What’s the perfect metaphor to explain the inventory market, that has despatched the S&P 500 up 16% from its October lows, and up 6% this 12 months?

Morgan Stanley strategist Mike Wilson has turned to the Jon Krakauer best-seller “Into Thin Air,” which chronicles the demise of 12 mountaineers attempting to scale Mount Everest. The ebook delves into the demise zone, which begins 3,000 ft from the mountain’s summit, an altitude the place oxygen strain isn’t adequate to maintain life for an prolonged interval.

“Either by choice or out of necessity investors have followed stock prices to dizzying heights once again as liquidity (bottled oxygen) allows them to climb into a region where they know they shouldn’t go and cannot live very long,” says Wilson. “They climb in pursuit of the ultimate topping out of greed, assuming they will be able to descend without catastrophic consequences. But the oxygen eventually runs out and those who ignore the risks get hurt.”

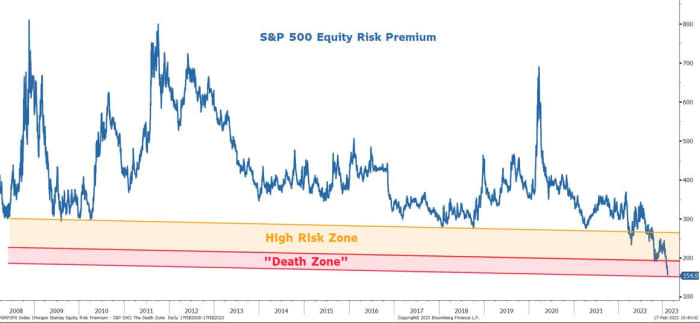

Wilson says that when shares began rising in October, they’d a lot decrease valuation, with a price-to-earnings ratio of 15 and an fairness threat premium of 270 foundation factors. The fairness threat premium is the distinction between the anticipated earnings yield and the yield on secure Treasurys, with the next quantity that means traders are being compensated extra for his or her investments in shares.

By December, nevertheless, “the air started to thin” with P-to-Es right down to 18, and the fairness threat premium right down to 225 foundation factors. “In the last few weeks of the year, we lost many climbers who pushed further ahead in the death zone,” he stated.

But then 2023 began, and “the surviving climbers decided to make another summit attempt, this time taking an even more dangerous route with the most speculative stocks leading the way,” on the defective premise of a Fed rate-hike pause, to be adopted by cuts later within the 12 months.

“Investors began to move faster and more energetically, talking more confidently about a soft landing for the U.S. economy. As they have reached even higher levels, there is now talk of a ‘no landing’ scenario – whatever that means. Such are the tricks the death zone plays on the mind – one starts to see and believe in things that don’t exist,” says Wilson.

Morgan Stanley

The “no landing” situation is one most carefully related to Torsten Slok, the chief economist at Apollo Global Management. It needs to be famous that Slok says a no-landing situation — the place the economic system doesn’t decelerate — isn’t good for markets, as a result of it’s going to require extra aggressive Fed rate-hike exercise.

Back to Wilson, who says the P-to-E ratio is now 18.6, and fairness threat premium at 155 foundation factors, that means “we are in the thinest air of the entire liquidity-driven secular bull market that began back in 2009.” He says the bear market rally that start in October from affordable costs has was a speculative frenzy primarily based on a Fed pause/pivot that isnt coming.

Granted, he says, liquidity principally boosted by Chinese and Japanese central banks has helped enhance international M2 — a measure of the cash provide — by $6 trillion since October, “providing the supplemental oxygen investors need to survive in the death zone” a bit longer.

The U.S. inventory market is closed on Monday in observance of Washington’s Birthday. Last week, the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

fell, whereas the Nasdaq Composite

COMP,

rose for the sixth time in seven weeks.

Source web site: www.marketwatch.com