(This is the second of a three-part collection that includes lists of high inventory picks amongst analysts working for brokerage corporations. Part 1 screens large-cap shares, led by Nvidia Corp.)

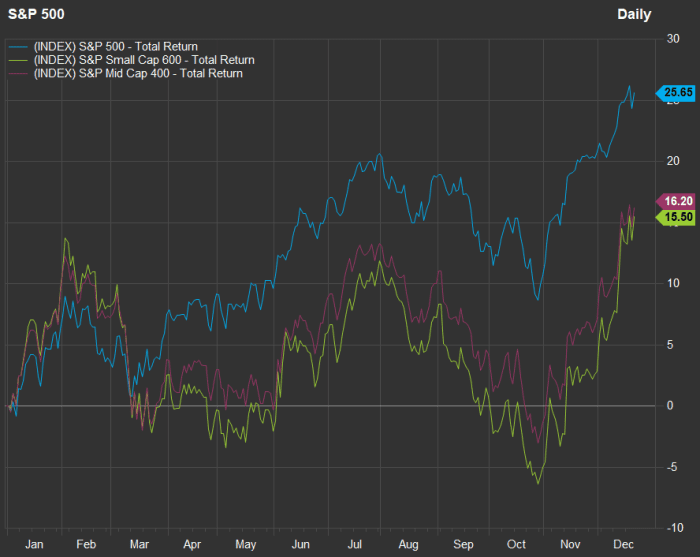

The 2023 stock-market rally has been led by the “Magnificent Seven” firms, which have pushed an accelerating upward pattern for the large-cap benchmark S&P 500. Shares of smaller and medium-sized firms have additionally rallied, however not as a lot:

Returns throughout 2023 for the S&P Small Cap 600 and the S&P 400 Mid Cap Index have lagged the large-cap S&P 500.

FactSet

All three indexes are weighted by market capitalization, however the lack of an upward restrict means the S&P 500 is extra concentrated than the S&P Small Cap 600 Index

SML

or the S&P 400 Mid Cap Index

MID.

In reality, the Magnificent Seven — Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

Alphabet Inc.

GOOGL,

GOOG,

Tesla Inc.

TSLA,

TSLA,and Meta Platforms Inc.

META,

— make up greater than 28% of the SPDR S&P 500 ETF Trust

SPY.

And when weighted by their market capitalization on the finish of 2022, the Magnificent Seven have contributed 59% to the S&P 500’s whole return this yr by way of Dec. 21.

All returns on this article embrace reinvested dividends.

When contemplating smaller firms for funding, traders usually give attention to the Russell 2000 Index

RUT,

however the next display screen begins with the S&P Small Cap 600 Index, which is extra selective. Initial inclusion within the S&P Small Cap 600 requires firms to report 4 subsequent quarters of profitability, amongst different standards.

This yr’s rally follows broad declines throughout 2022. So right here’s a have a look at whole returns from the tip of 2021 by way of Dec. 21, together with ahead price-to-earnings ratios for all three broad S&P indexes:

| Sector or Index | Return since finish of 2021 | Forward P/E | Current P/E to 5-year common | Current P/E to 10-year common | Current P/E to 15-year common | ||

| S&P Small Cap 600 | -3% | 14.3 | 98% | 94% | 98% | ||

| S&P Mid Cap 400 | 1% | 14.5 | 96% | 94% | 98% | ||

| S&P 500 | 3% | 19.6 | 102% | 109% | 121% | ||

| Source: FactSet | |||||||

The large-cap shares as a bunch commerce above their five-, 10- and 15-year weighted averages whereas the small-caps and midcap shares commerce beneath the averages.

Read: Beaten-down small-cap shares are roaring again. Why they may soar in 2024.

Screening the S&P Small Cap 600

Starting with the complete index, we narrowed the record to 385 firms coated by at the very least 5 analysts polled by FactSet. Then we pared the record to 91 firms with at the very least 75% “buy” or equal rankings.

Analysts working for brokerage corporations sometimes assign 12-month value targets to the shares they cowl. Among the 91 firms, listed below are the 20 with the best indicated upside potential for 2024, primarily based on consensus value targets:

| Xperi Inc. | Ticker | Share “buy” rankings | Dec. 22 value | Consensus value goal | Implied upside potential | Forward P/E |

| Vir Biotechnology Inc. |

VIR, |

88% | $10.11 | $32.00 | 217% | N/A |

| Arcus Biosciences Inc. |

RCUS, |

82% | $18.15 | $41.00 | 126% | N/A |

| Xencor Inc. |

XNCR, |

92% | $20.94 | $39.83 | 90% | N/A |

| Dynavax Technologies Corp. |

DVAX, |

100% | $13.84 | $24.80 | 79% | 185.0 |

| ModivCare Inc. |

MODV, |

100% | $43.89 | $75.50 | 72% | 6.8 |

| Xperi Inc |

XPER, |

80% | $10.68 | $18.20 | 70% | 30.1 |

| Ligand Pharmaceuticals Inc. |

LGND, |

100% | $71.51 | $114.80 | 61% | 16.8 |

| Ironwood Pharmaceuticals Inc. Class A |

IRWD, |

83% | $11.18 | $17.83 | 60% | 17.2 |

| Thryv Holdings Inc. |

THRY, |

100% | $20.60 | $32.75 | 59% | 25.5 |

| Catalyst Pharmaceuticals Inc. |

CPRX, |

100% | $16.58 | $26.20 | 58% | 13.8 |

| Green Plains Inc. |

GPRE, |

80% | $25.51 | $40.30 | 58% | 17.3 |

| Payoneer Global Inc. |

PAYO, |

100% | $5.12 | $8.00 | 56% | 21.3 |

| Patterson-UTI Energy Inc. |

PTEN, |

75% | $10.91 | $17.00 | 56% | 8.4 |

| Arlo Technologies Inc. |

ARLO, |

100% | $9.41 | $13.80 | 47% | 24.4 |

| Pacira Biosciences Inc. |

PCRX, |

100% | $33.05 | $48.40 | 46% | 9.6 |

| Helix Energy Solutions Group Inc. |

HLX, |

83% | $10.45 | $15.00 | 44% | 16.3 |

| Livent Corp. |

LTHM, |

75% | $17.23 | $24.34 | 41% | 10.1 |

| Talos Energy Inc. |

TALO, |

78% | $14.31 | $20.00 | 40% | 18.1 |

| Smart Global Holdings Inc. |

SGH, |

100% | $18.73 | $26.17 | 40% | 14.1 |

| Digi International Inc. |

DGII, |

100% | $26.16 | $36.14 | 38% | 12.8 |

Click on the tickers for extra about every firm.

Click right here for Tomi Kilgore’s detailed information to the wealth of data out there without cost on the MarketWatch quote web page.

Forward P/E ratios aren’t out there for the primary three shares on the record as a result of analysts anticipate these firms to report detrimental earnings over the subsequent 4 quarters.

Don’t miss: 13 shares which can be down for 2023 however could bounce again in 2024 or past

Source web site: www.marketwatch.com