For 5 years, most Americans have seen decrease income-tax charges and tapped a much bigger normal deduction, however with out congressional motion earlier than the top of 2025, the foundations might nonetheless revert to ranges set lengthy earlier than the pandemic blindsided households and inflation raged.

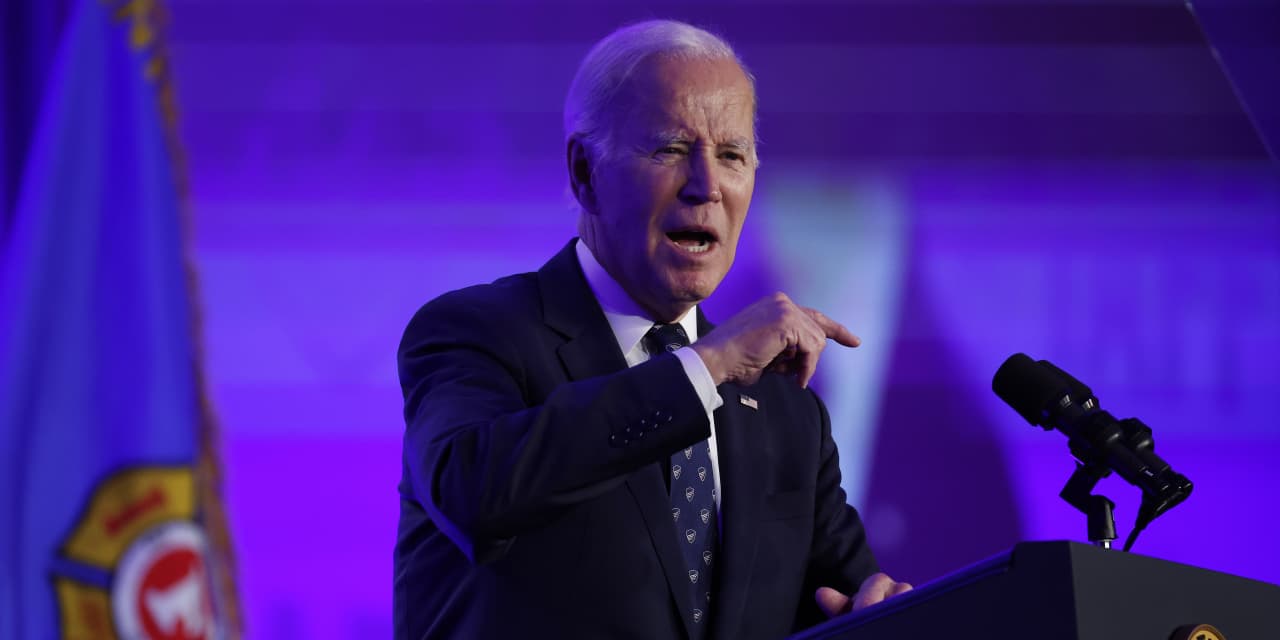

On Thursday, President Joe Biden is unveiling a finances that particulars his newest makes an attempt to tax the highest of the earnings ladder. That features a plan to lift the speed on the taxes related to Medicare for households making over $400,000. Other anticipated proposals might embody a billionaire minimal tax and quadrupling the present 1% inventory buyback tax — two concepts he’s touted.

There’s slim likelihood Biden’s tax-hike proposals develop into regulation anytime quickly, contemplating the Republican majority within the House. It’s about political messages forward of the 2024 presidential race, in line with observers.

Trump’s tax cuts for the wealthy will quickly come to an finish

But the solar will quickly set on Trump-era tax guidelines associated to marginal charges, normal deduction quantities, the kid tax credit score and different provisions. These guidelines have been a part of Trump’s Tax Cuts and Jobs Act of 2017, a regulation overhauling income-tax guidelines for people, estates, small companies and firms.

“I view the 2025 expiring tax provisions as this hurricane we already see on the radar and it’s slowly approaching,” stated Jennifer Acuña of KPMG, the tax, advisory and accounting agency. Acuña is a principal on the agency’s federal legislative and regulatory providers group in its Washington National Tax follow.

“ ‘I view the 2025 expiring tax provisions as this hurricane we already see on the radar and it’s slowly approaching.’ ”

“We’re talking about middle-class taxpayers across the board who are going to be affected by this,” stated Acuña who, as a high lawyer within the Senate Finance Committee, helped draft the 2017 regulation.

What occurs when the TCJA provisions expire in 2025 will spark a brand new spherical of debates between the Republicans and Democrats on tax breaks for the wealthy, stated Jorge Castro of the regulation agency Miller & Chevalier, and co-lead of the agency’s tax coverage follow. “You are going to see a lot back and forth beginning this year,” he added.

Erica York, senior economist and analysis supervisor on the Tax Foundation, a right-leaning tax-policy assume tank, added, “2025 is going to going down as a very messy year for tax policy.”

Republican lawmakers have been introducing legal guidelines in an try and make the Trump-era tax-law modifications everlasting. One invoice, the TJCA Permanency Act, has over 70 co-sponsors within the House.

Portions of the Trump tax cuts have lightened the tax burden for broad arrays of households, stated Steve Wamhoff, federal coverage director on the left-leaning Institute on Taxation and Economic Policy. “The higher you go up the income ladder, the more you get from making these tax cuts permanent,” he stated.

