Early commerce in futures recommend shares could end the week very near the place they began. Bulls could also be pissed off, however they need to take it as a win.

It’s doubtless few would have thought the S&P 500

SPX

may keep across the center of its near-four month vary when benchmark bond yields

BX:TMUBMUSD10Y

have once more burst above 4%. The final time yields moved up by means of that landmark in mid-October, the Wall Street fairness barometer was about 10% decrease.

And right here to supply additional consolation is Fundstrat’s head of analysis, Tom Lee. He says the market is prepared for a powerful eight week rally, a state of affairs which will catch out many buyers as a result of they continue to be nervous about “the understandable lack of clarity on inflation trajectory, Fed policy path, earnings risk and general heightened concerns about recession.”

Lee provides six causes for his optimism.

Better inflation news. He reckons the final of the ‘hot’ inflation information was the fourth quarter unit labor value numbers that got here in up 3.2%. Next week will see the beginning of financial and inflation information for February, which Lee thinks will present softer inflationary pressures and a softer jobs market.

“This will reverse, to an extent, the somewhat alarming surge in inflation and jobs data of Jan (part seasonal, part noisy data),” Lee writes in a late Thursday be aware to purchasers.

Supportive Powell. The Fed chair will give his semi-annual testimony to the Senate Banking Committee and House Financial Services Committee, beginning subsequent week, and Lee expects Powell to bolster the ‘data dependent’ message. That means the 25 foundation level hike for the March Fed assembly will likely be cemented, “barring evidence of continued acceleration of inflation.” That ought to scale back charge uncertainty for the long run, too.

Bonds rally. “The bond market will likely pivot dovish in March. The ‘hot’ Jan inflation data caused the bond market to price in higher odds of +50bp in March and April, and Fed speak seems to be pushing back against that — meaning, Fed is less hawkish than [the] recent move in bonds,” says Lee.

Falling VIX. “If the incoming data tilts the way we expect (“softer”), then bond volatility ought to fall, which helps a inventory rally in March to April. This means VIX may fall, and a falling VIX is supportive of upper fairness costs.”

The CBOE VIX

VIX

at the moment sits at 19.5, a fraction beneath its future common of 20.

The market is NOT costly. Arguing that shares normally are overvalued is, Lee believes, the affirmation bias of bears ready out on the sidelines.

“As highlighted earlier this week, ex-FAANG, the P/E (2024) of S&P 500 is 14.8X. And sectors like Energy are 10X and Financials 11X. These are not demanding valuations. And consider the fact that the U.S. 10-yr at 4.0% yield is an implied P/E of a bond of 25X. Yup. The bond market is still far pricier than stocks,” Lee contends.

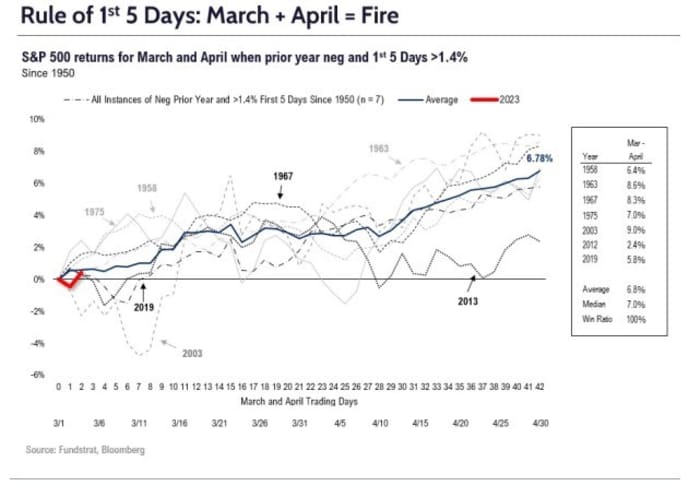

Seasonals are additionally supportive. Lee has crunched the numbers for the rule of first 5 days which market lore says that as goes the primary 5 periods of the January, so goes the 12 months. He has utilized that to the final seven instances instances when the primary 5 days produced a achieve of greater than 1.4% and got here after a down 12 months, as was the case at first of 2023.

Source: Fundstrat

“This composite implied market gains into Feb 16 and a consolidation through early March (3/7). 2023 is following this pretty closely. This same composite now implies March to end of April will be the strongest 8 week period for 2023 with a median gain implied of 7%,” Lee calculates.

