On the heels of final week’s losing-streak breaking rally, traders look headed for the sidelines on Monday.

Apart from an underwhelming development forecast from China over the weekend that’s knocking oil costs, we’ve obtained a sparse, however meaty lineup for the week that features remarks from Fed Chairman Jerome Powell and a jobs replace.

Here’s Deutsche Bank, summing up what’s at stake for the latter: “It’s fairly uncontroversial to say that the last payrolls report published on Feb. 3 was a huge moment, and one that started a series of events that has meant that the last month has been a struggle for most financial assets, especially bonds. As such if you thought the relatively random number generator that is payrolls is usually overhyped, you’ve seen nothing yet as we approach Friday’s big number,” wrote a crew of strategists led by Jim Reid.

However, latest momentum for market does seem to have nudged one among Wall Street’s most bearish strategists to ease up just a little on the gloom. Our name of the day returns to Mike Wilson, the Morgan Stanley strategist who two weeks in the past warned that traders had pushed shares right into a dying zone.

In a brand new be aware, the strategist factors out how the S&P 500

SPX

“survived a crucial test of support” final week by staying above the widely-watched 200-day transferring common. Stocks might see some additional positive factors within the brief time period if the greenback and rates of interest proceed to drag again, he stated.

Wilson has focused 4,150 as the subsequent resistance space for the S&P 500, although he nonetheless doesn’t appear to be prepared to surrender on that death-zone prediction.

“While this is an unequivocal positive in the short term, we believe it does not refute the very poor risk reward currently offered by many stocks given valuations and earnings forecasts that remain way too high, in our view,” he stated.

Wilson, who expects the S&P 500 will end the yr at 3,900 — the extra bearish finish of Wall Street’s wide-ranging forecasts — warned in late February that traders had been following inventory costs to “dizzying heights once again,” pushed by liquidity and greed. He stated dear valuations meant traders weren’t being compensated for threat.

Others are bit previous the 200-DMA, corresponding to this fund supervisor who notes how powerful the street shall be past that line within the sand:

@MikeDUnderhill

Our final phrase goes to Bill Blain, market strategist at Shard Capital, who has come to the conclusion that we face “directionless markets” and “a most dangerous moment.”

“There is no particular trend or belief driving prices. The equity bounce has gone. Bonds look tired. All the major themes are out there, clearly in play; inflationary expectations, interest rates, company valuations, the sustainability of national debt loads, geopolitics and global threats, but there is no particular momentum behind any of them. That will change in a flash – but how or when we simply don’t know,” Blain says in a weblog put up.

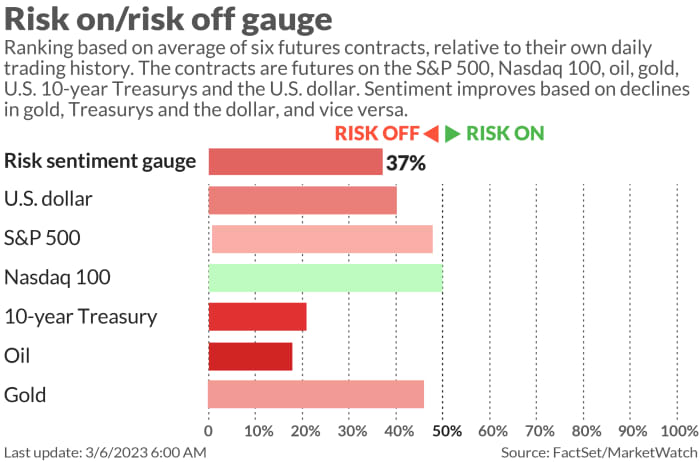

The markets

Stock futures

ES00

YM00

NQ00

are struggling for traction, whereas the 10-year Treasury yield

BX:TMUBMUSD10Y

is decrease, at 3.919% after briefly topping 4% final week. Oil costs

CL

are falling after China set a conservative development goal of “around 5%.” The greenback

DXY

is barely increased.

Also learn: Here’s what analysts are saying about China’s new development goal.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Tobacco maker Altria

MO

introduced a $2.75 billion deal for e-vapor product maker NJOY.

