April is National Financial Literacy Month. To mark the event, MarketWatch will publish a collection of “Financial Fitness” articles to assist readers enhance their fiscal well being, and provide recommendation on save, make investments and spend their cash correctly. Read extra right here.

If you’re feeling underwhelmed by the dimensions of your income-tax refund this yr, you’re most likely not alone.

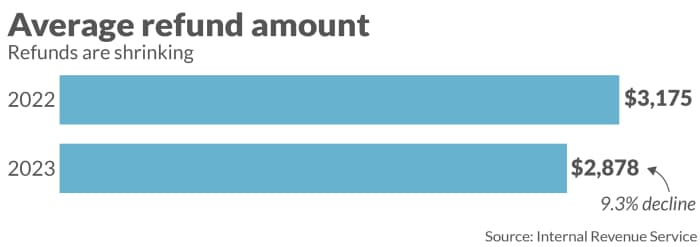

Before the beginning of the 2023 submitting season, tax professionals and the Internal Revenue Service had been cautioning U.S. taxpayers that many refunds would probably be smaller this yr as a result of expiration of numerous pandemic-related boosts to tax credit and deductions.

The submitting deadline is Tuesday, April 18 — besides for individuals who file for an extension — and the predictions about smaller refunds are coming into focus. The drop in refund quantities comes as notably dangerous news at a time when traditionally excessive inflation is cooling solely slowly.

Also learn: Yes, inflation does have an effect on your tax return. Here are 5 issues to be careful for.

On Friday, the most recent submitting statistics from the IRS confirmed the development on refund quantities. But whereas last-minute filers ought to be ready to hitch the gang of disenchanted folks, it’s not a tough and quick assure that they’ll.

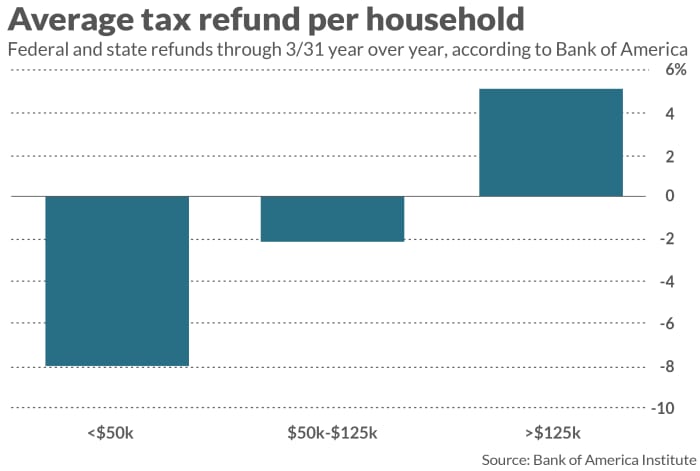

While many taxpayers are getting smaller refunds than they did final yr, some wealthier taxpayers are seeing bigger refunds this yr, in keeping with a brand new evaluation from Bank of America. That is likely to be defined by the capital losses traders can apply towards their capital positive factors and revenue, researchers mentioned. And traders positive did maintain losses final yr, as shares had their worst efficiency since 2008.

For many individuals, an income-tax refund is a major annual occasion of their monetary lives. But just like the tax code itself, lives are difficult. Here’s how refunds are enjoying out this tax season.

Refunds are smaller

When folks filed their 2021 returns final yr, hundreds of thousands of households bought the second half of enhanced baby tax-credit payouts of their refund. The credit score for folks with childcare prices was as a lot as $8,000, as a substitute of the earlier $2,100 most for 2 or extra dependents. The earned-income tax credit score additionally utilized to a bigger swath of employees in 2021 and paid extra to these with out youngsters. And even individuals who took the broadly used normal deduction may deduct some charitable contributions.

That all went away this yr.

The results might already be displaying up within the bigger economic system, with debit- and credit-card spending softening by 1.5% from February to March, in keeping with Bank of America. Lower tax refunds are one a part of the reason for that, researchers mentioned.