That means if 2023 follows the identical path the S&P 500 may attain 4,250 by the top of April.

Markets

A pullback in 10-year Treasury yields

BX:TMUBMUSD10Y

helps S&P 500 futures

ES00

achieve floor. Gold

GC00

is up because the greenback index

DXY

dips in response to the easing U.S. rates of interest.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

U.S. financial information due for launch on Friday embody the ultimate studying of S&P Global providers PMI for February at 9:45 a.m., adopted quarter-hour later by the ISM providers report.

Fed audio system embody Dallas Fed President Logan at 11 a.m. and Fed Governor Bowman at 3 p.m.

C3.ai shares

AI

are surging 18% in premarket motion after the enterprise synthetic intelligence software program group delivered well-received outcomes and upbeat forecasts. Wedbush raised its goal for the inventory from $13 to $24.

Marvell Technology Inc. inventory

MRVL

is down practically 9% after the chip firm met expectations with outcomes for its newest quarter however blamed stock corrections for an outlook that got here in beneath the consensus view.

The U.Ok.’s markets watchdog has launched an investigation into the London Metal Exchanges’ dealing with of a nickel market disaster final 12 months which led it to cancel billions of {dollars} price of nickel trades after costs surged.

Shares in numerous shares underneath the Adani umbrella rebounded after Florida-based GQG Partners invested practically $1.9 billion within the shares that had tumbled, following a report by U.S. short-seller Hindenburg Research late January.

German airline Lufthansa says demand by vacationers is powerful, serving to its shares

XE:LHA

take off.

Best of the online

Putin’s secret weapon on power: an ex-Morgan Stanley banker.

You aren’t a parrot and a chatbot just isn’t a human.

Scandal at South Africa’s Eskom: the CEO and the cyanide-laced espresso

The chart

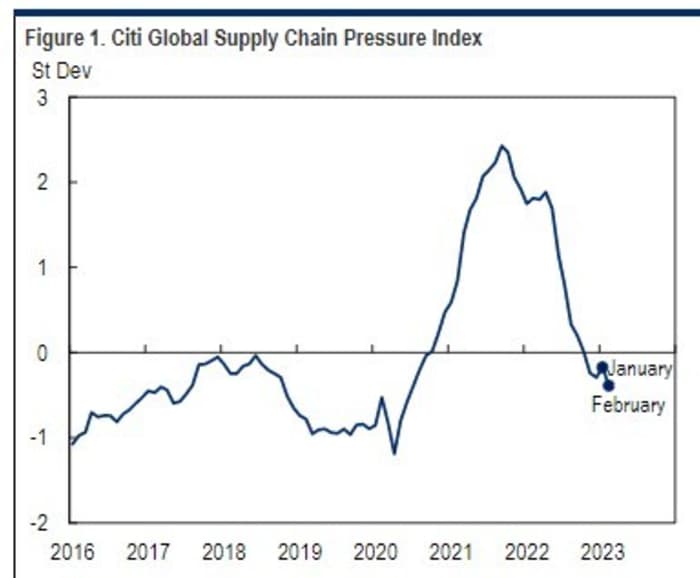

Here’s some good news from Citi’s international provide chain stress index, which has fallen considerably since final May and is now simply above the common stage seen within the years earlier than COVID, notes Nathan Sheets, the financial institution’s chief international economist.

“All three key components of the index—transportation costs, global purchasing managers indexes, and measures of inventory performance—show normalizing conditions. These dynamics suggest that pressures on goods prices are meaningfully reduced relative to last year and our modeling argues that core goods inflation could soon be running 1% or under in the U.S. and Developed Markets more generally.”

Source: Citi

Sheets does additionally be aware, nonetheless, that the service sector is the supply of a lot present inflationary pressures and “unless services inflation breaks far sooner and more forcefully than expected, many major central banks are likely to keep tightening policy in coming months.”

Top tickers

Here have been essentially the most energetic stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| XELA | Exela Technologies |

| GME | GameStop |

| TRKA | Troika Media |

| NIO | NIO |

| SI | Silvergate Capital |

| APE | AMC Entertainment most well-liked |

| AAPL | Apple |

Random reads

Living the tiny home life-style at no cost in Atlanta….

Terrible puns as Little Italy’s oldest cheese store closes.

New gecko species discovered on Australian island.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source web site: www.marketwatch.com