For all of the speak concerning the Magnificent Seven and the ultra-reliance of only a handful of corporations to drive stock-market returns, it seems the U.S. is in reality one of many least concentrated markets on the earth.

That’s in line with the newest findings of the worldwide funding returns yearbook, by Paul Marsh and Mike Staunton of London Business School and Elroy Dimson of Cambridge University, now being revealed at UBS after Credit Suisse’s premature demise.

The U.S. — as represented by its largest inventory (Microsoft), its largest three shares (Apple and Nvidia are actually 2 and three), and its largest 10 shares (the Magnificent 7 + Berkshire Hathaway, Eli Lilly and Broadcom) — is the second-least concentrated of the world’s 12 largest inventory markets.

That’s to not say the present arrange is essentially sustainable. But the authors, on a name with journalists, have been at pains to say that there’s nothing instrincially unstable. “The future is very uncertain, always,” mentioned Dimson. “There’s no easy shortcut for spotting a bubble.”

“We’re not in a position to outguess markets,” added Marsh. He additionally drew a distinction between now and the dot-com period in that the present stock-market leaders are producing huge earnings, with the one actual query being the value afforded to them. “The question is whether the price is too high, it’s not whether or not it’s a bunch of junk,” he mentioned.

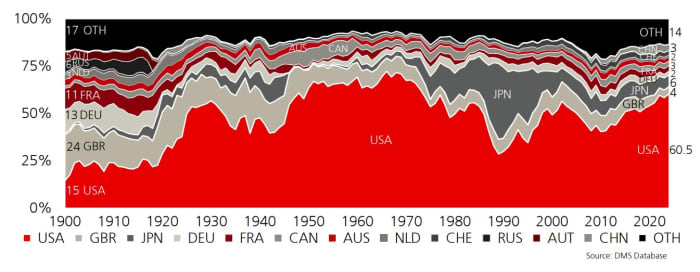

The U.S. accounts for three-fifths of the worldwide inventory market.

The U.S. dominance of world inventory markets is close to, however not at its peak, representing 61% of whole market capitalization on the finish of final yr.

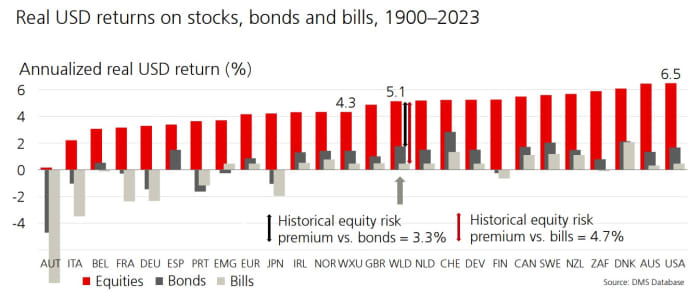

And the U.S. has been the perfect performing of the foremost inventory markets during the last 124 years. After inflation, it’s producing returns of 6.5%. Globally, shares over 124 years have generated an inflation-adjusted return of 5.1%, which is a 3.3% outperformance of bonds and a 4.7% outperformance of payments. Excluding the U.S., these returns have been 4.3% per yr, after inflation.

They don’t assume future returns will likely be so good, owing extra to the luck of earlier generations than worries concerning the future. They estimate Generation Z will see 4.5% annual actual returns on shares, 2% on bonds, and a 3.5% return on a 60/40 foundation; that’s worse than what the child boomers have skilled — 6.8% from shares, 3% from bonds, 5.6% total — however the identical stock-market return that millennials have seen.

