Leap day 2024 is nearly upon us and buyers could also be questioning if a date related to as soon as topsy-turvy traditions has any significance for a inventory market that’s kicked off the 12 months with an epic rally.

The reply, although it ought to be taken with an enormous grain of salt, is that leap days are usually not so fortunate for stock-market buyers. The S&P 500

SPX

and Dow Jones Industrial Average

DJIA

have each tended to say no on Feb. 29, which is added to the calendar in leap years, which happen each 4 years.

Why the grain of salt? The pattern dimension is kind of small and sure not sufficiently big to cross muster with statistically minded merchants, stated Matthew Weller, world head of analysis at City Index and Forex.com, in a observe earlier this week.

Nevertheless, “it’s still worth being aware of the potential for lower than usual stock market returns on leap day,” Weller wrote, observing that for these extra inclined to trace latest traits, the inventory indexes have fallen on every of the final three leap days when the market was open. Feb. 29 fell on a Saturday in 2020, the latest bissextile year.

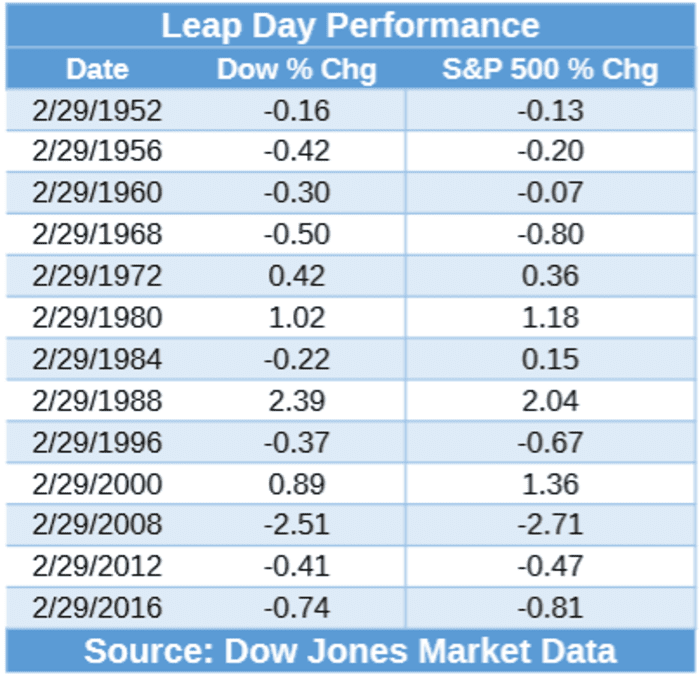

Dow Jones Market Data

According to Dow Jones Market Data, the S&P 500 has seen a median fall of 0.3% on the 13 leap days going again to 1952 (leap day in 2020 fell on a Saturday, when the market was closed). That compares to a median rise of 0.05% for the index on all different days since 1950. The S&P 500 has turned in a optimistic efficiency on simply 4 of these leap days, or 31% of the time, versus a 52% optimistic charge on all different days.

It’s an analogous story for the Dow, with the blue-chip gauge posting a median decline of 0.13% on leap days versus a median 0.05% achieve on all different days. It’s up simply 38% of the time on leap days, versus 53% for all different days.

Stocks are rolling into leap day this 12 months with a head of steam. The Dow and S&P 500 have notched greater than a dozen file finishes every up to now in 2024. Through Tuesday’s shut, the Dow had gained 2.2% in February and three.4% within the 12 months up to now. The S&P 500 was up 4.8% in February and 6.5% since Dec. 31.

“Acknowledging the obvious sample-size limitations of this analysis, there’s at least some statistical evidence that the stock market has tended to underperform on leap day, so bulls may want to exercise caution, especially after U.S. indices’ strong performance over the last month (and indeed last four months!),” Weller wrote.

—Michael Destafano contributed.

Source web site: www.marketwatch.com