Six months have handed because the S&P 500 index touched its lowest degree in additional than two years after shedding about 25% of its worth on the nadir of 2022’s bear market.

A restoration because the begin of 2023 has seen the massive capitalization index rise greater than 17% from its Oct. 12 closing low of three,577.03, based on FactSet knowledge.

However, traders nonetheless have loads of purpose to worry that the worst has but to reach, if historical past is any information, based on Warren Pies, the founding father of analysis store 3Fourteen Research.

Pies and his crew highlighted 4 causes in a latest observe to shoppers that was shared with MarketWatch.

“The last six months hold very little resemblance to a typical post-bottom environment,” he mentioned in a observe.

The S&P 500

SPX,

was buying and selling marginally decrease early Wednesday, but it surely has risen 6.8% because the begin of the yr, and 17.1% from its intraday low reached on Oct. 13, 2022, based on FactSet knowledge. The lowest closing degree arrived sooner or later earlier, when the large-cap index completed at 3,577, its lowest end-of-day degree since November 2020.

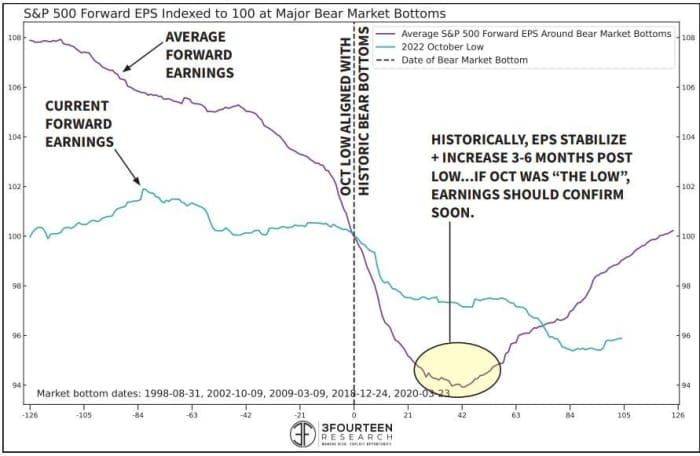

Earnings expectations proceed to fall

Earnings expectations for S&P 500 firms are a key metric for traders, since they’re used to calculate the market’s ahead price-to-earnings ratio, which is without doubt one of the hottest valuation metrics utilized by funding analysts.

Typically, ahead earnings estimates begin to get well between three and 6 months after a sturdy market backside, based on Pies and his crew.

But based on consensus estimates tracked by FactSet, expectations for earnings in 2023 have continued to bitter following the collapse of Silicon Valley Bank.

“The crisis, and resultant tightening of financial conditions, is likely to weigh on forward earnings (no rebound). Unsurprisingly, Financial Sector estimates are already rolling over hard,” Pies and his crew mentioned within the report.

They illustrated this pattern within the chart under.

3FOURTEEN RESEARCH

The bottom-up EPS estimate for calendar-year 2023 declined by 3.8% — to $221.50 from $230.33 — between Dec. 31 to March 30, based on FactSet’s John Butters.

The ahead 12-month P/E ratio for the S&P 500 stands at 18.15 as of Wednesday, based on FactSet knowledge. That’s under the five-year common of 18.5 but it surely stays above the 10-year common of 17.3.

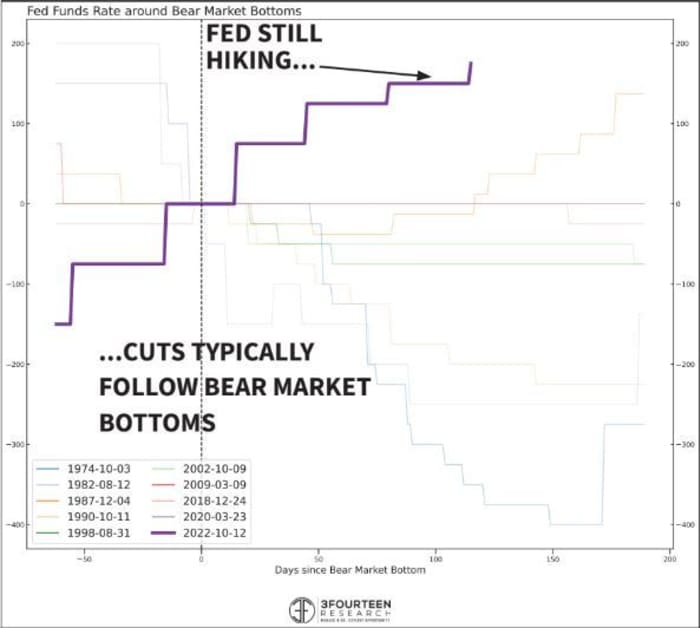

S&P 500 doesn’t backside whereas rates of interest are rising

It’s a chorus that has been repeated by many stock-market analysts. Historically, the S&P 500 doesn’t backside till after the Federal Reserve begins to chop rates of interest.

