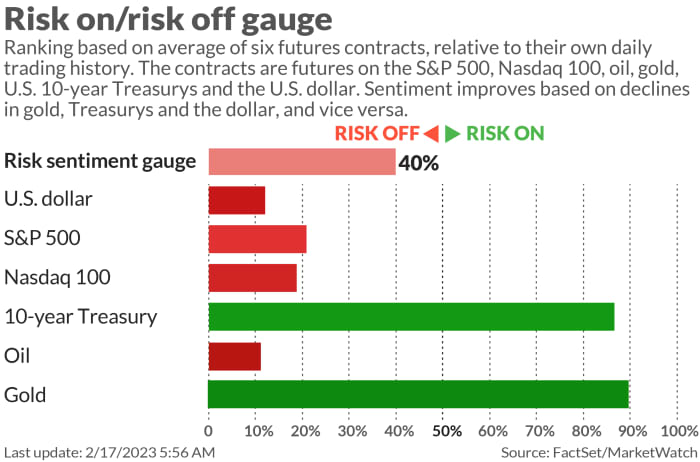

Stocks had been in line to increase Thursday’s losses with S&P 500 futures

ES00

down 0.7%. Ten-year Treasury yields

BX:TMUBMUSD10Y

rose 3.8 foundation factors to three.900% as buyers continued to concern inflation will stay stubbornly excessive. The greenback index

DXY

added 0.6% and gold

GC00

fell 1.1%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

China Renaissance shares

HK:1911

plunged by greater than 50% at one stage on Friday after the corporate revealed its chief govt and majority shareholder Bao Fan has gone lacking.

Traders can be eyeing the index of main financial indicators for January due at 10 a.m. We’ll additionally hear from two extra Fed officers, Richmond Fed President Tom Barkin and Fed Gov. Michelle Bowman, forward of the lengthy vacation weekend in observance of Washington’s Birthday on Monday.

Shares of Manchester United

MANU,

one among England’s most profitable soccer golf equipment, are within the highlight forward of Friday’s deadline for takeover bids. Entities from Saudi Arabi, Qatar alongside Jim Ratcliffe, the British billionaire proprietor of petrochemicals large INEOS, are believed to have an interest.

DoorDash

DASH

is up 6% in premarket motion after delivering well-received outcomes. Deere shares

DE

are up 3% after the tractor maker reported fiscal first-quarter revenue and income that beat expectations by a large margin.

Going within the different course is Moderna

MRNA,

down 6% after revealing disappointing outcomes for a flu vaccine.

In a lift to European companies and households, the area’s benchmark pure gasoline costs have fallen under 50 euros for the primary time in 17 months.

Best of the net

A stock-market disaster within the making.

How did Hindenburg brief Adani inventory.

Help, Bing gained’t cease declaring its love for me.

The chart

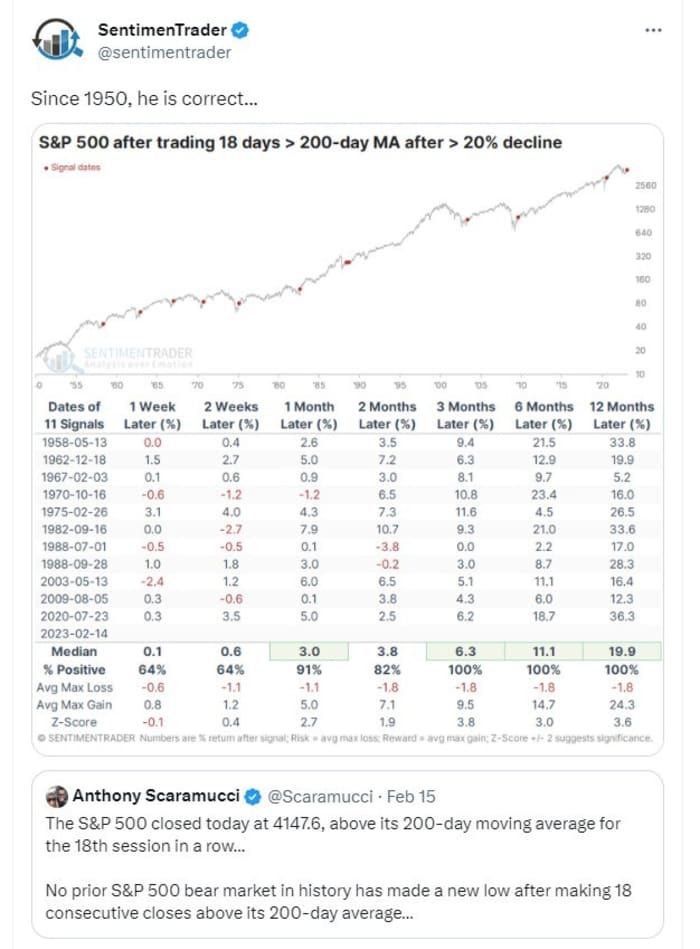

Rules are made to be damaged in markets, however bulls will hope that this tweet by hedge fund supervisor Anthony Scaramucci and response from SentimenTrader illustrates a phenomenon that may maintain.

Source: The Chart Report

Top tickers

Here had been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| GME | GameStop |

| AAPL | Apple |

| APE | AMC Entertainment most well-liked |

| BABA | Alibaba |

| NIO | NIO |

| NVDA | NVIDIA |

| MULN | Mullen Automotive |

Random reads

Bankrupt Alex Jones spends almost $100,000 a month.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source web site: www.marketwatch.com