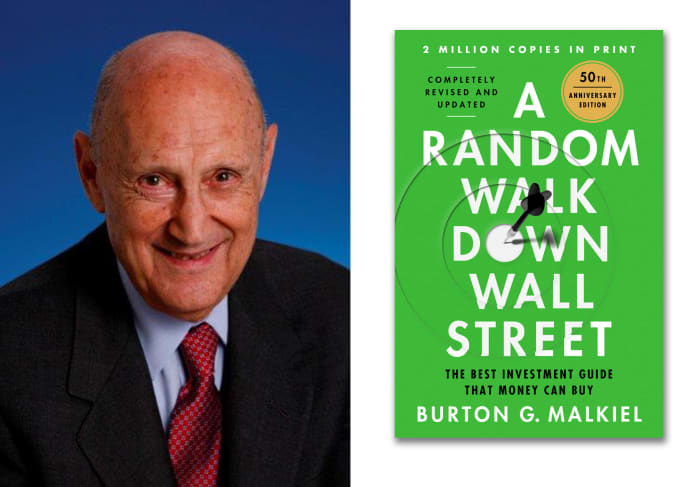

In January 1973, an funding guide was revealed that will assist change Wall Street perpetually. Burton Malkiel’s “A Random Walk Down Wall Street” made the then-heretical assertion that skilled cash managers weren’t price their charges. Malkiel put it bluntly, stating that, “a blindfolded chimpanzee with a dart and a list of stocks” may beat Wall Street execs at their very own recreation.

Beating the market is troublesome, Malkiel defined, as a result of the market digests all accessible info via what’s referred to as the efficient-market speculation. Malkiel argued that inventory costs observe a “random walk” and their fluctuations can’t be predicted.

Since most stock-pickers can’t constantly beat a benchmark index such because the large-cap S&P 500

SPX,

Malkiel, on the time a professor of economics at Princeton University, argued that buyers are higher off shopping for and holding the benchmark itself, settling for a return equal to the common. In this manner, you’ll do higher than energetic administration, at a decrease price and with higher certainty.

Malkiel’s assertion was met with skepticism if not outright derison. In 1973 there was no low-cost index mutual fund accessible to retail buyers. Malkiel advocated for the creation of such a product, however when John Bogle, founding father of the Vanguard Group, launched one three years later, the cash initially stayed away.

Half a century later, nonetheless, low-cost index mutual funds and exchange-traded funds are cornerstones of many funding portfolios. “A Random Walk” has develop into a basic must-read for buyers, and simply marked its fiftieth anniversary with one other in a collection of revised and up to date editions. In this current phone interview, which has been edited for size and readability, Malkiel mentioned the guide’s longevity and its relevance to the present stock-market setting.

MarketWatch: Half a century after its publication, “A Random Walk Down Wall Street” continues to be well timed and related — possibly now greater than ever. Such longevity is uncommon for an funding guide. Did you ever think about it having such endurance?

Malkiel: I notably didn’t anticipate it when the response from the monetary group was nearly uniformly damaging. I had this line within the first version {that a} blindfolded chimpanzee may choose a portfolio in addition to the specialists. It was a cute comment nevertheless it rubbed some professionals the unsuitable approach. I had some critiques from professionals together with one which mentioned this thesis, that you just’d be higher off with an index fund than an actively managed fund, was naïve at finest and fully unsuitable.

The proof over the previous 50 years is such that I really consider within the thesis much more in the present day. Indexing just isn’t a mediocre technique. It is an above-average technique and outperforms the common actively managed inventory fund by about 100 foundation factors a 12 months.

MarketWatch: It is troublesome for buyers to outperform the market common. So in case your return is constantly common, by definition you’ll beat buyers — together with professionals — who fall in need of a benchmark.

Malkiel: In any 12 months there are individuals who outperform, however the ones who outperform the following 12 months aren’t the identical. When you compound this over 10- or 20 years, we’re speaking about 90% of cash managers.

I’m not saying it’s unimaginable to outperform. Some individuals have completed it and will proceed. But if you strive for that, you’re more likely to be within the 90% who don’t.

MarketWatch: Yet the naysaying continues, 50 years on and regardless of the explosive reputation of indexing. Your guide was initially revealed in 1973, earlier than there was an index fund. Three years later John Bogle launched the Vanguard 500 Fund, first S&P 500 index fund. You and Bogle each helped ingite a revolution.

