In my day, making use of to varsity meant thumbing by a giant paperback encyclopedia of faculty listings after which pulling out the typewriter and filling in purposes. Thirty-some years later as my child prepares to use, I would like a spreadsheet and entry to reams of information that I’m unsure the way to course of.

I’ve tried doing it the old style method, by looking by the web sites of all the colleges my high-school senior is considering making use of to. For every faculty, you should discover the frequent information set, a multipage PDF that lists seemingly unrelated stats. Then you should run the net-price calculator, which makes an attempt to offer you a price ticket based mostly on the monetary data you enter. Then you place the whole lot collectively to attempt to get some sense of your child’s probabilities of getting in and what it may cost a little you so you’ll be able to evaluate the colleges to one another.

Of course, there’s an app for that. Well, not a lot one app, however a number of totally different packages that purport to type faculty information in a helpful method — a few of them free, some by subscription and a few by the varsity. All of it’s nonetheless complicated and overwhelming for the common household.

Big J Education Consulting is making an attempt to make it simpler with interactive charts, obtainable on its web site totally free, that assist you to simply type by information from the frequent information units of lots of of faculties, plus a few of the firm’s personal fact-checked and reported updates. Co-owners Jennie Kent and Jeff Levy have been making these charts for years for their very own enterprise, and so they went high-tech with a brand new format this 12 months that makes sorting and crunching the information straightforward sufficient for a layperson to do.

“People think about that common data set as a snapshot, but it’s really more of a collage,” says Kent. “Admissions fills out part, financial aid fills out part. Sometimes numbers are off, and we reach out to institutions. The best that any of us can do with this is to use the common data set.”

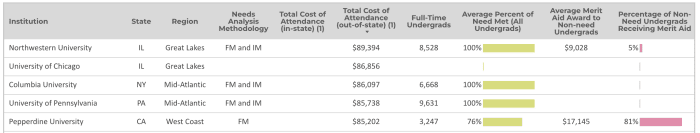

Take, for example, the generally outrageous cost-of-attendance quantity, a sticker worth that features tuition, room and board, books and costs for one 12 months. At the highest of their checklist is Northwestern University in Evanston, Ill., at a whopping $89,394. Levy and Kent say they’re listening to from plenty of colleges that the value for the upcoming 12 months can be over $90,000, at the very least for worldwide college students.

Need-based and advantage help for the category of 2026, sorted by whole price of attendance for out-of-state college students.

Credit: Jennie Kent, Jeff Levy, and Big J Educational Consulting, 2023

You can study lots from a chart like this and taking part in with it based on the alternatives pertinent to your loved ones. For occasion, one factor to notice is that when you type by worth, you don’t see costs beneath $80,000 till you get 4 pages in. Those are the most costly 78 out of 427 colleges.

To get to the least costly colleges, you must type by in-state costs, as a result of most of those can be public establishments that provide particular pricing to state residents.

Need-based and advantage help for the category of 2026, sorted by whole price of attendance for in-state college students.

Credit: Jennie Kent, Jeff Levy, and Big J Educational Consulting, 2023

Of course, a college’s checklist worth doesn’t inform you how a lot it should price your loved ones to ship a pupil there. The worth you pay will rely by yourself household’s monetary state of affairs, and that’s the place all of the strategizing is available in — and why households generally flip to professionals to crunch this information for them.

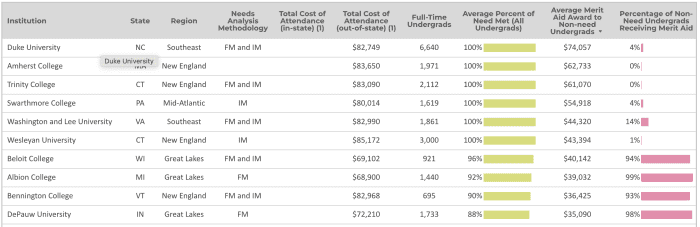

To get any sort of deal with on that, you must have a look at the opposite columns detailed on the chart beneath that analyze how a lot need-based help a college provides and the way a lot it provides out in so-called advantage help, which faculty finance specialists have taken to calling “tuition discounting,” as a result of it actually simply represents a coupon worth off the sticker worth.

If your loved ones falls below the brink of “need,” which varies by faculty, you may get a good image of what your worth could also be from the net-price calculator. But when you fall outdoors of these parameters, you’ll wish to know the way beneficiant a college is with that tuition discounting. You actually have to take a look at two numbers to determine this out, as a result of the common quantity of advantage help will be inflated by the small variety of college students it goes to.

Need-based and advantage help for the category of 2026, common advantage help awarded to non-need undergrads.

Credit: Jennie Kent, Jeff Levy, and Big J Educational Consulting, 2023

For occasion, based on common-data-set information compiled by Big J, Duke meets all wants of undergraduates and provides out a mean of $74,057 in advantage awards to non-need undergrads, but it surely solely provides that out to 4% of its full-pay candidates. Whereas Beloit College meets 96% of want however provides out a mean of $40,142 in advantage awards to 94% of non-need undergrads. Which appears like the higher probability of getting a reduction?

You can enter your personal choice of schools into this checklist and do a comparability that method. I enter the highest schools on my youngster’s checklist and was in a position to see how they stacked up in opposition to one another when it comes to advantage help and tuition worth. I discovered that helpful for weeding some out.

Playing the early sport

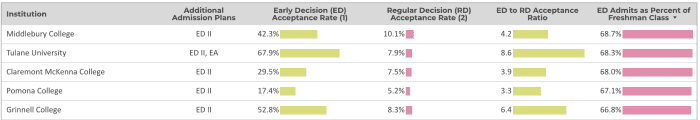

None of the value modeling issues in case your youngster doesn’t get into a college within the first place. That’s the place strategizing over what sort of software to submit issues. Slightly information visualization on early admission would possibly assist you if you wish to play that sport. And when you pair it with the monetary information, you may get a way of whether or not it issues at a specific faculty to use early, and what it may cost a little you — for the reason that determination is meant to be binding.

The alternative of whether or not to use for early determination is difficult this 12 months as a result of the federal financial-aid kind, FAFSA, isn’t opening till December, and colleges can not sometimes finalize their help packages with out it. Plus, extra schools throughout the spectrum are filling their lessons with early admits as a result of it maximizes their yield statistics — that’s, the variety of college students who settle for their affords. So competitors is fierce.

Early-decision and regular-decision acceptance charges for the category of 2026, sorted by early admits as % of freshman class.

Credit: Jennie Kent, Jeff Levy, and Big J Educational Consulting, 2023

On the Big J chart for early-decision and regular-decision acceptance charges, the colleges profiting from this are filling extra two-thirds of their lessons with early admits. They are additionally sometimes accepting college students at a far higher fee from the early-decision pool than they’re from the regular-decision pool. At Tulane, for example, the early-decision acceptance fee is 8.6 occasions higher than that for normal choices.

Looking at that information would possibly make you are feeling somewhat stress, however keep in mind, on the finish of the day, the one faculty your youngster ought to choose for early determination is one that you would be able to afford and that may be a good match for them.

More on saving for faculty

Source web site: www.marketwatch.com