Wall Street analysts appear to love buy-now-pay-later companies firm Affirm Holdings Inc., however most of them anticipate the inventory to drag again — loads — in 2024 after rocketing greater than five-fold this 12 months.

The monetary expertise firm has benefited immensely through the vacation months, as a rising variety of customers, who’ve grown weary of inflation and rising borrowing prices, have embraced the delayed-payment choices offered by BNPL suppliers.

Affirm’s inventory

AFRM,

has rocketed 420.7% 12 months up to now as of noon buying and selling Thursday, together with a near-tripling (up 186%) for the reason that finish of October.

Don’t miss: Affirm’s inventory rockets after Walmart expands buy-now-pay-later possibility to incorporate self-checkout purchases.

Truist analyst Andrew Jeffrey wrote in a latest observe to purchasers BNPL quantity on Cyber Monday, or the Monday following the Thanksgiving weekend, jumped 42.5% from a 12 months in the past, as customers sought fee flexibility and shied away from legacy financial institution playing cards.

The Financial Brand, which analyzes monetary companies sector developments, reported that BNPL accounted for 8% of all spending on Cyber Monday, up from 6.5% on Amazon Prime Day simply 4 months earlier, as Jeffrey famous.

Read: Affirm’s inventory wins over a former skeptic as BNPL developments appear to be bettering.

Also learn: Affirm’s inventory pops after earnings deliver narrowing loss, large income beat.

But regardless of this bullish outlook on BNPL, Jeffrey is among the many minority on Wall Street who advocate buyers purchase Affirms’ inventory at present ranges.

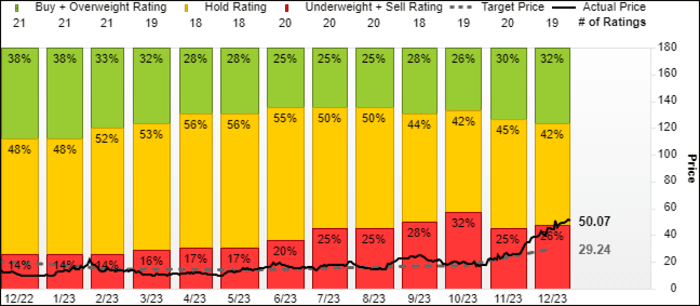

Of the 19 analysts surveyed by FactSet who cowl Affirm, solely six are bullish, whereas eight are impartial and 5 are bearish. The common 12-month inventory worth goal is $29.24, which suggests 42% draw back from present ranges.

Less than a 3rd of Wall Street analysts are bullish on Affirm’s inventory.

FactSet

Jeffrey’s been bullish on the inventory for the reason that starting, and his 12-month inventory worth goal of $55 is certainly one of solely two which might be above present ranges. (Affirm’s inventory went public in January 2021.)

The different is Mizuho Securities analyst Dan Dolev’s 12-month goal of $65.

“We expect the debate around Affirm to increasingly shift from BNPL and partnerships like Walmart, to [Affirm] becoming a full-fledged financial services firm with direct deposits, saving, etc.,” Dolev wrote in a observe to purchasers.

Meanwhile, J.P. Morgan’s Reginal Smith is constructive about Affirm’s prospects following a blowout earnings report, given the outlook for sustained progress, bettering profitability and robust credit score efficiency.

But Smith charges Affirm impartial and the 12-month worth goal of $35 implies about 30% draw back: “We increasingly see Affirm as a core holding in our fintech coverage universe, but think shares are likely due for a breather.”

Even Wedbush’s David Chiaverini, who’s among the many most bearish on Affirm’s inventory with a $15 worth goal given considerations over valuation, competitors the well being of customers, views the corporate’s progress and profitability targets over the medium- and long-term as “net positive.”

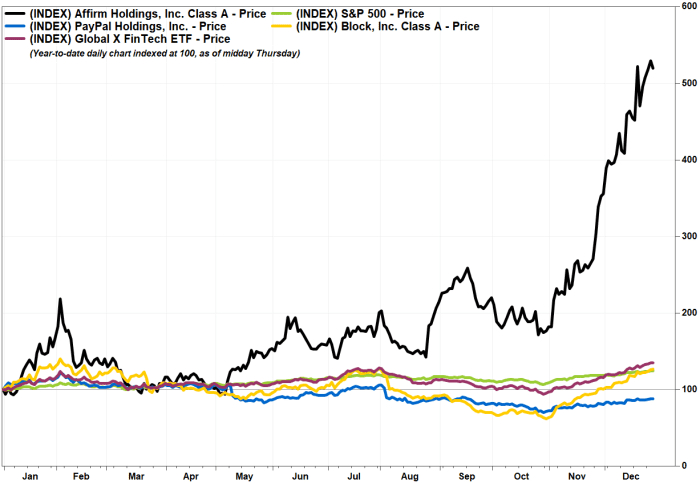

Affirm’s inventory has outperformed its friends and the inventory market by a really broad margin this 12 months.

FactSet, MarketWatch

Among Affirm’s greatest BNPL rivals, shares of PayPal Holdings Inc.

PYPL,

have shot up 21.5% for the reason that finish of October however have dropped 11.7% 12 months up to now, whereas Block Inc.’s inventory

SQ,

has soared 98.4% over the previous two months and has rallied 27.1% this 12 months.

In comparability, the Global X FinTech ETF

FINX

has powered up 39.4% the previous two months and hiked up 35.5% 12 months up to now, whereas the S&P 500 index

SPX

has gained 14.1% since October and superior 24.7% this 12 months.

Of the 48 analysts surveyed by FactSet who cowl PayPal, 58% are bullish and the typical 12-month inventory worth goal of $73.99 implies about 18% upside.

And the majority of analysts who cowl Block are bullish — 36 out of fifty — whilst the typical inventory worth goal of $76.19 is about 5% beneath present ranges.

Source web site: www.marketwatch.com