If you pay a 1% administration payment for a monetary skilled to deal with your funds, you seemingly count on that recommendation to yield way over it’s costing you. But how would you recognize?

There’s nobody quantifiable measure of success for all of the parts that go into monetary planning. Some analysis papers have tried to place a quantity on it, like 1.5% of belongings, or so forth, however that’s largely for funding efficiency. If you pay in any capability for monetary recommendation, you’re additionally going to get providers like retirement and tax planning, funding choice and property planning. Beyond that, there are financial components at work which are out of the management of people, even ones who’re alleged to have coaching and experience within the area.

Your adviser might have performed a improbable job in 2022 and you continue to misplaced cash as a result of each shares and bonds have been down considerably. In the previous, that very same particular person might have been doing a awful job and also you would possibly nonetheless have made way over you have been paying. And sooner or later? There’s merely no manner of figuring out.

“People have tried to say how many basis points of value you get from financial advice, but it’s so dependent on an individual’s particular circumstances,” says Roger Young, thought management director at T. Rowe Price. “How much do you benefit from the huge category of coaching and behavioral improvement? It’s very hard to measure.”

T. Rowe Price went by way of an train to attempt to see how prospects worth monetary recommendation as a manner of making an attempt to determine the predictors of what would get individuals to pay for recommendation. The survey outcomes present that folks have a tendency to not place a lot worth on the monetary planning providers which are hardest to see a financial return, like day-to-day cash administration, goal-setting and ongoing assist and training.

Retirees have been much more more likely to pay for monetary providers than individuals nonetheless working, with 45% paying versus simply 26%. Those retirees who have been already working with advisers have been most curious about funding administration—funding choice, asset allocation and rebalancing.

Those providers, not coincidentally, are those the place it’s most simple to see a quantitative return on funding, particularly at larger earnings ranges. “You can show stats of how well we’ve done, and that’s an area where we can see evidence of the value of using an asset manager that can potentially exceed fees we pay,” says Young.

The tax planning conundrum

Surprisingly, tax planning fell low on the record of issues individuals need to pay for, particularly when T. Rowe Price did statistical evaluation of the survey outcomes.

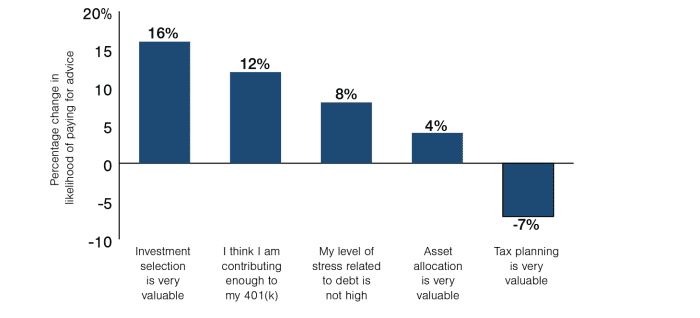

Subjective Responses Most Highly Related to Paying for Advice (in contrast with solely contemplating paying)

Source: T. Rowe Price

“For people still working, tax planning was second-highest in terms of being rated as very valuable, but at the same time, when you control for everything else, valuing tax planning didn’t drive people to seek advice and was kind of a negative,” says Young.

While T. Rowe Price didn’t seize a definitive motive for this, Young surmises that it’s as a result of individuals don’t consider tax planning as a part of monetary planning, and consider it largely as in-the-moment assist filling out their yearly tax types.

“Tax planning is definitely important to people,” says Young. “It’s a matter of where they are going to get that help.”

Is anybody listening?

Financial planning can also be a matter of the consumer heeding the recommendation given, and possibly that’s the place among the perceived worth will get misplaced for the behavioral features that scored low on T. Rowe Price’s research. Just hiring knowledgeable will not be sufficient; the consumer has to know the recommendation and implement the solutions to be able to decide if it’s worthwhile.

“That’s where the rubber meets the road,” says Cary Carbonaro, an authorized monetary planner and director of ladies and wealth for Advisors Capital Management Wealth Services. “My job is to let you sleep at night and help keep you from making bad decisions.”

But not everybody listens, Carbonaro has discovered, and people purchasers maintain her up at night time. “Sometimes you can’t get through to them. That just kills me. I just eat myself up over it,” she says. “They’ll sell when the market’s down, cash out IRA and pay penalties and taxes because they want to buy something. They’ll put their whole life and future in jeopardy.”

During the market dip of 2020, she was in a position to persuade 11 out of 12 purchasers who needed to money out to remain invested. The ones who listened ended up rebounding and have been joyful. The twelfth, not a lot. Last yr, everybody misplaced cash, regardless of Carbonaro’s greatest efforts.

“If I‘m just being judged on market performance, it’s hard. But I believe I’m doing more,” says Carbonaro. “If you listen to me and I can talk you out of the bad ideas, I will keep you on track for the rest of your life and you will meet your goals.”

More from MarketWatch

Source web site: www.marketwatch.com