Financial circumstances is likely to be tighter this yr because the Federal Reserve retains up its inflation struggle, however they’ve but to limit U.S. corporations from borrowing through Wall Street’s debt financing machine.

Companies with investment-grade credit score scores have been borrowing within the U.S. company bond market at a document clip to begin 2023, though they’ve additionally been paying a number of the highest charges in 14 years.

Yields on the ICE BofA US Corporate Index have been final pegged close to 5.7%, a degree final seen in 2009, outdoors of a short 6% yield peak in October. The upward pattern in yields traces the Fed’s rate of interest climbing marketing campaign that kicked off final March, with a concentrate on cooling demand by making borrowing prices costlier and thereby tamping down stubbornly excessive inflation.

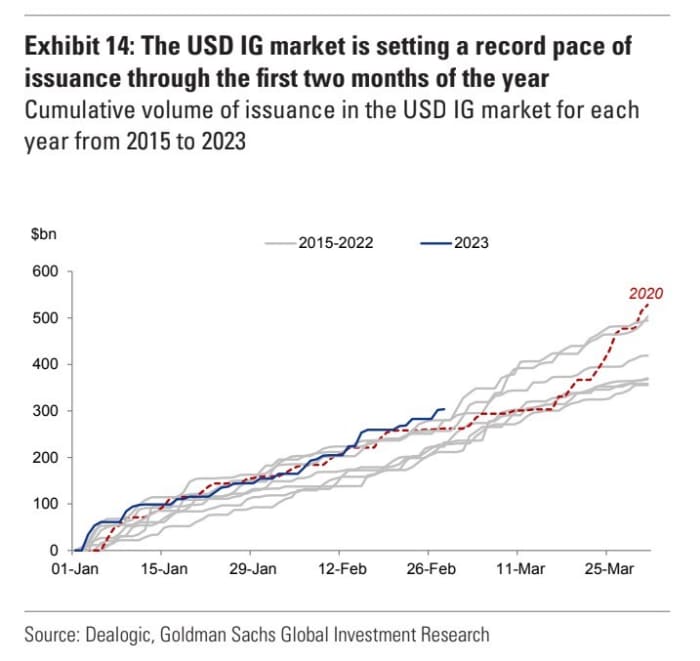

Bond issuance nonetheless hit $304 billion within the U.S. investment-grade company market within the first two months of the yr, the best tempo ever for a similar stretch of prior years (see chart), in keeping with Goldman Sachs analysis.

Record issuance of U.S. funding grade company bonds to begin 2023

Goldman Sachs Research, Dealogic

Helping to spice up bond issuance volumes in February was Amgen Inc.’s

AMGN,

$24 billion debt financing to assist fund its acquisition of Dublin-based Horizon Therapeutics

HZNP,

one of many Top 10 greatest bond offers of its variety.

While February sometimes has been a much less lively month for investment-grade company bond issuance, U.S. corporations have been busy “front-loading” their tempo of borrowing this yr to benefit from sturdy investor demand for debt and to get a head of future Fed rate-hiking dangers, BofA Global strategists mentioned.

“That leaves a smaller borrowing need for March,” a BofA staff led by Yuri Seliger, defined in a Wednesday consumer observe, including that their $150 billion-$170 billion bond provide forecast for March could be the bottom vary since 2019.

The Fed in early 2020 reduce rates of interest to virtually zero in the beginning of the coronavirus pandemic, which spurred a document U.S. company borrowing binge.

From the archive: A binge? Bulge? Or simply the brand new regular for debt in America as Fed helps spur string of information

Concerns have been rising in 2023 a few potential reacceleration of the U.S. financial system, which may warrant even increased Fed rates of interest to get U.S. inflation again right down to the central financial institution’s 2% annual goal.

Those jitters briefly pulled U.S. shares decrease this week and pushed the benchmark 10-year Treasury charge

TMUBMUSD10Y,

above 4%. Although by Friday, the S&P 500 index

SPX,

Dow Jones Industrial Average

DJIA,

and Nasdaq Composite index

COMP,

have been every increased, headed for weekly features, and the 10-year yield fell to three.86%, in accordance to FactSet.

Still, Goldman analysts reiterated their full yr provide forecasts of $1.3 trillion in for U.S. investment-grade company bonds and anticipated $190 billion to be issued by high-yield, or “junk rated” corporations.

Source web site: www.marketwatch.com