Tesla

TSLA

late Sunday lower the costs of its Model S and Model X automobiles to assist enhance gross sales as the primary quarter attracts to a detailed. Shares aren’t doing a lot in premarket buying and selling.

As a part of a cost-cutting transfer, Amazon

AMZN

will shut eight of its cashierless comfort shops in San Francisco, New York City and Seattle.

Esperion Therapeutics inventory

ESPR

tumbled 22% as traders questioned knowledge it reported on a ldl cholesterol drug for sufferers who can’t tolerate a statin. Nyxoah inventory

NYXH

climbed 19% after the medical expertise firm stated it achieved key regulatory and medical milestones.

A handful of U.S.-listed Chinese shares are decrease on the heels of that modest development goal. Alibaba

BABA,

Nio

NIO

and Baidu

BIDU

are all down 1% or extra.

Ciena

CIEN

shares are climbing on an earnings beat from the optical networking group.

WW International (Weight Watchers)

WW

will report after the shut.

Norfolk Southern

NSC

introduced a six-point security plan after final month’s derailment of a practice in Ohio that was carrying hazardous supplies.

Factory orders are due at 10 a.m., in every week that can finish with nonfarm payroll knowledge, by which we’ll see if January’s surge was a blip. And biannual Congressional testimony from Fed’s Powell is scheduled for Tuesday and Wednesday.

Read: Powell to speak to Congress about the opportunity of extra interest-rate hikes, not fewer

Best of the online

Is the U.S. housing market headed for a crash? ‘It all depends on how high rates go,’ mortgage veteran says.

Billionaire investor Mark Mobius says he can’t get his cash out of China.

The chilly actuality of trench warfare on Ukraine’s entrance strains.

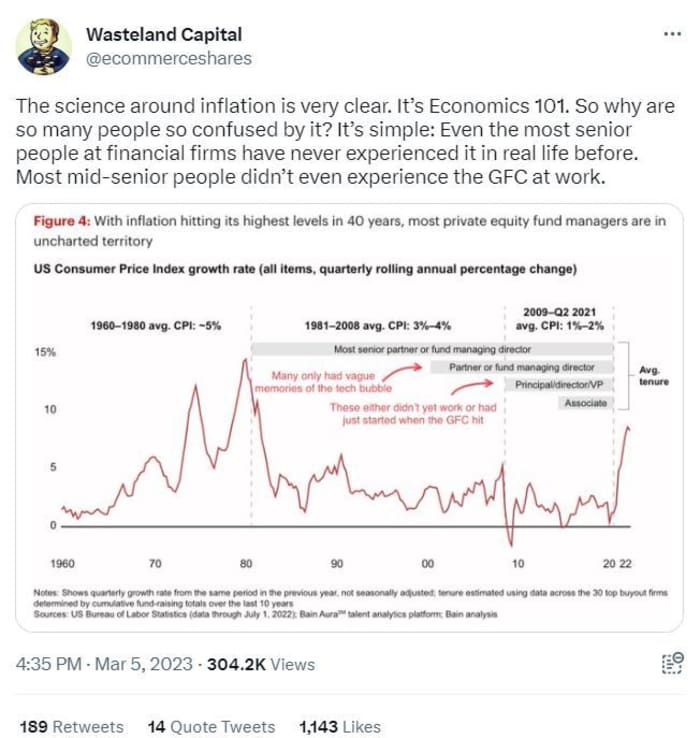

The chart

Why are most traders befuddled by inflation today? The Twitter account behind Wasteland Capital has an concept. You simply haven’t lived it but, child.

@ecommerceshares

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security title |

| TSLA | Tesla |

| BBBY | Bed Bath & Beyond |

| TRKA | Troika Media |

| AMC | AMC Entertainment |

| GME | GameStop |

| NIO | NIO |

| AAPL | Apple |

| MULN | Mullen Automotive |

| APE | AMC Entertainment Holdings most popular shares |

| XELA | Exela Technologies |

Random reads

An emblem of outdated, rustic Paris is about to be remodeled.

Toblerone is dropping its Alpine mountain picture.

A tacky U.S. victory over Europe.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e-mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source web site: www.marketwatch.com