The market

U.S. inventory futures

ES00,

NQ00,

have been weaker after the S&P 500

SPX

closed Tuesday at its third-highest degree ever. The huge story was bitcoin

BTCUSD,

which continued to surge.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,078.18 | 2.06% | 3.11% | 6.46% | 27.91% |

| Nasdaq Composite | 16,035.30 | 2.59% | 3.39% | 6.82% | 39.98% |

| 10 yr Treasury | 4.299 | -2.13 | 38.03 | 41.84 | 30.48 |

| Gold | 2,036.30 | -0.02% | -1.04% | -1.71% | 10.45% |

| Oil | 78.13 | 0.09% | 3.01% | 9.53% | 0.53% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The buzz

Tesla

TSLA,

CEO Elon Musk says a brand new roadster will likely be unveiled on the finish of the yr with the intention of delivery subsequent yr. The automaker, to place it mildly, has had a historical past of not all the time assembly Musk’s meant timetable for product shipments.

Apple

AAPL,

in line with experiences from Bloomberg and different news shops, is ending its decade-long effort to develop an electrical automotive.

Beyond Meat inventory

BYND,

soared in premarket commerce because the pretend meat maker reported better-than-expected income and forecast bettering margins.

Salesforce

CRM,

HP

HPQ,

and Snowflake

SNOW,

report outcomes after the shut.

Fourth-quarter GDP information will likely be revised because the advance U.S. commerce report is revealed, as a trio of Fed officers converse.

In the Michigan major, President Joe Biden disregarded a problem from Rep. Rashida Tlaib’s “uncommitted” marketing campaign, whereas former President Donald Trump cruised to victory on the Republican aspect.

Best of the net

Surge pricing is coming to Wendy’s — right here’s the way it has affected different purchases.

Behind the “nuclear” choice Universal Music has invoked in opposition to TikTok.

South Korea’s child bust breaks data.

Top tickers

Here have been essentially the most lively inventory market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security identify |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

MARA, |

Marathon Digital |

|

BYND, |

Beyond Meat |

|

SOUN, |

SoundHound AI |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

COIN, |

Coinbase Global |

|

NIO, |

Nio |

The chart

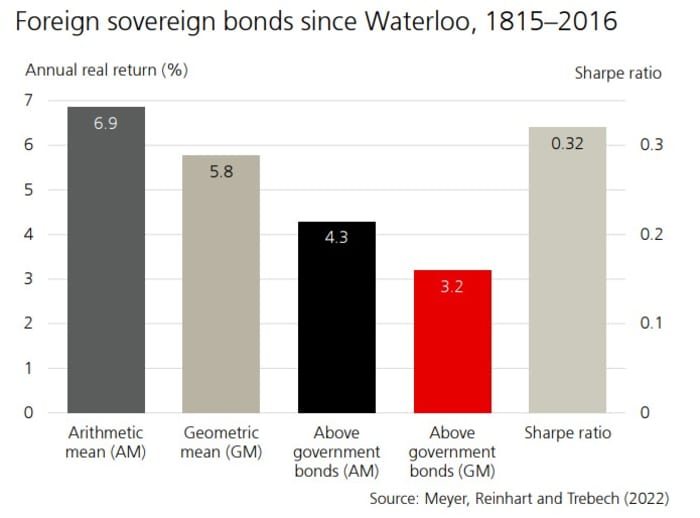

How is it that nations like Argentina, which has defaulted 9 instances, can frequently entry capital markets? Check out this chart — once more from the worldwide funding returns yearbook — displaying the return on sovereign bonds issued in international nations, since Waterloo in 1815. (That was an vital date since Napoleon’s defeat set the stage for thus many Latin American nations to turn into impartial, after which to hunt international capital.) The trio additionally estimated the credit score premium on company bonds vs. authorities bonds relationship again to 1900, which they are saying for investment-grade bonds is 0.75% per yr.

Random reads

A hearse driver tried to make use of a corpse as a passenger within the carpool lane.

An actual life Winnie the Pooh — a bear in North Carolina emerged from a small vent opening.

Woman lifts a paving slab within the backyard, finds World War II-era tunnel beneath.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast concerning the monetary news we’re all watching — and the way that’s affecting the financial system and your pockets.

Source web site: www.marketwatch.com