After a frantic regulators-to-the-rescue weekend that sparked a rally for U.S. fairness futures on Sunday evening, the ambiance has turned extra cautious, apart from still-partying tech futures. That’s as plenty of banks are within the crimson forward of Monday’s open.

Nervous traders could also be cautious of extra sneakers dropping following the Silicon Valley Bank fallout that’s resurfacing nice monetary disaster reminiscences for some extra long-toothed merchants. And no relaxation for the depraved as the following replace on shopper costs hits Tuesday.

Read: SVB collapse means look out for extra stock-market volatility, say analysts.

Here’s Jim Reid and a workforce of strategists at Deutsche Bank, neatly summing up a whirlwind few days: “SVB’s woes are a combination of one of the largest hiking cycles in history, one of the most inverted curves in history, one of the biggest bubbles in tech in history bursting, and the runaway growth of private capital. The one missing ingredient not involved here is a U.S. recession.”

It’s simply extra of the boom-bust cycle we’re caught in, says Reid. “That being… too much stimulus -> very high inflation and an asset bubble -> aggressive central bank hikes -> inverted curves -> tighter lending standards/accidents -> recession.”

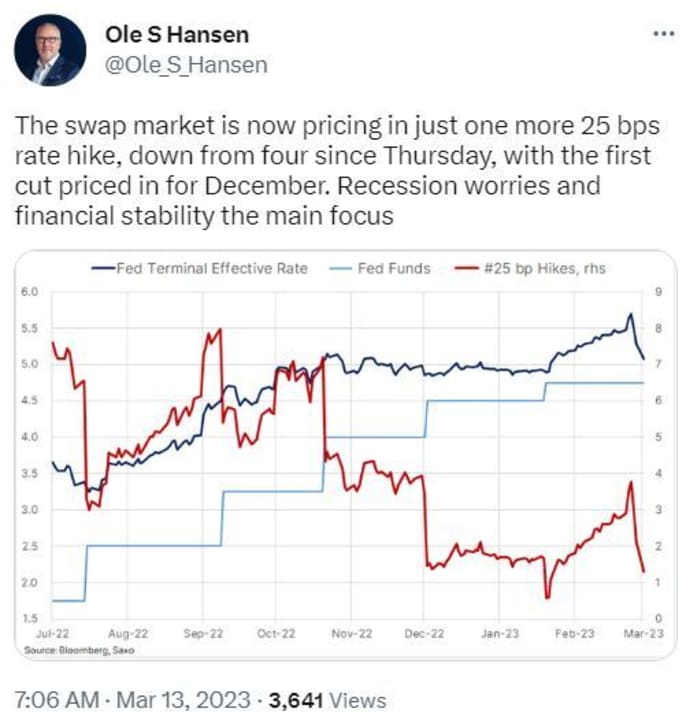

Onto our name of the day from Goldman Sachs, the place economists say the rescue of SVB and different depositors will tie the Fed’s arms subsequent week.

“In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March,” stated a workforce led by chief economist Jan Hatzius in a observe to purchasers late Sunday.

Hatzius and Co. had anticipated a 25-basis level hike subsequent week. “We have left unchanged our expectation that the FOMC will deliver 25bp hikes in May, June and July and now expect a 5.25-5.5% terminal rate, though we see considerable uncertainty about the path,” they stated.

They clearly aren’t alone as Fed fund futures point out the probabilities of the Fed mountaineering rates of interest by 50 foundation factors subsequent week have fallen from 70% to zero in latest days.

@OleSHansen

But some say the Wall Street banking behemoth is getting forward of itself:

@INArteCarloDoss

Capital Economics, in the meantime, is siding with Goldman right here: “Even if the authorities are successful at putting a firewall around the problems at SVB and Signature Bank, the lags with which policy operates are a reason to adopt a more gradual approach to policy tightening from here,” stated Neil Shearing, group chief economist.

Note, Goldman additionally stated that whereas the Fed has stemmed the panic over SVB and Signature Bank, it stays to be seen whether or not the FDIC would equally tackle different such lenders in the event that they have been smaller than the 2 banks in query.

Last phrase and maybe a testiment to nervousness round banks, goes to Mark Haefele, chief funding officer at UBS Global Wealth Management who advised purchasers this: “We remain least preferred on financials in our US strategy and recommend investors who have above-benchmark weights in global financials (15% of the MSCI ACWI) to revisit their exposure.”

The markets

After hovering late Sunday within the wake of measures to curb SVB panic, Nasdaq-100 futures

NQ00

are increased, S&P 500 futures

ES00

are flat, however Dow futures

YM00

are within the crimson. The two-year Treasury yield

BX:TMUBMUSD02Y

is down 31 foundation factors to 4.284%, the greenback

DXY

is off 0.4% and gold

GC00

is up $28.30 to $1,895.80 an oz.. For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The FDIC stated it has transferred all deposits of Silicon Valley Bank to a newly-created, “bridge bank” — Silicon Valley Bank N.A. — naming a Tim Mayopoulos, a former president and CEO of the Federal National Mortgage Association, as CEO. SVB Financial

SIVB

in the meantime, says it has appointed a restructuring committee to discover strategic alternate options for the holding group, and its SVB Capital and SVB Securities companies. Those shares have been halted since earlier than Friday’s open.

