Beijing’s more and more aggressive rhetoric towards the United States is regarding. For the primary time, Chinese president Xi Jinping has instantly criticized Washington. He’s now encouraging Chinese firms to hitch the “fight” towards U.S. insurance policies which have “contained and suppressed” the People’s Republic.

Clearly, relations between the 2 international locations have deteriorated. If Beijing is laying the groundwork for an invasion of Taiwan, the opportunity of navy battle has additionally elevated.

If warfare have been to come back within the Pacific, the U.S. could be at a disturbing drawback as a result of its heavy dependence on China for a large swath of requirements, from antibiotics to navy {hardware}.

Obviously, warfare ought to be a final resort — and a battle not initiated by the United States. But in a worst-case situation, what would possibly occur?

For starters, some intelligence estimates foresee China invading Taiwan inside the subsequent 18 months. In reality, CIA Director William Burns believes Xi is making ready China’s navy to invade Taiwan by 2027.

Read: America’s strongest weapon to beat China and Russia in Cold War 2.0 is free commerce

“ China currently controls about 90% of the global supply of inputs needed to manufacture generic antibiotics. ”

If China invades Taiwan, it’s doubtless that the United States would reply with speedy sanctions whereas additionally aiding in Taiwan’s protection. Should that occur, China may reply in a variety of methods designed to cripple America’s financial system.

The best legal responsibility could be China’s skill to chop off key exports to the United States. This is especially evident within the pharmaceutical area. China at present controls about 90% of the worldwide provide of inputs wanted to fabricate generic antibiotics. Even the generic medicines utilized in America’s intensive care models, emergency rooms and ambulances are made with chemical compounds and substances sourced virtually solely from China.

Beijing is properly conscious of its stranglehold over America’s pharmaceutical provides. In March 2020, China’s official news outlet threatened that, within the occasion of a battle, Beijing would use “strategic control” over medical merchandise to “ban exports to the United States.”

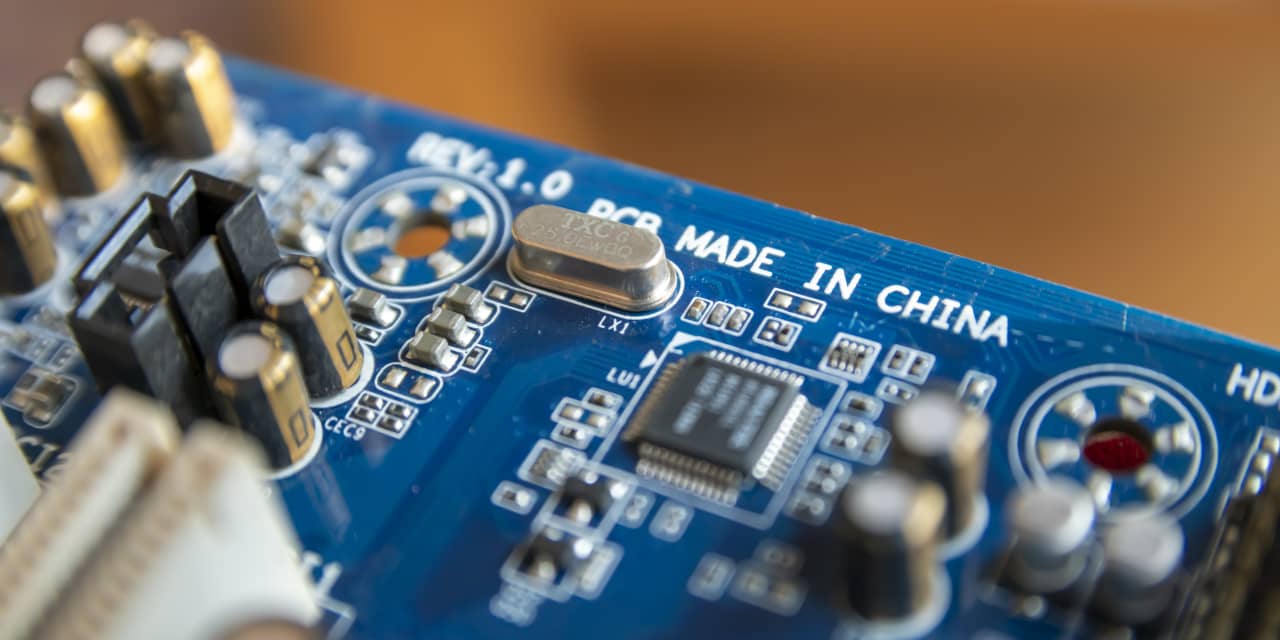

The risk is just not solely to medicines. The Australian Strategic Policy Institute (ASPI) has compiled a “Critical Technology Tracker” that illustrates China’s maintain over the world’s most necessary applied sciences. ASPI estimates that China’s international lead now extends to 37 of the 44 most-advanced applied sciences, together with protection, robotics, power, and biotechnology. Most worrying is that China far outpaces the U.S. in analysis on nanoscale applied sciences and superconductors.

Read: ‘Right now there are changes, the likes of which we haven’t seen in 100 years.’ Here’s what China’s Xi stated to Putin earlier than leaving Russia.

These shortfalls in each life-saving medicines and high-tech gear could be much more regarding in wartime. The U.S. navy would hit a wall in a battle with China, as a result of China dominates the worldwide manufacturing of uncommon earth metals, together with the aspect antimony, which is utilized in every part from armor-piercing bullets to night-vision goggles. China’s chemical business additionally has develop into important to America’s war-fighting gear because the Pentagon depends on China for a key ingredient in Hellfire missile propellant.

“ U.S. investors are unwittingly funding China’s military growth. ”

All of this places the U.S. at a severe drawback. But these troubles run even deeper, since U.S. buyers are unwittingly funding China’s navy development.

Entities tied to China’s navy are publicly traded on inventory exchanges and thru Exchange Traded Funds (ETFs) and different funding merchandise. For instance, CSSC Holdings Ltd.

600150,

— China’s largest builder of navy ships — is listed in a number of main funding indices, together with MSCI Emerging Markets, MSCI ACWI, FTSE Emerging, and FTSE All-World.

Congress can work to halt such funding by passing laws that will shut the loopholes in U.S. sanctions coverage that at present enable cash to movement to China’s state-owned entities. Yet America’s import-dependence on China stays significantly disturbing.

Congress ought to launch a moonshot effort to incentivize the rebuilding of home manufacturing for important medicines, uncommon earth metals, electronics, and navy gear. Otherwise, the U.S. may very well be held captive to the whims of a significant adversary.

Even if there isn’t a speedy warfare between the U.S. and China, it’s unwise to cede financial freedom and nationwide safety to Beijing’s leverage. Taking motion now may forestall future navy motion whereas additionally lowering the potential for resource-driven battle.

Robby Stephany Saunders is vice chairman for nationwide safety on the Coalition for a Prosperous America.

More: U.S. firms will rely much less on China and transfer manufacturing nearer to house as globalization splinters, El-Erian says.

Plus: Freeing the U.S. financial system from China will create an American industrial renaissance and thousands and thousands of good-paying jobs

Source web site: www.marketwatch.com