“Stocks have never bottomed during the hike phase of a Fed Cycle,” Pies and his crew mentioned.

This was definitely true in March 2020, in the beginning of the pandemic when shares bottomed just a few days after the Fed lower its coverage rate of interest to zero and introduced steps to enhance companies’ entry to credit score.

3FOURTEEN

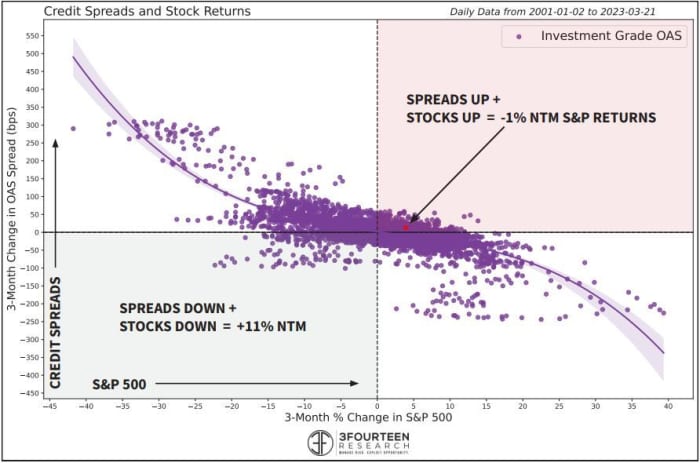

Credit spreads a priority

U.S. shares have powered larger this yr, however investment-grade credit score spreads are usually not trying so wholesome.

“While equities continue to bounce up towards the top of their trading range (S&P 500 ~4,000), investment grade credit spreads have blown out to 163 bps, which is just under the October highs (165)—back when the stock market was making its low (chart right). This is an awful combination for forward equity returns,” he mentioned.

3Fourteen added that “typically, IG spreads and stocks move together. However, when spreads blow out while stocks are up (top right quadrant), stocks suffer badly in the next 12 months,” they mentioned.

3FOURTEEN

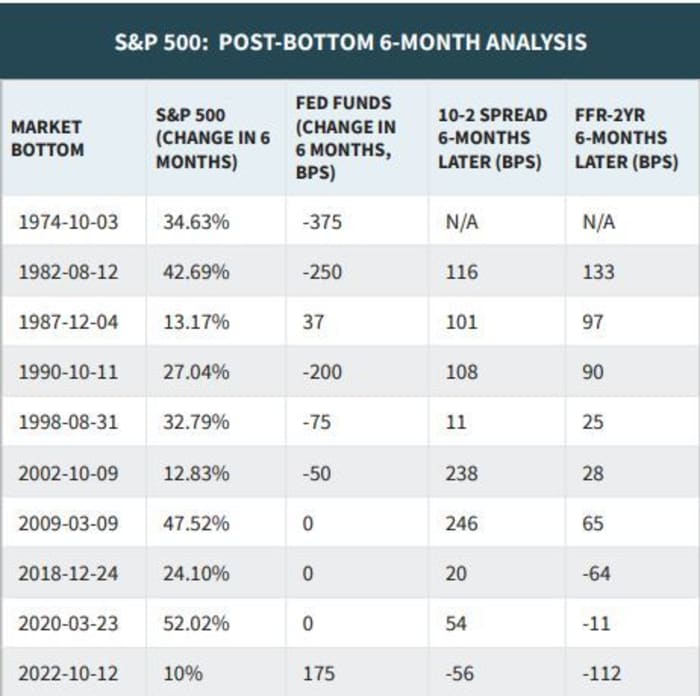

Treasury yield curve nonetheless inverted

The yield on the 2-year Treasury observe

TMUBMUSD02Y,

was roughly 40 foundation factors larger than that of the 10-year observe

TMUBMUSD10Y,

as of Wednesday, based on FactSet knowledge. That’s a considerable enchancment from roughly one month in the past, when the curve inverted by roughly 100 foundation factors, its most inverted degree in many years.

It’s nonetheless a good distance away from regular although, the place traders sometimes can anticipate to be paid a premium for holding longer-dated bonds.

Historically, the yield curve has returned to some semblance of regular six months after a market backside, however that hasn’t occurred but.

3FOURTEEN

U.S. shares have been vacillating in a decent vary all yr. The distinction between the S&P 500’s 2023 excessive and its 2023 low is lower than 400 factors.

For what it’s value, Wall Street strategists are rising more and more pessimistic about shares, together with JPMorgan Chase & Co. fairness strategist Marko Kolanovic.

All three main U.S. indexes have been buying and selling within the pink early Wednesday, with the S&P 500 down 0.6%, whereas the Nasdaq Composite

COMP,

was off by 1.4%, and the Dow Jones Industrial Average

DJIA,

was marginally decrease, helped by its bigger weighting towards “defensive” worth shares.

Source web site: www.marketwatch.com