Over the weekend, U.S. regulators promised Silicon Valley Bank

SIVB

depositors can have entry to their cash, with no fallout for U.S. taxpayers, although share and bondholders seem like out of luck. Depositors of crypto-friendly New York-based Signature Bank

SBNY,

closed Sunday by its state regulator, acquired comparable ensures. The Fed additionally introduced a brand new emergency mortgage program for banks in hassle to ease contagion danger. President Joe Biden will talk about the steps taken at 9 a.m. Eastern.

But chaos continues on either side of the Atlantic. Tainted by similarities to SVB, First Republic Bank

FRC

is down 60%, regardless of getting a Fed and JPMorgan funding enhance and reassurances by executives. PacWest Bancorp

PACW

is down 37% and Western Alliance

WAL

is off 51%. PNC Financial

PNC

is down simply 2% after an improve from Citigroup.

Read: Stablecoin issuer Circle to switch $3.3 billion in money held at Silicon Valley Bank to BNY Mellon

SVB’s U.Okay. arm has been purchased for £1 by HSBC

HSBC

UK:HSBA

in a deal brokered by the nation’s Treasury and Bank of England. U.S.-listed HSBC shares are down 2%, whereas Credit Suisse shares

CS

CH:CSGN

are off 9%, hitting a brand new report low.

BILL Holdings

BILL

inventory is up 4%, with the software program firm getting a lift from the SVB measures, after saying it has some publicity to the troubled financial institution.

Shares of pharma group Provention Bio

PRVB

are up 260% in premarket buying and selling after French drugmaker Sanofi

FR:SAN

stated it might purchase the guy pharma group in a deal value $2.9 billion.

Pharma big Pfizer

PFE

stated it pay $429 a share in money for Seagen

SGEN,

a deal value $43 billion that’s driving shares of the most cancers biotech firm up 18%.

Applied Materials

AMAT

hiked its dividend by 23% and elevated its buyback program by $10 billion. Shares are up 1%.

Apart from CPI on Tuesday, the week can even deliver different vital information together with retail gross sales, producer costs, housing updates and the Empire State manufacturing survey.

Best of the net

“Everything Everywhere All at Once” dominated the Oscars, nabbing finest image and different awards. Check out the largest speeches, snubs and different viral moments.

A driver spent $180,000 to start out an Uber Black enterprise. Then the corporate deactivated his account.

Some of the worst casualties of SVB’s collapse have been corporations growing options for the local weather disaster.

Armed with human hair and used clothes, a Philippine island’s residents try to maintain an oil spill from marring pristine seashores.

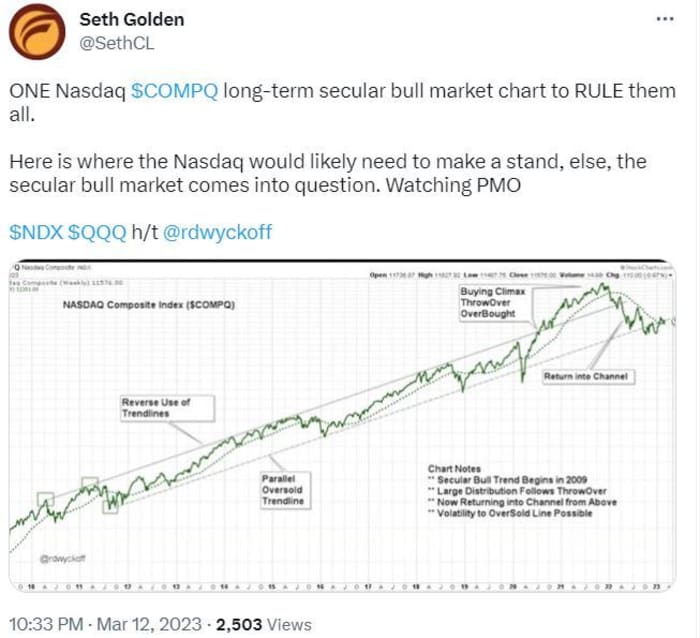

The chart

@SethCL

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| FRC | First Republic Bank |

| SIVB | SVB Financial Group |

| AMC | AMC Entertainment |

| GME | GameStop |

| TRKA | Troika Media |

| AAPL | Apple |

| NVDA | Nvidia |

| APE | AMC Entertainment Holdings most popular shares |

Random reads

SVB U.Okay. was bought for £1. That can even purchase you some band-aids or elbow grease.

Vasectomies: A guilt-free path to March Madness viewing.

£250,000 will purchase you Britain’s “loneliest home,” which requires a 20-minute hike out of your automobile and a whole renovation.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Want extra for the day forward? Sign up for The Barron’s Daily, a morning briefing for traders, together with unique commentary from Barron’s and MarketWatch

writers.

Source web site: www.marketwatch.com