Malkiel: The response to the primary index fund was about the identical because the skilled response to my guide: poor at finest and terribly damaging at worst. Bogle requested the underwriters to get the primary index fund began and he needed to promote $250 million. The underwriters mentioned we don’t assume we will do 250. Let’s set it up for 150. When the books have been closed it raised $11 million. It was ridiculed. It was referred to as “Bogle’s folly.” The fund didn’t accumulate a lot cash for not less than a decade, even two. Now greater than half of the cash in funding funds is listed.

MarketWatch: So a lot about investing has modified in 50 years, in fact. What about indexing has stayed constant?

Malkiel: What hasn’t modified is that whereas the market isn’t all the time proper, it actually does a exceptional job of reflecting info and to that extent is actually fairly environment friendly. Therefore you’re a lot better off accepting the judgment of the market and easily shopping for an index fund.

“ ‘It’s not that we have too much indexing; I think we still have too little.’ ”

MarketWatch: With a lot cash now tied to index funds, has indexing develop into too well-liked?

Malkiel: Over 50% of the cash invested in funding funds is listed. Is that too giant? First of all, because the proportion of funds listed has grown, you would possibly assume energetic administration will do higher and higher, however the truth is it’s doing somewhat worse every year. The development in indexing has not led to energetic managers doing higher.

And to those that say finally there received’t be anyone left to make the market environment friendly, I might say that even when 95% of the market was listed, I wouldn’t fear. It’s not that we now have an excessive amount of indexing; I feel we nonetheless have too little. I see nothing to make me fear that the success of indexing will result in its personal downfall, as many individuals consider.

MarketWatch: Why are you satisfied that indexing’s reputation received’t attain a tipping level?

Malkiel: The thought behind indexing is that the market will largely get it proper. If there’s an organization that discovers a treatment for a specific sort of most cancers and its inventory is promoting at $20 a share and this announcement ought to make its inventory go to $40 a share, the concept of comparatively environment friendly markets means the worth will go to $40 immediately.

Let’s suppose 100% of the cash was listed. The drug comes out, the inventory nonetheless sells at 20. In our capitalist system, with hedge funds and personal fairness companies round, are you able to really consider that no person goes to step in and search for that type of arbitrage? As lengthy as we now have free markets and any person should buy what they need, it’s inconceivable to me that there isn’t some investor who will are available and hold shopping for that inventory till it sells at $40 a share.

MarketWatch: Are you involved about newer, focused index funds that promise extra bang on your buck?

Malkiel: I do query the proliferation of index funds into narrower and narrower slices of the market, and made to enchantment to much more speculative buyers. For occasion, I feel it’s horrible that we now have index funds that purport to provide you 3 times the up and down of the S&P 500. I additionally don’t like a number of the slim indexes that actually are nearly energetic administration, as a result of they recommend you may decide a small a part of the market that’s “undervalued” and do higher. Using these to invest to assume you may beat the index is totally unsuitable and self-destructive.

I favor broad-based index funds, and whole stock-market index funds over S&P 500 index funds, since you must personal every little thing. Since now you can purchase a complete stock-market index fund for an expense ratio of two or three foundation factors — basically zero — that’s what I favor.

MarketWatch: Do all of the funding decisions and methods accessible these days tempt buyers to disregard what the inventory market can realistically ship over time?

Malkiel: In a approach buyers have develop into smarter. But individuals now may be somewhat unrealistic concerning the inventory market returns they must count on. Over the previous 100 years the broad U.S. inventory market has given a complete return of 9%-10% a 12 months. I don’t assume the following decade is probably going to try this.

There is one valuation metric that does a good job of predicting 10-year charges of return — the CAPE ratio, the Cyclically Adjusted Price Earnings a number of. It appears to elucidate one thing like 60% of the variation in 10-year charges of return. What tends to be the case is that when the CAPE is well-above common, the following 10-year price of return tends to be on common extra like 4% or 5%. When the CAPE is low, in single digits, the 10-year price of return has been one thing within the teenagers.

Today the CAPE is round 30, which is without doubt one of the highest in historical past. Realistically, individuals must count on mid-single-digit returns over the following 10 years. That worries me somewhat. If they’re serious about how a lot they should save for retirement, how a lot to take out of their retirement fund to protect its actual worth, buyers ought to contemplate that projecting 9%-10% over the following decade doesn’t make sense.

