Buying Nvidia name choices stays a great way to revenue from good points within the AI chipmaker’s share worth as a result of volatility is being undervalued, in accordance with Bank of America.

In a observe printed Tuesday, the BofA world fairness derivatives staff noticed that Nvidia’s

NVDA,

continued share worth rise since final week’s blowout earnings report implies that maintaining with the market with out having sufficient publicity to AI shares, particularly Nvidia, has been an uphill battle.

“With the outlook on the AI-wave and NVDA’s central role remaining upbeat from last week’s earnings call, upside continues to be the pain trade,” mentioned the BofA staff.

Using derivatives to chase this rally stays a “prudent strategy,” they added, as a result of the market retains undervaluing the volatility part of name choices.

Call choices give buyers the fitting to buy an underlying inventory at a specific stage, often known as the strike worth.

To simplify, one technique of building the price of an possibility is to take a look at the intrinsic worth (decided by how shut the shares are buying and selling to the choice strike worth), the time worth (how quickly earlier than the choice expires), and the volatility worth (the extra the underlying shares are anticipated to maneuver, the upper the volatility value).

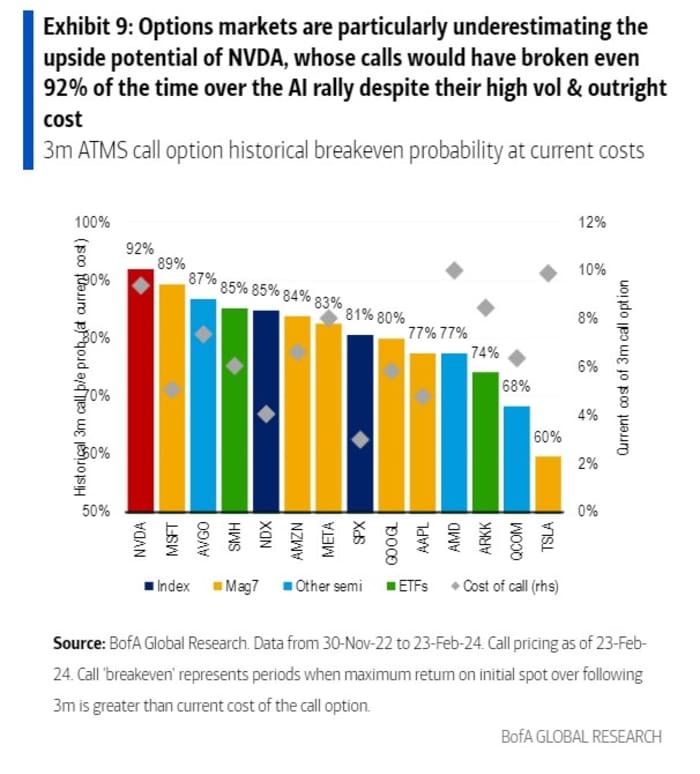

BofA mentioned possibility markets are “grossly underestimating the range of outcomes” for a lot of AI-related shares regardless of the rally since ChatGPT was launched in late November 2022.

In essence, the market retains getting caught out by the scale of strikes in Nvidia shares. For instance, simply previous to final week’s earnings report, the choice market was pricing within the probability of a roughly 9% transfer up or down by Nvidia shares as much as the top of the week. In truth, the following two days after earnings noticed Nvidia’s shares bounce 16.8%.

The chart under produced by BofA reveals that solely Advanced Micro Devices

AMD,

and Tesla

TSLA,

have 3-month on the cash name choices that value extra as a share of the share worth than Nvidia’s present 10%.

However, whereas the chance of such calls breaking even since November 2022 for Tesla are simply 60%, and 77% for AMD, the chance for Nvidia is the best of the cohort at 92%.

“As a result, even though buying outright call options on NVDA (or other AI-related names) may have a degree of sticker shock, it has proven to be a reasonably effective way to rent the upside in the current rally,” the BofA staff.

Source web site: www.marketwatch.com