A Federal Reserve repo facility is again in focus as a gauge of liquidity as U.S. shares stumble and buyers brace for one more barrage of Treasury borrowing to fund the U.S. authorities’s massive funds deficit.

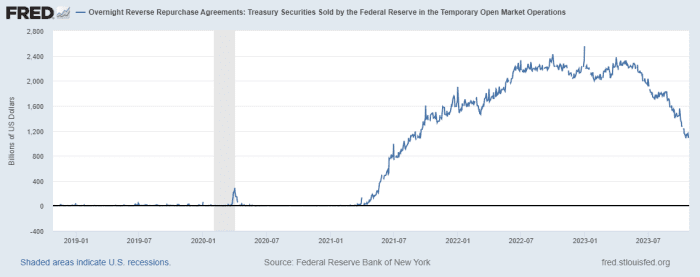

Funds parked by institutional buyers short-term on the New York Fed’s in a single day reverse repo facility have dropped to $1.1 trillion from a peak of about $2.5 trillion in December, in accordance with Fed knowledge.

Cash park on the Fed’s in a single day facility has been falling on heavy Treasury provide to fund the federal government’s massive borrowing wants.

Federal Reserve

It indicators {that a} main supply of money ready on the sidelines to deploy to purchase Treasury debt or different cash-like investments over the previous two years has dramatically dwindled.

The retreat additionally comes because the S&P 500 index

SPX

was on tempo to log a detailed in correction territory Friday, with any end beneath 4,130.06 marking a stoop of not less than 10% from its latest closing excessive of 4,588.96 set on July, in accordance with FactSet. The Nasdaq Composite Index

COMP

logged its seventieth correction earlier this week.

While funds parked in a single day on the Fed have been incomes 5.3%, just lately, the quantity of money has decreased sharply for the reason that Treasury started stepping up debt issuance to fund a massive federal funds deficit. For fiscal 12 months 2023 it was pegged at $1.7 trillion, up 23%, from a 12 months in the past.

“I’ve been tracking the volume and size of the Fed reverse repo facility,” stated Bryce Doty, a senior portfolio supervisor at Sit Investment Association in Minneapolis. “It isn’t a perfect measure of liquidity,” he stated, however value watching because the Treasury prepares subsequent week to announce its coming borrowing wants.

Read: Wall Street braces for roughly $1.5 trillion in additional borrowing wants by Treasury

The Fed is also extensively anticipated on Wednesday to carry its coverage rate of interest regular at a 22-year excessive within the 5.25%-5.5% vary.

Doty stated the roughly $1 trillion money pile within the Fed’s repo facility was nonetheless an enormous quantity. “But what happens if that gets tapped out?”

U.S. shares and bonds have been unstable within the second half of this 12 months because the Fed bolstered its message that rates of interest seemingly want to remain increased for longer to maintain falling inflation heading again towards its 2% annual goal.

The Fed’s most well-liked inflation tracker, the personal-consumption expenditures worth index for September, registered on Friday at 3.4% over the previous 12 months, unchanged from the prior month.

Stocks had been principally decrease Friday, heading for sharp weekly losses, with the Dow Jones Industrial Average

DJIA

on tempo for a 2.2% weekly drop, the S&P 500 index

SPX

off 2.8% and the Nasdaq Composite Index down 2.9% for the week, in accordance with FactSet.

Weekly losses for the S&P 500’s communications companies sector had been on tempo to prime 6%, underscoring the sharp selloff in shares of a number of huge know-how firms. Its vitality element additionally was down about 6%, in accordance with FactSet.

Bond yields had been principally rising too, with the benchmark 10-year Treasury

BX:TMUBMUSD10Y

yield regular at 4.84% Friday, after just lately topping 5%, the very best since 2007.

–Greg Robb contributed reporting

Source web site: www.marketwatch.com