Equities are nonetheless one of the best recreation on the town. They are the asset class that almost all dependably has outlasted inflation, has completed higher than gold, bonds, actual property. My recommendation can be to be life like and cautious. Don’t blindly assume {that a} 10% common annual whole return is written in stone. Valuations are prolonged now. I’m undecided what number of buyers perceive that.

MarketWatch: If shares give simply 5% on common over the following decade after factoring for inflation, the place and the way ought to individuals contemplate allocating their cash?

Malkiel: I’m not suggesting that you just hand over equities. I’m a terrific believer in dollar-cost-averaging with shares. Frankly, if markets are very risky, and generally you’re shopping for actually low, you’ll get greater than 5% from dollar-cost-averaging.

For younger individuals beginning out, save somewhat bit every week. Even in the event you by no means make some huge cash, you’ll have a terrific nest-egg if you retire. Put the lion’s share of your cash into dollar-cost-averaging, right into a broad based mostly index fund. We’ve had some horrible markets over the interval for the reason that guide got here out. The Nineteen Seventies weren’t a really nice interval for shares. The first 10 years of the 2000s markets have been mainly flat. But what if beginning in 1978 you place $100 a month into the Vanguard 500 index fund? Today you’d have nearly $1.5 million. The factor that most likely pleases me essentially the most concerning the guide is fan mail saying, “Thank you. I’ve done exactly what you said.” My playing cards and letters say it really works.

If you’re older, and now have that nest egg, and earned it in a tax-friendly approach, then you shouldn’t have an all-equity portfolio. I might advocate you are taking the required minimal distribution due inside one 12 months and put it in a one-year Treasury bond. Take the RMD it’s important to take out in two years and put it in a two-year Treasury. Bonds now not less than provide you with a price of return. For particular RMD I need Treasurys. For common funding functions you must have index funds however add whole bond-market funds.

W. W. Norton & Company

MarketWatch: There’s an ongoing debate concerning the knowledge of the standard 60% inventory/40% bond portfolio allocation that’s typically a place to begin for buyers. Are you a fan of the 60/40 portfolio?

Malkiel: It would possibly effectively be that for a retired particular person, 60/40 is smart. But as a common rule, no.

In my very own portfolio I do what I mentioned when it comes to the RMDs. I’m not investing for myself, I’m investing for my kids and grandchildren. So I’m nonetheless a closely fairness investor. If you’ve acquired sufficient to dwell on and also you’re investing on your kids and grandchildren, you don’t need 40% in bonds.

What definitely is the case is that youthful buyers must be primarily fairness buyers and older buyers nonetheless want numerous fairness. But a a lot higher allocation to bonds is warranted.

“ ‘My favorite inflation hedge would be a real estate index fund.’”

MarketWatch: What recommendation would you give now to buyers who’re spooked by Wall Street’s randomness — on this case the surge in stock-market volatility and the market’s painful 2022 return?

Malkiel: Depending upon your danger tolerance, there are variations. If you may’t sleep at evening since you have a look at your portfolio, then being 100% in equities just isn’t for you. Sell all the way down to the sleeping level.

That’s notably true now as a result of I fear about how troublesome a job it’s going to be for the Federal Reserve to get us again to a 2% inflation price. So you undoubtedly want some property which can be possible to supply an inflation hedge. My favourite inflation hedge can be an actual property index fund, versus gold. Common shares have completed an excellent job of hedging inflation and actual property has completed higher than gold. I wouldn’t prefer to be in long-term bonds. Particularly now I’d moderately have safer ones. There’s nothing unsuitable with getting 4% plus from a one-year Treasury.

Volatility actually helps dollar-cost averaging. For the primary 10 years of the 2000s, out of the dot-com bubble, we had horrible inventory markets. The market led to 2010 the place it began in 2000. Yet the $100 a month, dollar-cost-averaging investor earned 5.7% on common. It works.

One different factor to recollect: Good monetary outcomes rely upon doing the suitable factor. The proper factor for me is common investing in a broad-based index fund. It ought to be all-equity in the event you can take the chance and also you’re younger, or with bonds and bond index funds in retirement.

The different a part of that is don’t do the unsuitable factor. Avoid errors. Don’t strive the flowery pictures. Just hit the ball again and also you’ll be nice.

More: Here’s the one type of monetary recommendation individuals assume is price paying for

Also learn: 20 income-building shares that the numbers say may develop into elite Dividend Aristocrats

Source web site: www.marketwatch.com