The $24 trillion Treasury market, a dependable predictor of previous U.S. recessions, has been flashing the identical sign for some time: The Federal Reserve’s use of upper rates of interest to tame inflation doubtless will harm the financial system.

Its sign has deepened this 12 months, evidenced by a lopsided Treasury yield curve the place buyers in 2-year notes now fetch practically a 5% yield, however these for 10-year paper obtain solely about 4%.

See: Bond-market recession gauge plunges additional into triple digits beneath zero after reaching four-decade milestone

One learn of the scenario factors to buyers bracing for a recession, but in addition to an financial downturn that might set off a spherical of Fed fee cuts to assist perk the financial system again up.

The downside is, buyers don’t but know the place all of the chips will fall after a once-in-a-lifetime COVID pandemic, or the ripple results of the coverage response it triggered, together with a deluge of fiscal and financial stimulus to include its toll.

“We definitely are seeing more resilience in the economy than we were expecting,” mentioned Andrzej Skiba, head of U.S. mounted revenue at RBC Global Asset Management BlueBay, in a cellphone interview. “But at the same time, things might not last forever,” he mentioned, warning that the financial system may break if the Fed is compelled to extend its coverage fee to six%, or past, to decrease inflation.

“There will come a point when the tightening of financial conditions is such that businesses have to lay off workers, and a good chunk of job openings disappear,” Skiba mentioned.

An in depth name

Despite the yield curve’s recession warning, monetary markets have been signaling the worst of the results of the Fed’s speedy fee improve could have been included in final 12 months’s carnage.

The S&P 500 index

SPX,

was up 2.1% on the 12 months by way of Thursday, whereas the Nasdaq Composite

COMP,

was up 8.3%. Of the three huge indexes, solely the Dow Jones Industrial Average

DJIA,

was decrease, down 2.7% 12 months to this point.

Perhaps the yield curve’s message, this time, actually is fake.

In sensible phrases, the deeply skewed Treasury yields of 2023 solely replicate the oddity of buyers eager to earn extra for lending to the U.S. authorities for 2 years, reasonably than for a full decade, even by way of longer-term bets may be riskier.

With inflation greater and stickier than beforehand anticipated, the Fed must be extra aggressive, Skiba mentioned. What it may’t do is flip again time, when most U.S. owners refinanced at low, 3% mounted mortgage charges, which additionally blunts the impression of its fee hikes in curbing client spending.

“That is what is giving some chance of a soft landing over the coming quarters, instead of a more traditional expectation of a recession,” Skiba mentioned. “In our opinion, it’s a close call.”

A ‘loaded’ 10-year Treasury debate

Fed Chair Jerome Powell spooked markets Tuesday by suggesting an even bigger fee hike might be on the desk for late March. The subsequent day he mentioned no resolution has been made but. Stocks ended Wednesday principally greater, however dropped sharply Thursday.

Dizzying each day market gyrations make it onerous to know what sort of financial final result has been priced into markets.

“The bond market is pricing in a recession, credit spreads are not,” Luke Tilley, chief economist at Wilmington Trust, advised MarketWatch. “The stock market is sort of trying to straddle the line in the middle.”

Given the unsure backdrop for short-term Fed charges, it is smart that the policy-sensitive 2-year Treasury yield

TMUBMUSD02Y,

this week shot above 5%, the best since 2007.

In late 2007, the Fed started down its path of reducing its coverage fee to nearly zero as the worldwide monetary disaster deepened, a playbook it returned to in 2020 because the pandemic unfolded.

A maybe more durable job is decoding strikes within the equally essential 10-year Treasury yield

TMUBMUSD10Y,

which this week was knocking on the door of 4%, a stage hardly ever exceeded prior to now 20 years.

“The 10-year is a loaded question,” mentioned David Petrosinelli, a senior fixed-income dealer at InspereX, including that charges can shift on a dime, and recently have been susceptible to doing so, even when Powell has repeated the central financial institution’s total messaging.

“If the Fed needs to raise rates a little bit more, and hold them there for longer, the knee-jerk reaction is that the economy is strong,” Petrosinelli mentioned. “But if the Fed keeps going, it isn’t going to be strong.”

More combined messages

Here’s one other view on whether or not the Treasury market is priced for a recession: “No, the market is expecting rates to go back down,” mentioned Robert Tipp, chief funding strategist at PGIM Fixed Income, who sees “upward pressure that keeps the 10-year rate above 4%, rather than below it.”

The course of the 10-year Treasury fee can hinge on investor sentiment in regards to the financial system. The fee issues as a result of lenders use it as a baseline to cost nearly every little thing, from client loans to company debt.

A prime fear on Wall Street has been that the U.S. financial system may falter when the 10-year fee stays a lot above 3%, significantly after an period of it operating on plentiful and low-cost debt.

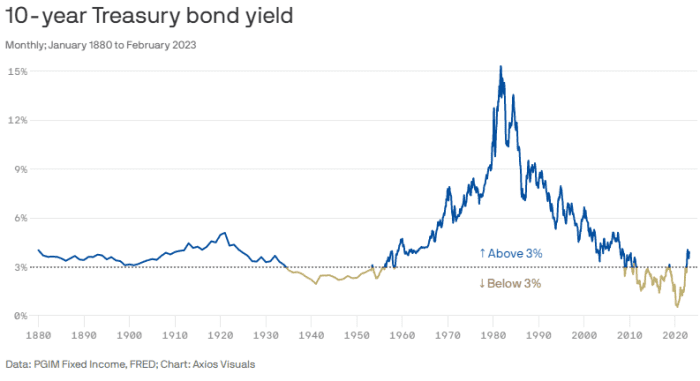

Tipp checked out roughly 140 years of knowledge on the 10-year Treasury fee, which confirmed comparatively few patches in historical past the place it truly held beneath 3% (see chart).

A sub 3% 10-year Treasury yield isn’t the norm, outdoors of the previous 20 years.

PGIM Fixed Income, FRED, AXIOs Visuals

He nonetheless thinks at present’s bond-market yields look engaging, and might offset any upward strain, from right here, on rates of interest.

Source web site: www.marketwatch.com