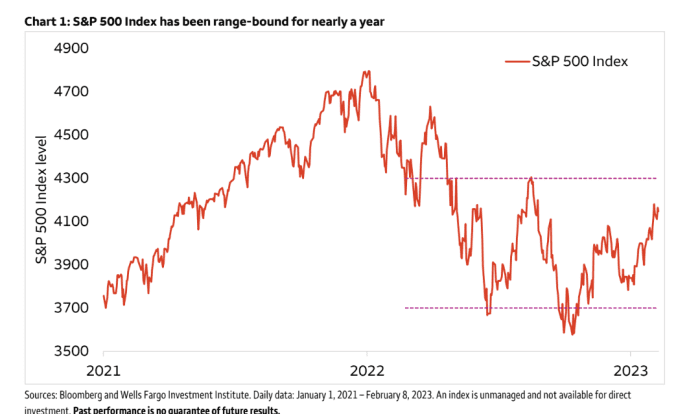

Investors ought to brace for the S&P 500 index

SPX,

to maintain oscillating within the 3,700-to- 4,300 vary, because it has been for greater than a 12 months, in line with strategists on the Wells Fargo Investment Institute.

Technology shares could also be having fun with an enormous bounce to kick off 2023, with the Nasdaq Composite Index

COMP,

up virtually 12.6% on the 12 months by way of Thursday, even with this week’s pullback.

But that doesn’t imply traders ought to maintain their breath for a sustained stock-market rally, in line with a Wells Institute workforce led by Chris Haverland, international fairness strategist.

While it has been uncommon for the S&P 500 to be caught in roughly the identical vary for almost a 12 months (see chart), in line with the workforce, additionally they stated the inventory market isn’t but giving an “all-clear signal” for a sustained push greater.

Stocks are caught in a variety, not prepared for a breakout, says Wells Fargo Institute

Bloomberg, Wells Fargo Investment Institute

Instead, they level to a continued “disconnect” between the market’s view on the place charges are headed and what has been outlined by the Federal Reserve.

“The Fed has communicated that the peak in rates is near, but, for a year now, equity markets consistently have extrapolated this message to mean that rate cuts are soon coming,” the workforce wrote, in a Thursday consumer word.

“Inflation past its peak only encourages this view among investors. But a slower rate of interest rate increases — or even a pause — is not the same as rate cuts.”

Furthermore, sharp fee will increase and wage development have been “eroding earnings for the S&P 500 index as a whole,” they wrote. But additionally they suppose analyst expectations for earnings stay too optimistic, and see a “short and moderate” recession in 2023 as possible, adopted by an financial restoration by year-end.

“To that point, our year-end S&P 500 index price target remains 4,300-4,500,” they stated.

The S&P 500 closed down 0.9% on Thursday at 4,081.50, after shares gave up earlier positive aspects. The Dow Jones Industrial Average

DJIA,

closed down 0.7%, whereas the Nasdaq Composite shed 1%, in line with FactSet.

Source web site: www.marketwatch.com