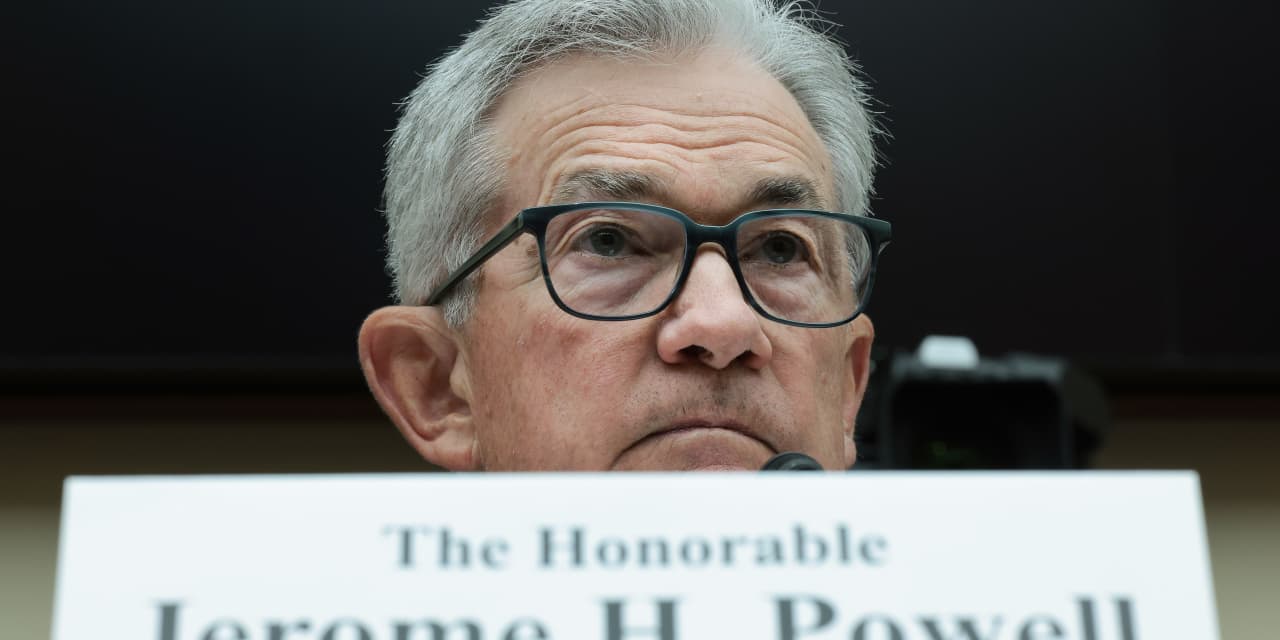

The Federal Reserve will not be anticipated to vary the stance of its interest-rate coverage or say something definitive about its near-term outlook at this week’s coverage assembly. But Fed watchers know the place to search for delicate hints in regards to the Fed’s pondering relating to the outlook for the economic system and rates of interest.

Read: Powell to tread fastidiously subsequent week

Most of the main target shall be on the Fed’s financial forecast, referred to as the Summary of Economic Projections.

“The SEP is arguably the most important aspect of the September meeting for markets,” stated Aditya Bhave, senior U.S. economist at Bank of America, in a word to shoppers.

Here are 4 issues that economists shall be paying essentially the most consideration to:

Will the Fed keep its projection of 4 interest-rate cuts in 2024?

Fed officers have insisted that they intend to maintain their benchmark rate of interest excessive to proceed to push inflation down. The price is now in a spread of 5.25%-5.%.

In June, Fed officers projected the equal of 4 25-basis-point cuts subsequent 12 months. Some economists assume the Fed will pencil in fewer cuts.

Bhave stated the Fed is prone to mission solely three 25-basis-point cuts subsequent 12 months.

“They have been pushing this view of ‘higher for longer,’ and I think they go further in that direction.” Bhave stated in an interview.

“They will say, given the resilience of the economy, there is less need to cut,” he added.

There is even an opportunity that the median dot plot reveals fewer cuts.

“If that were to occur, it would be a significant hawkish surprise for markets,” Bhave stated in a analysis word.

How many Fed officers assume charges have peaked?

In June, solely six of 18 Fed officers thought the central financial institution was completed climbing charges.

Krishna Guha, vice chairman of Evercore ISI, stated he thinks that complete will rise to just about half of the committee.

“We think Powell will characterize this more as a split vote than a clear bias to hike further, keeping market pricing around 50-50,” Guha stated in a word to shoppers.

What modifications will the Fed make to its financial forecast?

Economists at Bank of America assume the Fed’s forecast for 2023 progress shall be revised as much as 2% from 1%, given how sturdy the economic system is.

In phrases of inflation, the Fed may decrease its core PCE inflation forecast to three.7% from 3.9%. But core inflation could possibly be revised up two-tenths, to 2.8% for 2024, given how resilient the economic system has been.

The Fed is prone to present inflation reaching 2% in 2026.

Will the Fed’s projection of the impartial price start to float greater?

Economists assume the Fed may increase its estimate for the longer-term impartial price. That is extra vital than it sounds. It means “the whole level of rates moves higher,” stated Yelena Shulyatyeva, senior economist at BNP Paribas.

That signifies that Americans won’t see the ultra-low mortgage charges and different lending charges that had been frequent after the worldwide monetary disaster in 2008.

At the second, the Fed initiatives a 2.5% impartial price, however the vary of estimates spans from 2.375% to three.625%.

Source web site: www.marketwatch.com