The roughly $25 trillion Treasury market first started flashing this telltale signal {that a} U.S. recession seemingly lurks on the horizon virtually a yr in the past, in accordance with Bespoke Investment Group.

It was late October of 2022 when the 3-month Treasury yield

BX:TMUBMUSD03M

first eclipsed the 10-year Treasury yield

BX:TMUBMUSD10Y,

leading to an “inversion” of a key a part of the yield curve that’s been a dependable predictor of previous recessions.

Where is that this long-anticipated recession? Analysts at Bespoke assume the following financial pullback nonetheless might be about 275 days away, or beginning roughly in early June 2024, in accordance with information as of Wednesday.

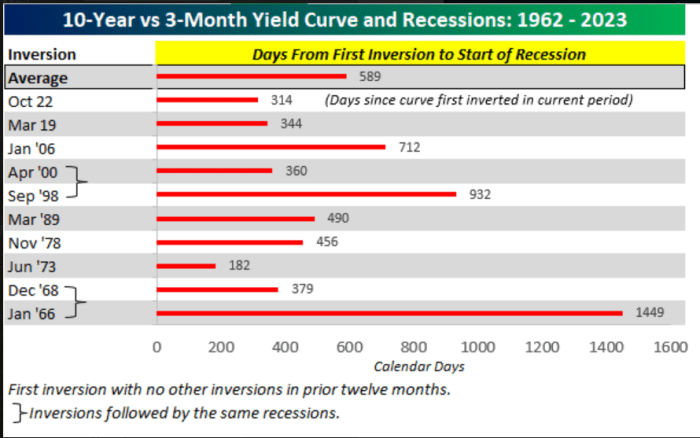

That’s as a result of previous recessions took a median 589 days to materialize after the 10-year and 3-month yield curve first inverted, primarily based on information because the early Nineteen Sixties.

Past recessions took virtually 600 days on common to start out after a key recession gauge first flashed.

Bespoke Investment Group

There has been appreciable debate about what level alongside the Treasury yield curve issues most to buyers as a recession predictor. Doubts additionally linger about if Wall Street’s varied recession barometers even work anymore, given the COVID disaster and the deluge of worldwide stimulus launched by governments and central banks in its wake.

“It’s tempting to dismiss the yield curve in this cycle, but history has shown that recessions haven’t been quick to arrive after the yield curve first inverts,” the Bespoke group wrote in a associated shopper be aware.

Their information additionally exhibits June 1973 was the one time previously six a long time when a recession arrived inside 300 days of the 10-year and 3-month yield curve first inverting.

The 10-year Treasury yield was again to virtually 4.3% on Wednesday, close to its highest degree of the yr, placing additional strain on property house owners, households and company debtors in search of new financing.

The Federal Reserve’s Beige Book report on Wednesday confirmed the financial system grew modestly in July and August, bolstered by “the last stage of pent-up demand” for leisure actions. Goldman Sachs economists earlier within the week pegged the percentages of a recession within the subsequent 12 months at 15%, which implies to them there isn’t a urgent hazard of 1.

U.S. shares posted back-to-back losses Wednesday, however with the S&P 500 index

SPX

nonetheless up 16.3% on the yr, the Nasdaq Composite Index

COMP

32.5% increased and Dow Jones Industrial Average

DJIA

up 3.9% for a similar stretch.

From the archives: Why the countdown to a recession begins now, in accordance with these bond market alerts

Source web site: www.marketwatch.com