The White House and congressional finances proposals ought to all be speaking about these expiring provisions and the best way to pay for them if they’re being prolonged, stated Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

“Budgets that ignore these expirations are likely to paint an overly rosy outlook, as extensions without offsets would dramatically worsen the fiscal outlook,” she stated in a press release.

What occurs subsequent will hinge on who’s president in 2025, which occasion controls Congress and the way heavy a task the nation’s money owed will play, consultants say. Some expiring provisions might provide paths for settlement. For others, it’s an open query.

Here’s a glance:

Standard deduction

The normal deduction almost doubled underneath the 2017 regulation. In 2018, the usual deduction elevated to $12,000 from $6,500 for particular person filers and jumped to $24,000 from $13,000 for married {couples} submitting collectively.

The deduction is up to date for inflation yearly. As a end result, for the income-tax returns persons are submitting now, the usual deduction is price $12,950 for people and $25,900 for joint filers.

As the usual deduction went up, extra folks used it. That’s as a result of itemizing is sensible solely when the sum of itemized deductions outweigh the usual deduction’s quantity.

Around two-thirds of particular person returns took the usual deduction within the 12 months earlier than the increase, IRS statistics present. Approximately 90% of particular person returns took it final submitting season, IRS numbers present.

An ordinary deduction that is still bigger could possibly be low-hanging fruit with bipartisan enchantment, Acuña stated. “It’s worked pretty well. It has really simplified the filing process and it’s been less polarizing.”

Income-tax charges

The TCJA lowered 5 of the seven income-tax charges and shifted the earnings ranges on when households bump as much as the following bracket. Only the ten% fee on the backside finish and the 35% fee close to the highest have been unchanged.

The high fee decreased to 37% from 39.6%. Biden pressed for a return to the 39.6% fee as each a candidate and as president. “The biggest fights are going be about provisions that affect the wealthy,” York stated.

As for lower-rung tax charges? “I can see there being political will from both political parties to extend that,” Castro stated. “No one wants to raise taxes on lower- and middle-class families.”

But even when there’s settlement to maintain taxes decrease for low- and moderate-income households, the small print will get difficult shortly contemplating the tax income at stake, Acuña stated. “Any slight modification, it just costs a lot of money,” she famous.

Child tax credit score

Before the TCJA, the kid tax credit score paid $1,000 per little one, with a phase-out kicking in at $75,000 for people and $110,000 for married {couples}. The regulation doubled the quantity and pushed the earnings eligibility phase-out again a lot farther. But the credit score is partially refundable, which means taxpayers wanted earned earnings and tax legal responsibility to unlock the total fee.

The American Rescue Plan of 2021 modified that for a 12 months. Payouts jumped to $3,600 per little one underneath age 6 and $3,000 for ages 6 to 17. Half of the quantity was paid in month-to-month installments and the remaining within the tax-year 2021 refund. The credit score grew to become absolutely refundable, pausing an earned earnings requirement.

The credit score is already the topic of debate — significantly the earned earnings necessities. The enhanced credit score’s supporters have already tried a number of instances to revive it, most lately on the finish of 2022. “The appetite for lawmakers to come together on that is uncertain,” York stated.

Broadly talking, each side of the aisle need to lengthen tax reduction to households elevating children, Castro stated. Yet agreeing to the combo of eligibility guidelines and fee quantities would be the open query, he famous.

State and native tax deductions

While the TCJA elevated the usual deduction, it curbed some itemized deductions and the restricted the state and native tax deduction to $10,000. The deduction was beforehand limitless and if tax guidelines went again to the place they have been, the cap would come again off.

The $10,000 cap was controversial from the beginning, prompting lawsuits from a number of Democratic-led states. (The litigation was unsuccessful and the Supreme Court final 12 months refused to take the case.)

There is a bipartisan band of lawmakers in states with larger state and native taxes, generally known as the SALT caucus. But will the SALT cap come again off? “That’s probably a jump ball right now,” Castro stated.

Tax guidelines for small enterprise house owners

While the TCJA completely reduce the company income-tax fee to 21% from 35%, the regulation additionally allowed eligible taxpayers a 20% deduction on certified enterprise earnings.

As firms obtained a everlasting tax reduce, the thought was giving pass-through companies, together with small companies, tax reduction as properly, York stated.

For instance, round 75% of the members within the National Federation of Independent Business, a small-business commerce and advocacy group, arrange their enterprise as entities that go earnings via to its house owners or companions.

The deduction applies to companies fashioned as restricted legal responsibility corporations, partnerships, sole proprietors and S firms. If tax guidelines lapse again, the 20% deduction would go away and the enterprise house owners’ income-tax fee would additionally return up, York stated.

Critics, like Wamhoff, are fast to notice that there’s a variety of very well-off taxpayers who can profit from tax guidelines billed as a profit to small enterprise. The guidelines are difficult and “a lot of this tax break is designed for when someone is successful, it makes things easier for them.”

One doable end result could possibly be a narrower model of the tax guidelines tucked in Section 199A, stated Acuña. But nothing’s for certain. Compared to the prospect of an ordinary deduction that stays bigger, “that one is a lot more polarizing,” she stated.

Source web site: www.marketwatch.com