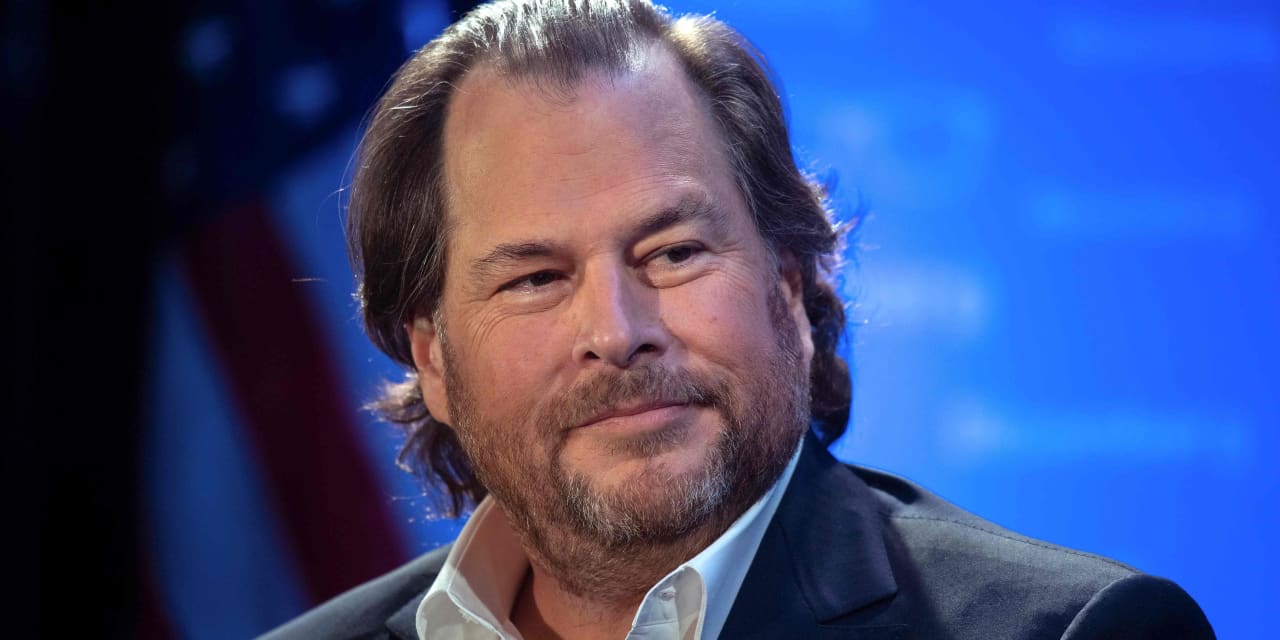

I wrote Tuesday that Marc Benioff confronted the tip of a really glad period at Salesforce Inc., with Wall Street ganging up on the software program firm as layoffs rile workers.

Benioff reached out to say it was “quite a headline,” agreeing to an interview Wednesday afternoon. He took the chance to remind me that I had been the primary reporter to put in writing about Salesforce

CRM,

when he requested Larry Ellison to go away his board in 2000, and used that reality to make a degree — that he has handled multiple boom-and-bust cycle over the previous 24 years, that means this isn’t the primary time he has needed to “reshape” Salesforce.

“This isn’t my first recession,” Benioff mentioned in our telephone interview, however that slipping into recession stays an uncertainty for the U.S. economic system.

“Every year we constantly reshape the company,” he instructed MarketWatch. “We have gone from zero to $35 billion, we have added a lot, we have lost a lot, we reshaped over 24 years.” (Salesforce is projected to hit $35 billion in fiscal 2024 income.)

Yesterday’s column: Marc Benioff’s fairy story is crumbling down and round him

Benioff was chatty and appeared in good spirits as his inventory spiked towards its finest day in additional than two years, after a blowout earnings report and a forecast that confirmed what value cuts may do for Salesforce’s backside line. While booming inventory costs fulfill Wall Street, my concern was not only for the inventory: An evidently deteriorating office tradition amid large layoffs and the activist buyers swarming into the inventory in an unprecedented method signify severe, twin threats.

Benioff disregarded any concern concerning the activists, saying “they made a lot of money today,” and forcefully argued that Salesforce’s tradition is “still very strong.”

“It’s a culture of volunteerism and giving, it is still very much alive and well,” Benioff mentioned, noting that Hawaiian-shirt Fridays are nonetheless a factor at Salesforce, as is the 1-1-1 mannequin, which dedicates 1% of fairness, 1% of product and 1% of worker time to the neighborhood.

