Investors are bracing for a preholiday knowledge dump that features the Fed’s favourite inflation gauge, because the final full week of buying and selling for 2023 closes out.

Questions are being raised about whether or not the midweek plunge in shares was random jitters, or the beginning of one thing extra sinister. Stock futures are pointing to a different day of losses, as China gaming shares assist dampen the festive temper.

Our name of the day comes from a Wall Street veteran who theorizes that based mostly on the excessive variety of inventory holdings for American households, buyers might be going through “seven lean years” of returns forward.

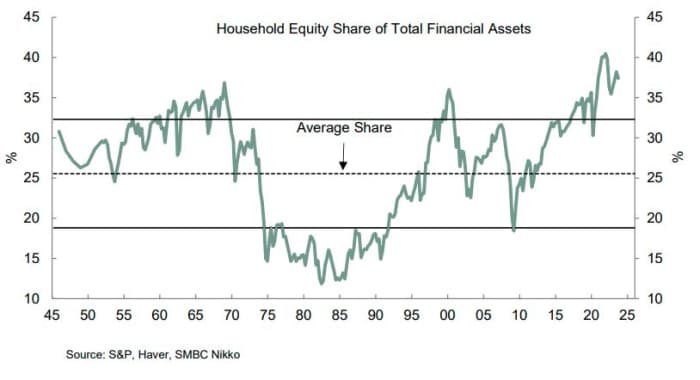

The U.S. family fairness share of complete monetary belongings was 36.3% within the third quarter, Joseph Lavorgna, former Deutsche Bank chief U.S. economist, who now does the identical job at SMBC Nikko Securities, instructed shoppers in a latest word.

That share is down from an file of 40.5% within the fourth quarter of 2021, however nonetheless nicely above some other interval previous to the present enterprise cycle, he says.

Before the pandemic’s onset, the earlier file share was set in the course of the web growth within the first quarter of 2000, with the height earlier than that 36.9% in the course of the decade’s “conglomerate fad,” mentioned Lavorgna, who additionally served as chief economist of the Council of Economic Advisers below former President Donald Trump.

So why does elevated fairness publicity matter? “Historically, when households own a high percentage of equities in their investment portfolio, future stock returns tend to meaningfully lag historical averages,” he mentioned.

“Future returns are based on the stock market’s performance over the next seven years because this is broadly consistent with the average length of the post-WWII business cycle,” he explains.

Lavorgna and his workforce calculated the common long-term family fairness share of economic belongings at 25.6%, represented by dashed line within the above chart. High or low family publicity is decided by one-standard deviation bands round that long-term common, proven as stable strains.

“From 1952 to 2016, the long-term total annualized return of the S&P 500 including reinvested dividends is 11.4%. However, when the household

share of stock holdings is one standard deviation above its long-term average, stocks return just 4.1% annualized over the proceeding seven years. The opposite is true when the household share of stocks is below its long-term average. Stocks return a large 16.0% annualized over the next seven years,” he mentioned.

The S&P 500’s complete return by November is 22.9%, and nicely above the market’s long-term annual common, he says, however notes that the cumulative annualized return since 2016 is 11.4%, equal to annual returns from 1952 to 2016 interval.

While the ratio stood at 31.9% within the fourth quarter of 2016, if historical past holds, Lavorgna says “stock returns over the next seven years should be much lower than the historical average of double-digit gains.”

The markets

Stock futures

ES00,

YM00,

NQ00,

are pointing south forward of the open following Thursday’s rebound, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

regular, and gold

GC00,

up 0.5% to $2,062 because the greenback

DXY

weakens. Oil

CL.1,

is transferring increased.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,746.75 | 0.58% | 4.17% | 23.63% | 24.18% |

| Nasdaq Composite | 14,963.87 | 1.37% | 4.89% | 42.97% | 42.84% |

| 10 12 months Treasury | 3.889 | -2.44 | -58.20 | 0.99 | 14.04 |

| Gold | 2,059.50 | 1.26% | 2.78% | 12.53% | 14.04% |

| Oil | 74.54 | 3.85% | -0.85% | -7.42% | -6.06% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors. | |||||

The buzz

The Fed’s most popular inflation gauge — the worth index for personal-consumption expenditures (PCE) — is due at 8:30 a.m., alongside durable-goods orders, private earnings and spending. New dwelling gross sales are due at 10 a.m.

Follow the info and market motion in MarketWatch’s Live Blog

Nike shares

NKE,

are down 11% after the athletic-wear maker introduced plans to chop $2 billion in prices over three years, citing a ‘softer’ outlook and cautious client spending. Adidas

ADS,

and Puma shares

PUM,

additionally fell in Europe.

NetEase

9999,

NTES,

misplaced 1 / 4 of its worth and Tencent shares

700,

tumbled 12% after China’s gaming regulator introduced new proposals aimed toward spending and rewards in on-line gaming.

Tesla

TSLA,

moved ahead with a plan to construct an energy-storage battery manufacturing facility in China. Separately, Elon Musk instructed Cathie Wood, chief government of ARK Invest, that he needs to transform his X platform right into a “giant brain” and monetary platform.

Rocket Lab USA

RKLB,

inventory jumped after the corporate received a authorities contract to construct 18 automobiles.

Best of the net

Apple’s AI analysis alerts ambition to meet up with Big Tech rivals.

Bank have been rising their utilization of a Fed facility arrange after the collapse of SVB.

CIA’s chief spy emerges as key determine in Hamas hostage disaster.

The chart

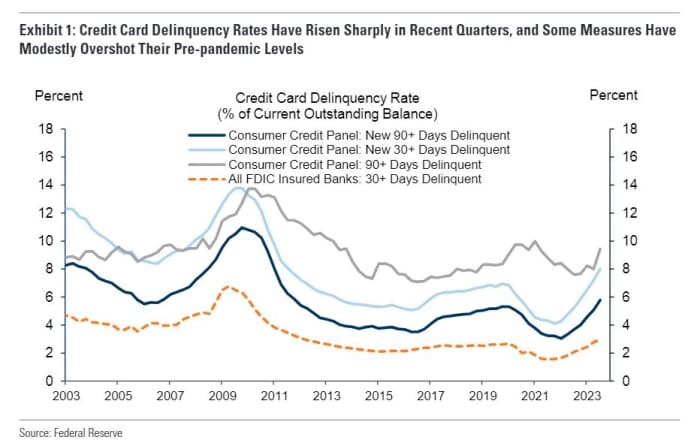

The under chart from Goldman Sachs gives a visible on issues this 12 months of credit-card debt and delinquency, with some measures now above prepandemic ranges. Chief economist Jan Hatzius cites three drivers: an more and more dangerous borrower pool, rising rates of interest and resumption of pupil mortgage funds this fall.

Overall, they count on new bank card delinquencies to rise from 8% within the third quarter of this 12 months to 9.5% within the first half of subsequent 12 months, then again to 9% at finish 2024.

Top tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

NVDA, |

Nvidia |

|

MARA, |

Marathon Digital |

|

AMC, |

AMC Entertainment |

|

NKE, |

Nike |

|

BABA, |

Alibaba |

Random reads

The “world’s most expensive handbag” and all the pieces else that billionaires need for Christmas.

NASA finds Christmas tree cluster in area.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com