Rude Europeans used to inform tales, probably apocryphal, about American vacationers who would ask for instructions to a well-known landmark whereas truly standing proper in entrance of it.

The Parisian would take a look at the couple, take a look at the huge iron construction towering instantly above them, and marvel how on earth Americans received the struggle.

Don’t giggle.

Based on their dealing with of Social Security, the 535 individuals in Congress are even worse.

So allow us to rejoice a momentous occasion that quietly occurred final week, when immediately a couple of overpaid legislators in Washington seemed straight up and stated, “oh, wow—do you think that’s it?”

Read: What most individuals get flawed about Social Security

The topic underneath dialogue is the monetary disaster hurtling towards America’s pension plan. The Social Security belief fund faces an accounting gap of about $20 trillion. It is predicted to expire of money in a couple of decade—at which level advantages may very well be minimize throughout the board by 20%. This drawback has been looming for years.

People on the “blue” crew say the issue is that taxes are too low, particularly on “millionaires and billionaires.”

Meanwhile individuals on the “red” crew say, no, the true drawback is that advantages are too excessive. (For all people else, however not for you, naturally.)

It actually has resembled nothing a lot as a vacationer couple in Paris arguing over a map.

So let there be rejoicing within the streets. At final! At final! Some senators and Congressman have immediately seen the huge, apparent reply towering proper above them.

It’s the investments, silly!

A bipartisan group of senators is immediately speaking about possibly, simply possibly, stopping an important pension fund in America from blowing all our cash on horrible, low-returning Treasury bonds.

Congressman Tim Walberg Is additionally speaking about one thing comparable.

There is not any thriller about why Social Security is in bother. None.

Social Security invests each nickel in U.S. Treasury bonds on account of a political maneuver by Franklin Roosevelt within the Nineteen Thirties, who used the brand new program to sneak some further taxes. It could even have appeared an affordable funding alternative again then, just some years after the horrible inventory market crash of 1929-32.

But it’s a catastrophe. A sheer, unmitigated catastrophe.

No state or native pension plan does this. No personal pension plan does this. No college endowment does it. No worldwide “sovereign-wealth fund” does it.

Oh, and not one of the millionaires or billionaires in Congress or the Senate does it both. These individuals blowing your financial savings on Treasury bonds? The ones saying there is no such thing as a various?

They have their very own loot within the inventory market.

Of course they do.

Oh, and no monetary adviser in America would advise you to maintain all and even most of their 401(okay) or IRA in Treasury bonds both, except possibly you wanted all of that cash throughout the subsequent few years.

For a long run investor they’d urge you to maintain a lot or most of your cash in shares. For a quite simple purpose: Stocks, whereas extra unstable, have been a lot, a lot better investments over just about any interval of about 10 years or extra.

Read: ‘I don’t assume I can wait till 70’: I’m nonetheless working at 66. Should I wait or declare Social Security now?

Even first yr Finance 101 college students know that Treasury bonds are protected haven however a poor supply of long-term returns. This is fundamental stuff.

Don’t imagine me? Try some easy numbers.

Since the Social Security Act was handed in 1935, the U.S. inventory market has outperformed U.S. Treasury bonds by an element of 100.

A greenback invested in Treasury bonds in 1935, with all of the curiosity reinvested (and no taxes), would have grown to $52 at the moment.

A greenback invested within the S&P 500 on the identical time? Er…$5,700.

No, actually. 100 instances as a lot.

And over any given 35 years—which means, roughly, the size a typical employee may pay into Social Security—shares outperformed bonds on common by an element of 5.

Bonds ended up round 800%. Stocks: 4,000%.

