Shares of AMC Entertainment Holdings Inc. rallied once more Wednesday, extending a current sharp bounce that seems to have put the inventory on monitor to interrupt out from a long-term technical downtrend.

The movie-theater operator’s

AMC,

inventory, which was one of many authentic “meme” shares, shot up as a lot as 11.3% intraday earlier than pulling again to be up 3.5% in afternoon buying and selling. That adopted a 16.4% surge on Tuesday, which bucked the broader inventory market’s worst day of 2023, though AMC didn’t launch any news.

And after working up 20.6% in two days and 40.4% in 5 days, Wednesday’s intraday pullback seems to recommend that upward momentum could also be waning, particularly for the reason that inventory couldn’t fairly make it as much as take a look at a few key technical ranges on the shorter-term charts.

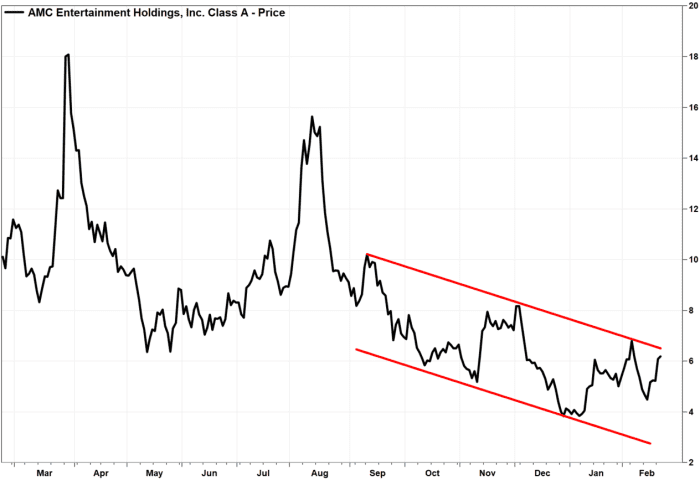

For one, a downtrend line beginning on the Sept. 12 shut that connects the closing highs in early December and early February presently extends to roughly $6.50, or about 2.8% above present ranges.

FactSet, MarketWatch

Trendlines are one of many best methods to determine a development. Keep in thoughts that whereas it solely takes two factors to attract a line, it takes three factors on the road to determine a development. Read extra about trendlines.

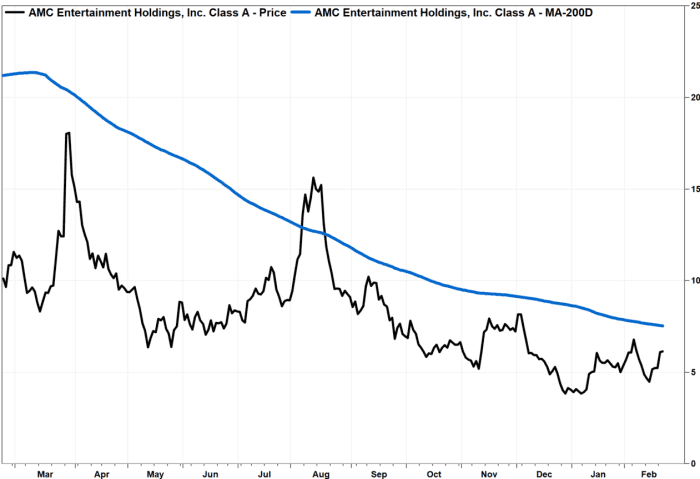

Meanwhile, the 200-day transferring common, which many chart watchers view as a dividing line between longer-term uptrends and downtrends, extends to $7.54 on Wednesday, in line with FactSet knowledge, which is about 19% above present ranges.

FactSet, MarketWatch

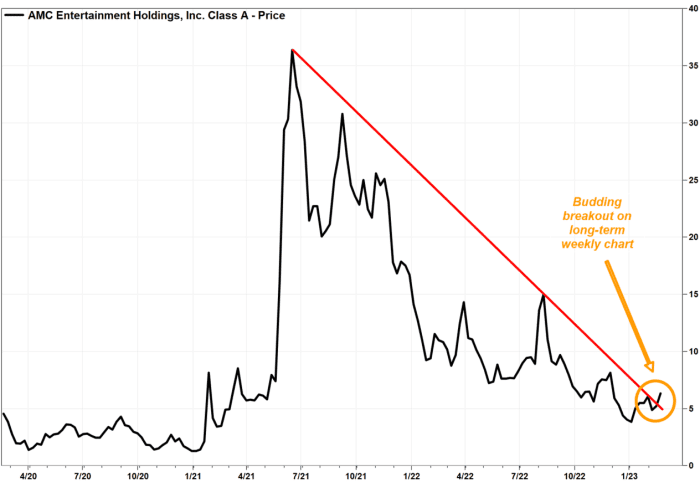

Clearing these ranges might sound daunting for bulls, who’ve already put in loads of work prior to now week. But extending the timeframe of AMC’s inventory chart from a each day chart to a weekly chart, there could also be good cause for bulls with a longer-term view to precise some enthusiasm.

Also learn: AMC CEO Adam Aron eyes 2023 hike in film releases, touts ‘path to eventual pandemic recovery.’

The inventory’s rally this week has taken it above a downtrend line that began on the meme-stock weekly closing peak of $36.40 on June 16, 2021, and linked the weekly closes of $15.01 on Aug. 12, 2022, and $6.08 on Feb. 3.

FactSet, MarketWatch

That downtrend line presently extends to simply about $5. An in depth Friday above that line would recommend a breakout has occurred.

One of the six main tenets of the Dow Theory of market evaluation, which has remained related on Wall Street for greater than a century, is {that a} development is assumed to stay in impact till there’s a particular sign that it has reversed. And trendlines are among the many instruments that may present these indicators, in line with the CMT Association. Read extra concerning the Dow Theory.

If the breakout sign is confirmed, the 200-day transferring common can be a key chart level to regulate, at the least for the brief time period.

AMC shares have soared 55.2% to this point in 2023 however have shed 37.6% over the previous 12 months, whereas the S&P 500

SPX,

has slipped 0.6% this yr and has misplaced 7.6% over the previous yr.

Source web site: www.marketwatch.com