Meanwhile, retail gross sales dropped 1% in March, in keeping with Friday’s knowledge. It was the most important drop in 4 months.

Many will use their refund to repay debt

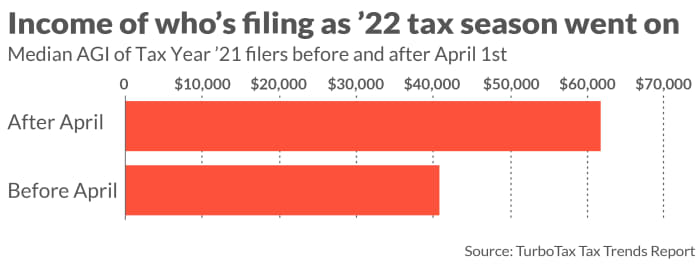

There was a transparent divide between the incomes of taxpayers who filed earlier than April 1 final yr and those that filed after that date, in keeping with analysis from TurboTax.

The knowledge is from 2022, however it’s probably that the development continued this yr, mentioned Lisa Greene-Lewis, an authorized public accountant and tax skilled at TurboTax.

And even when the common refund is decrease than it was final yr, it’s nonetheless a big sum of cash which means quite a bit to individuals who might have little in the way in which of financial savings. “The refund, for a lot of people, it’s the biggest paycheck that they get all year and they rely on it for bills or to get ahead,” Greene-Lewis mentioned.

Nearly one-third of individuals (28%) mentioned they might use their refund cash to pay down money owed, whereas 26% mentioned they might put the cash in financial savings, in keeping with a Bankrate survey final month.

Opinion: We all know an emergency fund is necessary. Here’s get began.

Not all refunds are decrease

In an evaluation launched Thursday, Bank of America reviewed inside knowledge to see if decrease refunds had been constant throughout revenue teams. They weren’t.

The largest drops got here for households with revenue beneath $50,000. Households incomes between $50,000 and $125,000 additionally noticed decrease refunds yr over yr. But it was a unique story for households incomes greater than $125,000.

What explains the refund disparity that’s giving a lift to wealthier taxpayers? The researchers have one concept. “In our view, this could be due to realized losses in capital markets for higher-income households,” they wrote.

Investors can promote capital belongings, like shares, at a loss and apply these losses to offset capital positive factors. If losses exceed positive factors, losses as much as $3,000 will be deducted and the rest can get carried ahead. (The $3,000 capital-loss limitation has been in place since 1978.)

Tax-loss harvesting is a method to collect up a number of capital losses, and final yr’s market circumstances probably made it a tempting technique. Stocks and bonds had been socked by recession worries, rising rates of interest and the heavy toll of inflation.

Also learn: U.S. billionaires have grown practically one-third richer throughout the pandemic, whereas a ‘permanent underclass’ struggles, Oxfam says

Another concept about why higher-income households are seeing greater refunds this yr has to do with estimated tax funds, in keeping with Jason Stein, founding father of Bluepoint Wealth in Orange County, Calif.

Stein doesn’t put together tax returns, however he does assist purchasers with their tax planning and techniques. While salaried wage earners have taxes taken out of each paycheck, individuals who depend on funding revenue pay their taxes for the approaching yr quarterly, Stein famous.

Equities had a high-flying efficiency in 2021. If traders primarily based their 2022 estimated tax funds on what they owed for 2021, Stein mentioned, they could have been overpaying.

“If your income is largely attributed to investment earnings, your investment earnings can vary substantially between those two years,” he mentioned.

On Friday, the Dow Jones Industrial Average

DJIA,

S&P 500

SPX,

and Nasdaq Composite

COMP,

all closed decrease regardless of huge first-quarter earnings beats from the nation’s largest banks.

Year to this point, the Dow is up greater than 2%, whereas the S&P is up 7.7% and the Nasdaq is up 15.8%.

Also learn: What is the tax extension deadline? When is Tax Day? Take the MarketWatch Tax Quiz to see in case you are ready

Source web site: www.marketwatch.com