Fresh knowledge confirmed China’s financial system knocked it out of the park early this yr, as its strict pandemic lockdown ended. That could also be giving a carry to U.S. inventory futures for Tuesday, probably bringing the S&P 500 one step nearer to these February highs.

But buyers might not need to get too far forward of themselves with the majority of earnings season but to return, and recession worries lingering. Credit Suisse’s Andrew Garthwaite tells purchasers “recession risk is flashing bright red,” retaining them cautious on shares, whereas JPMorgan’s Marko Kolanovic warns even a light recession might imply equities appropriate by 15%.

Also grabbing some limelight as of late is the King Dollar, whose six-month rally got here to a grinding halt in current weeks. As MarketWatch’s Joseph Adinolfi factors out, a lot of that is because of expectations Fed hikes will quickly be over, although hypothesis of the greenback’s early demise may additionally be enormously exaggerated.

That brings us to our name of the day from a workforce of analysts at Citigroup, led by Maximilian J Layton, who see extra greenback weak spot forward, which is nice news for a shiny asset much less usually within the highlight.

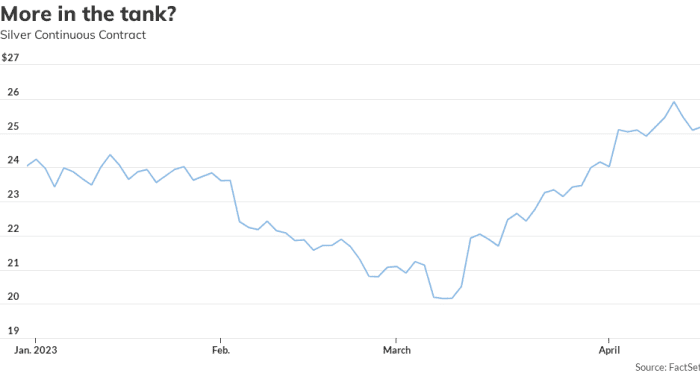

“Silver

SI00,

has already rallied 20% in a brief time frame, however we predict it has one other >10% transfer within the tank over the approaching months to $30/ounce, with our bull case of $34/ouncestill a definite risk over the subsequent 6 -12 months,” Layton and the workforce informed purchasers in a observe.

The analysts see many basic drivers of the valuable metallic’s bull market but to totally play out, together with extra draw back for the greenback and rates of interest, and elevated investor curiosity in valuable metals within the coming months.

Layton and the workforce observe since mid-March, December silver futures

SIZ23,

are up 13.6% to round $26.02 an oz., inside their $28 goal. They are lifting their prior “bullish” 0 to three month forecast to $28/ozfrom $24/oz, their six-month forecast to $30/ozfrom $28/oz, and a one-year worth goal to $27/ozfrom $25/oz.

“Precious metals and especially silver has near perfect conditions for the ongoing bull market,” they are saying, noting that the elemental story is corresponding to what was seen within the second half of 2007 and early 2008 —weaker developed markets and stronger rising markets. Those circumstances have marked main valuable bull markets of the previous 20 years, they added.

Speculative curiosity in silver, reminiscent of futures motion and exchange-traded funds, additionally has a lot additional to run, says Layton and the workforce. The worth of that curiosity proper now quantities to about $7 billion, whereas prior silver bull markets have seen it within the ballpark of $12 billion to $26 billion.

“ETF buying seems strongly negatively correlated with U.S. real interest rates and thus a significant move lower in real rates could provide a large move higher during 2023,” mentioned Citi.

And it’s an asset that’s vulnerable to dramatic features as soon as buyers get up, because the market is tiny relative to the size of speculative curiosity. Examples of that dramatic worth motion: a three-week rally in July 2020 that noticed costs climb to $29/ozfrom $19/ozor a 166% surge between August 2010 and April 2011 when costs shot to $48/ozfrom $18/oz.

Investors can get publicity to silver by way of the futures markets, and even cash, however there are additionally loads of ETFs to select from: Global X Silver Miners ETF

SIL,

up 11% yr so far, ProShares Ultra Silver

AGQ,

up 5% and iShares Silver Trust

SLV,

up 4%, to call a couple of.

Read: Speculators wager the U.S. greenback is poised for a rebound after longest shedding streak in 3 years

The markets

Stock futures

ES00,

YM00,

NQ00,

are greater, whereas Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

are decrease, together with the greenback

DXY,

Gold

GC00,

and silver

SI00,

are up, and oil costs

CL.1,

are little modified. The Hang Seng

HSI,

fell 0.6%, as knowledge confirmed China’s financial system grew 4.5% within the first quarter of the yr, as consumption rebounded.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Bank of America

BAC,

inventory is up 2.8% after topping earnings estimates, whereas Bank of New York Mellon

BK,

is down 4% as earnings matched forecasts, with price income flat. Goldman Sachs

GS,

remains to be to return. Johnson & Johnson

JNJ,

is up 1% after the patron well being and pharma group beat estimates and lifted steerage.

