Federal Reserve Chairman Jerome Powell has repeatedly stated undercutting wage development for American employees is crucial for tamping down the worst bout of inflation within the U.S. in additional than 40 years.

But a raft of information counsel that sturdy company revenue margins — not wages — are having a a lot greater affect on rising costs, in keeping with longtime Société Générale strategist Albert Edwards.

Edwards calls this dynamic “greedflation”: the notion that company value gouging helps to maintain inflation sturdy at a time when commodity costs, which have been initially blamed for the worth shock, have truly fallen over the previous 12 months.

West Texas Intermediate crude oil

CL00,

was buying and selling at roughly $77 a barrel on Thursday, in contrast with $115 a barrel one 12 months in the past, in keeping with FactSet knowledge. Prices of different necessary industrial commodities, together with copper, have additionally declined throughout the identical interval.

In his newest observe on the subject, shared with MarketWatch Thursday, Edwards questioned why the Fed has been so insistent on concentrating on wages as a substitute of pointing the finger at companies: “the primary driver of this inflation cycle is soaring profit margins. Rather than calling this out as the primary cause of high inflation, central banks have instead chosen to focus on rising nominal wages as threatening to embed higher inflation – the so called ‘wage/price spiral’.”

Blaming wage development for inflation appears significantly misguided contemplating that employees’ wages haven’t even saved tempo with rising shopper costs, Edwards stated.

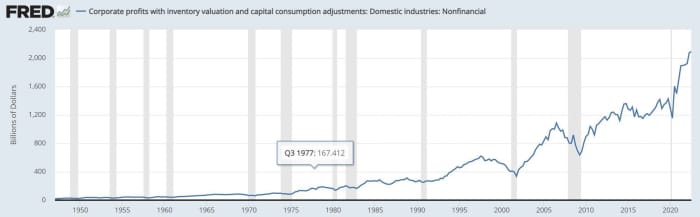

Meanwhile, company revenue margins have climbed to near-record highs. Profits for non-financial corporations rose to just about $2.1 trillion within the third quarter, a document excessive on a nominal foundation, in keeping with Commerce Department knowledge. They have risen sharply because the onset of the COVID-19 pandemic in March 2020.

ST. LOUIS FED

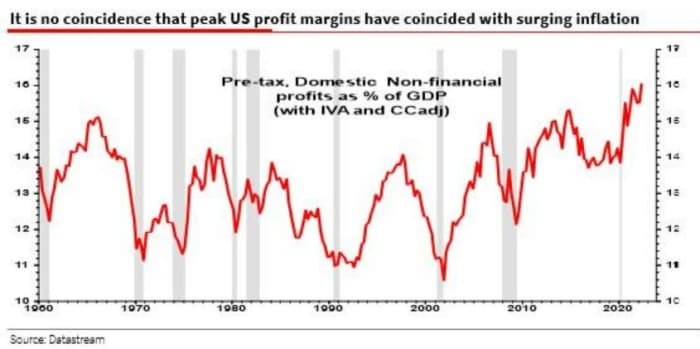

This isn’t the primary time Edwards has explored this subject in his analysis shared with Societe Generale shoppers. He examined the problem of value gouging in a observe printed again in November. The chart under, which reveals how company income as a share of GDP have risen to document highs, is from that earlier observe.

SOCGEN

While employees’ earnings have typically elevated, they haven’t saved tempo with rising shopper costs, which signifies that, when adjusted for inflation, employees’ incomes energy has truly declined.

Average hourly earnings elevated by 4.6% year-over-year, in keeping with the most recent month-to-month jobs knowledge launched by the Department of Labor. That’s lower than the headline year-over-year enhance within the consumer-price index, which stood at 6%.

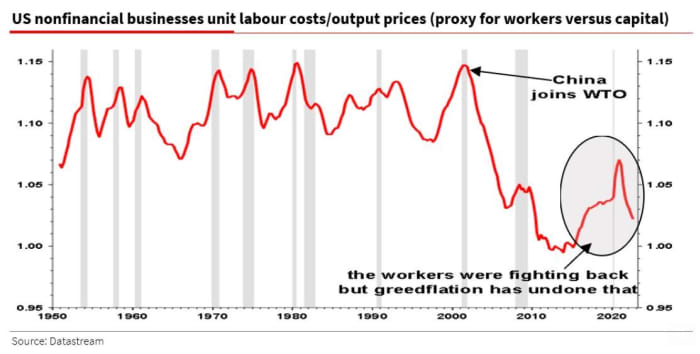

Moreover, Edwards confirmed that U.S. employees’ earnings in comparison with the prices of the products and companies they assist to provide had been declining for years, tracing the beginning of the pattern to when China joined the World Trade Organization in December 2001.

SOCGEN

Using an instance taken from Howard University economics professor William Spriggs, Edwards identified that if wages actually are the driving inflation, then the price of meals at eating places ought to be rising sooner than the price of meals consumed at residence due to the price of labor.

But the other is true, in keeping with the consumer-price index, a carefully watched gauge of inflation produced by the U.S. authorities.

The value of meals eaten at residence has risen by 10.2% through the 12 months by way of February, in keeping with the most recent CPI knowledge from February. By comparability, the price of meals shopper away from residence has elevated by 8.4%.

“If wage inflation was pushing prices higher, food at home would exceed food away from home,” Edwards stated.

Therefore, “wages are not the problem.”

Source web site: www.marketwatch.com