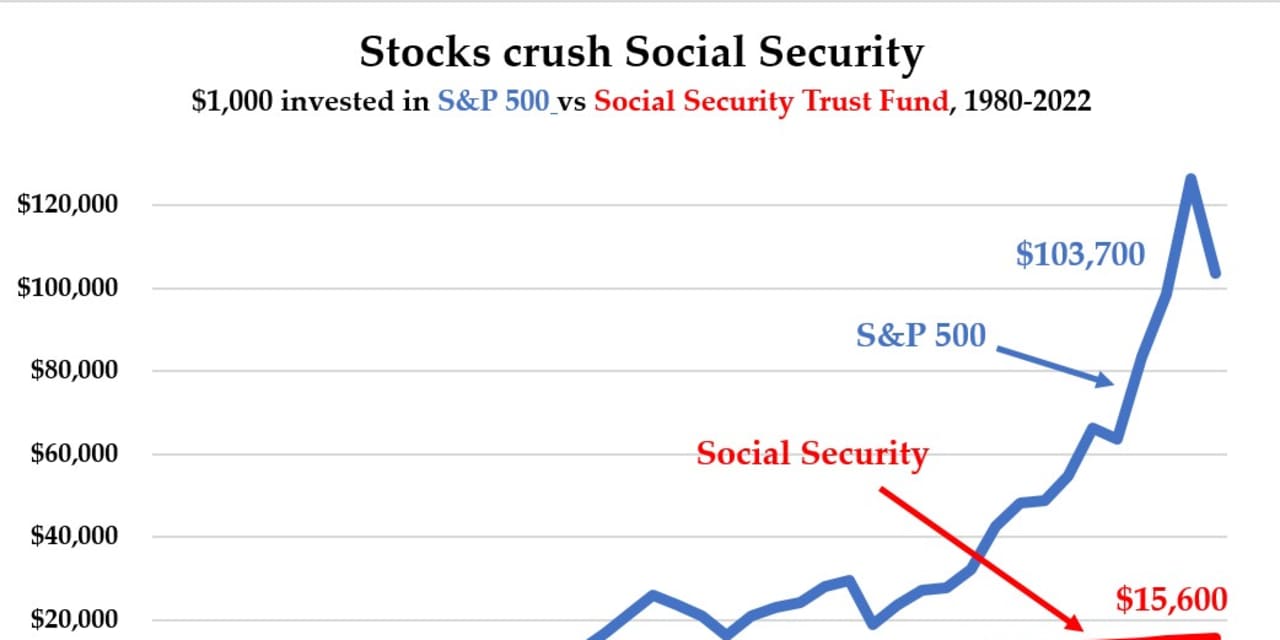

The chart above exhibits what would have occurred since 1980 should you’d invested $1,000 within the Social Security belief fund and one other $1,000 within the S&P 500.

It’s not even shut. As you may see, we’re taking a look at outperformance by a couple of issue of seven. The S&P 500 beat Social Security by roughly 700%.

(These are utilizing the numbers revealed by the Social Security Administration.)

Or simply take a look at precise pension funds.

In the previous 20 years, says the National Conference on Public Employee Retirement Systems, the typical U.S. state or native pension fund has produced greater than 2-1/2 instances the funding returns of Social Security: 320% to 120%.

Social Security doubled your cash. America’s different public pension funds quadrupled it.

But yeah, certain, the true drawback with Social Security is the taxes. It’s the advantages. It’s all of the peasants residing too lengthy. That’s the issue.

This is sort of a drunken driver totaling 10 automobiles in a row and blaming the transmission. Or possibly the upholstery.

If any personal sector pension plan invested in the identical means, the individuals operating it will be sued into oblivion for breach of fiduciary responsibility. A monetary adviser who stored all his shoppers in Treasury bonds all through their profession could be drummed out of the enterprise.

None of the options want contain investing the entire thing within the S&P 500

SPX,

or (a lot better) a world inventory market index fund. It’s not about one excessive or one other. Most pension funds are about 70% invested in shares, 30% in bonds.

But even a 30% allocation to shares within the Social Security belief fund would have doubled complete returns since 1980. No kidding.

If they’d made this alteration a era or two in the past, there could be no disaster. Nobody could be speaking about increased taxes, decrease advantages, or working into our 70s.

It actually isn’t difficult. At final, solely about 80 years too late, some individuals in Washington could also be getting a clue.

Source web site: www.marketwatch.com