Netflix

NFLX,

will report after the shut on Tuesday, with Tesla

TSLA,

and Morgan Stanley

MS,

anticipated on Wednesday.

Bed Bath & Beyond inventory

BBBY,

is hovering 13% in premarket, extending a bounce from Monday after the home-goods retailer inventory slid final week.

U.S.-listed Ericsson shares

ERIC,

are down 5% after the Swedish telecom gear maker’s reported forecast-beating earnings, however warned of a uneven 2023.

Bellus Health

BLU,

BLU,

shares are up 97% after GSK

GSK,

mentioned it has reached a deal to purchase the Canadian late-stage biopharmaceutical group for $14.75 a share in money.

Housing begins are due at 8:30 a.m., adopted by a speech from Fed Gov. Michelle Bowman at 1 p.m.

Games maker Capcom

9697,

surged in Tokyo due to an alternate actuality sport — Monster Hunter Now — it developed with the creator of Pokémon Go.

Best of the net

Are you submitting your taxes on the final minute? Take the MarketWatch Tax Quiz to see if you’re ready.

Apple CEO Tim Cook greeted at India’s first retailer opening by crowds and an outdated Macintosh Classic.

Employees requested about cancelled bonuses. The CEO replied, ‘Leave Pity City.’

Ramit Sethi’s 5 classes on the right way to get wealthy — from his new Netflix sequence

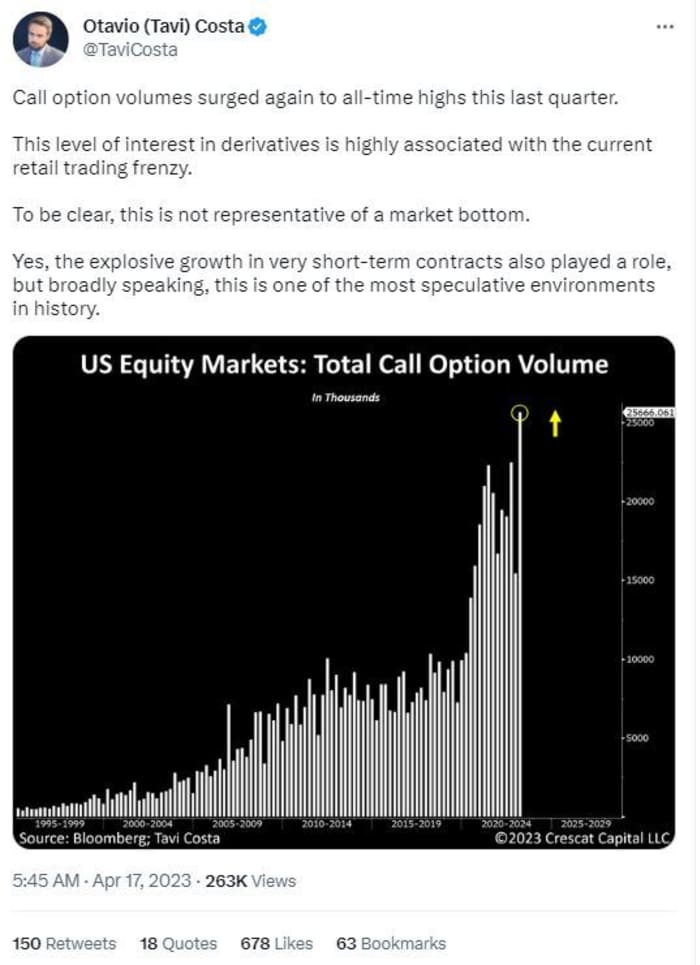

The chart

Is a retail frenzy afoot? Here’s a chart from the portfolio supervisor of Crescat Capital, Otavio Costa, on name choices, that are primarily a wager on greater costs:

@tavicosta

The tickers

These have been the highest searched tickers on MarketWatch as of 6 a.m. Eastern

| Ticker | Security title |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

BUD, |

Anheuser-Busch InBev |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

INFY, |

Infosys |

|

BABA, |

Alibaba |

Random reads

“Leave pity city.” CEO responds to worker queries on cancelled bonuses.

Not fairly the chosen one. Teen will get caught inside “the claw” machine.

Test your trash/treasure sniffer, with the Antiques Roadshow quiz.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com