“It is also a performance culture — we also demand high performance, to give back to the company in [employee] performance,” he mentioned, having just lately instructed the Wall Street Journal that workers pushed again in opposition to a system for performance-based layoffs via a rating system. “That is our Ohana culture.”

“Our innovation,” he continued, “is very strong, [and] we are at record-low attrition with our customers. The company has never been stronger.”

While Benioff has no plans to go away his submit anytime quickly — he mentioned he nonetheless loves Salesforce and nonetheless likes to be concerned, even when he spends most of his time aboard airplanes — he did level out that “I always have a strong successor in place, I always will.”

Benioff has named two co-CEOs in recent times, and neither managed to really take over from Benioff earlier than leaving in comparatively brief order. High-profile government departures have fueled additional questions on Salesforce’s trajectory. Co-CEO Bret Taylor was the most recent to go away, after only a yr of sharing the highest spot with Benioff.

More from Therese Poletti on Salesforce: Salesforce had higher get used to Marc Benioff in cost, as a result of he retains chasing off his chosen successors

Also see: Amid layoffs, Salesforce reportedly has been paying Matthew McConaughey greater than $10 million a yr

Taylor left “because he had a twinkle in his eye when he saw all the changes with AI,” Benioff mentioned Wednesday. “It will be something amazing,” he mentioned, referring to Taylor’s plan to discovered an artificial-intelligence firm with Clay Bavor, a former Google vp.

On Wednesday’s essential post-earnings convention name, Benioff was joined by Chief Operating Officer Brian Millham and Chief Financial Officer Amy Weaver, who each have president titles with the corporate. I discussed that the construction was just like that put in place by his mentor, Ellison, at Oracle Corp.

ORCL,

Oracle, the place Benioff spent almost a decade and a half, additionally had two presidents at one time, Mark Hurd and Safra Katz, who ultimately turn out to be co-CEOs as Ellison moved to chairman. On the decision with analysts, Benioff talked about having obtained a textual content from Ellison proper after this newest earnings report got here out, saying that Ellison has spent a number of time “giving me the Oracle playbook.”

Benioff referred to as Millham and Weaver “my top two execs” in our interview, however when requested particularly whether or not his present succession plan concerned them, he mentioned provided solely: “I have not talked about it.”

“They have different roles,” Benioff mentioned, “Amy is the CFO, and Brian is the COO. He manages all the distribution and the go-to-market.”

More on the earnings news: Salesforce inventory soars as Benioff says purpose is to be the ‘most profitable software company in the world’

Asked what was taking place with the 5 activist buyers who’ve purchased into his inventory, Benioff introduced up G. Mason Morfit and ValueAct Capital, saying, “We have been getting to know them over the last year.” Morfit joined the Salesforce board this week, and Benioff mentioned the ValueAct CEO has been sharing with Salesforce a number of suggestions and methods — “in all probability what he discovered on the Microsoft

MSFT,

board” — about, for instance, distribution and pricing.

As far as the opposite activists go, Benioff mentioned that not each activist has enterprise-software experience, however “we are willing to listen to everyone.”

“I can learn from anyone and everyone. That is what I do every single day,” he mentioned, including that he practices shoshin, the Zen Buddhist idea of a newbie’s thoughts. “I try to have a beginner’s mind.”

He hinted that, in his relations with activists, it’s productive to remember their final objectives. “They are investors, [and] they want to make money.”

“I think,” he mentioned, as Salesforce shares spiked in after-hours trades, “they made a lot of money today.”

In depth: ‘No one is immune’: Activist buyers goal tech firms after shares dive

That cash will calm Wall Street down for a short while, but it surely doesn’t imply the storm is previous within the residence entrance.

MarketWatch requested whether or not extra layoffs lie forward after executives talked about “short-term and long-term restructuring” on the convention name and a number of funding analysts broached the opportunity of extra cuts. Benioff would solely repeat that Salesforce has been reshaped yearly and that the corporate’s tradition of Ohana — that’s the Hawaiian phrase for household — remains to be robust.

“As we get bigger, it is more newsy when we make these changes,” he noticed.

Benioff nonetheless possesses the appeal and bluster to dispatch the present challenges, but when value cuts to spice up earnings as income development slows turn out to be a brand new norm, Salesforce dangers evolving into one thing extra like the corporate the younger Benioff escaped to pursue his personal, totally different dream.

Decades in the past, I wrote about Benioff’s want to interrupt away from Oracle, and now it feels increasingly as if he’s strolling Ellison’s path.

Source web site: www.marketwatch.com