Americans are discovering it laborious to afford properties at mortgage ranges now past 7%, in line with some measures. Home costs have begun to mirror that.

As mortgage charges rose within the final quarter of 2022, Americans discovered the price of homeownership more and more difficult, including lots of of {dollars} in curiosity to their potential month-to-month mortgage cost. Yet dwelling costs held regular, given how few properties have been available on the market.

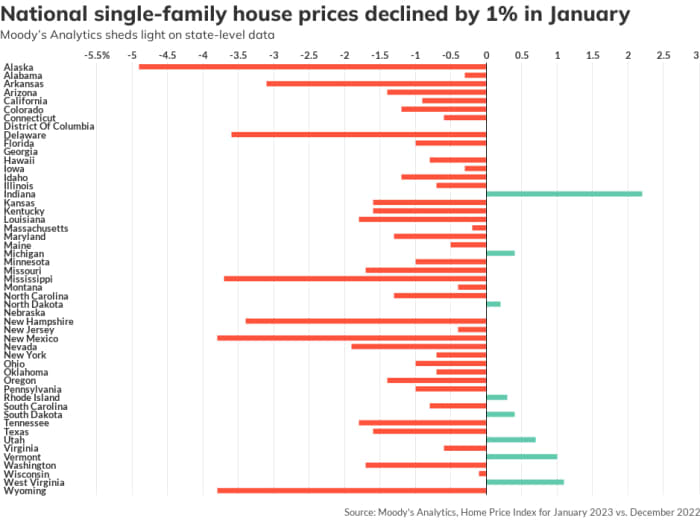

But months of excessive mortgage charges and a drop in dwelling gross sales are lastly impacting dwelling costs. Single-family dwelling costs slid 1% in January, as in comparison with December 2022, in line with information from Moody’s Analytics.

“The U.S. housing market is crumbling under the weight of higher mortgage rates and rock-bottom affordability,” Matthew Walsh, Moody’s Analytics housing economist, mentioned.

Alaska had the largest decline in month-over-month costs. Home costs fell by 4.9% in January. New Mexico and Wyoming adopted, with a 3.8% decline. Mississippi took the subsequent spot with dwelling costs dropping 3.7% in January as in comparison with the month earlier than.

However, it wasn’t all dangerous news. House costs additionally rose month-over-month in Indiana, by 2.2%, West Virginia, by 1.1% and Vermont by 1%.

But taking a look at costs year-over-year, the West Coast is main the drop, Moody’s Analytics mentioned, with California, Nevada and Washington reporting values under what they noticed in 2022.

The median value of an present dwelling was $359,000 in January, in line with the National Association of Realtors. The median value of a brand new dwelling bought in January was $427,500, in line with Census information.

To be clear, dwelling costs aren’t crashing, however slightly falling progressively as purchaser demand dries up.

Part of the rationale why gross sales aren’t transferring extra is as a result of sellers are reluctant to listing. Having secured an ultra-low mortgage charge over the past two years, there’s little curiosity in giving up that deal.

Uncredited

“There were fewer new listings in January than at any point on record, with the exception of the start of the pandemic,” Taylor Marr, deputy chief economist at Redfin, mentioned in a latest report.

“That hampered demand because it meant that many of the buyers who were still in the market had a tough time finding a home that met their needs. The shortage of homes for sale also buoyed home prices,” he added.

Home buy functions have dropped to the bottom stage in 28 years, the Mortgage Bankers Association mentioned this week.

“Following two years of double-digit price growth, the housing market is extremely overvalued, and affordability is near a three-decade low,” Walsh wrote in a word.

“The housing market will descend further into correction through 2023. Our baseline forecast expects that house prices will decline by 5% to 10% over the

next two years,” he added.

He anticipated dwelling costs to return to 2021 ranges by 2025.

Source web site: www.marketwatch.com