U.S. yields had been little modified to barely decrease Friday morning, with 10- and 30-year charges remaining close to their highest ranges since 2007 and 2011.

What’s taking place

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

was 4.923%, down 3.6 foundation factors from 4.959% on Thursday. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 4.262%, down 4.5 foundation factors from 4.307% Thursday afternoon. Thursday’s stage was the very best since Nov. 7, 2007, primarily based on 3 p.m. knowledge from Dow Jones Market Data. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

was 4.391%, down 2 foundation factors from 4.411% late Thursday. It completed Thursday on the highest stage since April 28, 2011.

What’s driving markets

The massive story in monetary markets is that longer-term debt continues to say no in worth, with yearly returns within the Treasury market slipping into destructive territory this week. The selloff has pushed 10- and 30-year yields to their highest closing ranges in over a decade on Thursday.

Read: Treasury market returns are destructive once more. Why this time for bonds appears completely different than 2022.

U.S. financial knowledge launched this week — notably retail gross sales, industrial manufacturing and weekly jobless claims — pointed to a surprisingly resilient U.S. financial system after a collection of Federal Reserve rate of interest will increase. There’s no main financial knowledge scheduled to be launched on Friday.

Meanwhile, Treasury debt issuance is on the rise to refill the U.S. authorities’s coffers following the debt-ceiling debate in Congress earlier this 12 months, and the Federal Reserve has been shrinking its stability sheet as a part of the central financial institution’s quantitative-tightening program.

Yields exterior the U.S. have additionally been rising, with the 10-year German bund charge

BX:TMBMKDE-10Y

close to its highest stage since 2011.

What analysts are saying

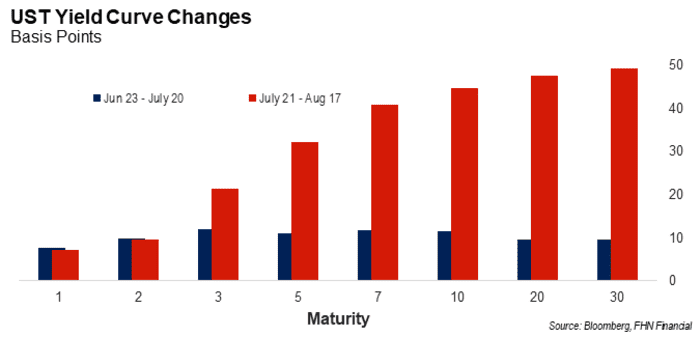

“The last few weeks of bond trading have been full of counter-intuitive movements, featuring intra-day spikes and dips that often follow no consistent or coherent narrative. Rather than focus on the day-to-day reactions, it’s worth taking a step back and looking at a slightly longer horizon,” stated macro strategist Will Compernolle at FHN Financial in New York.

“The chart below puts recent trading into better context, comparing yield curve changes during the last twenty complete sessions with the twenty right before,” he wrote in a word. “What really sticks out about the yield changes since July 21 is not how much they have gone up, but that it’s been almost entirely focused at the long end of the curve.”

Source: Bloomberg, FHN Financial

Source web site: www.marketwatch.com