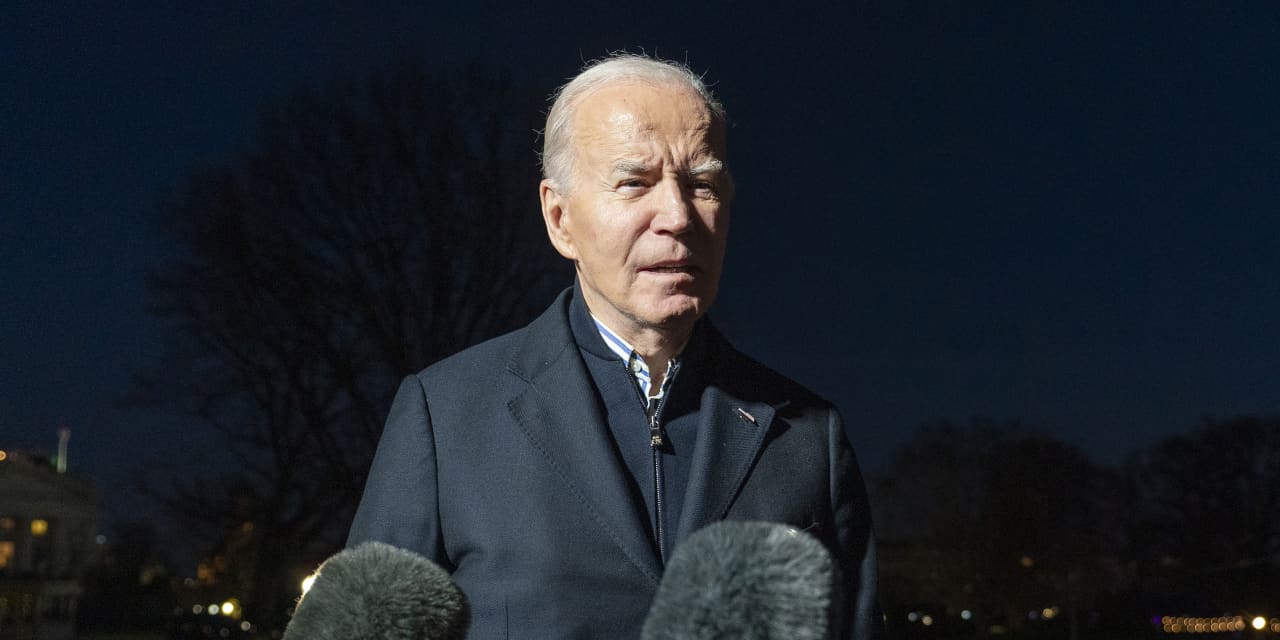

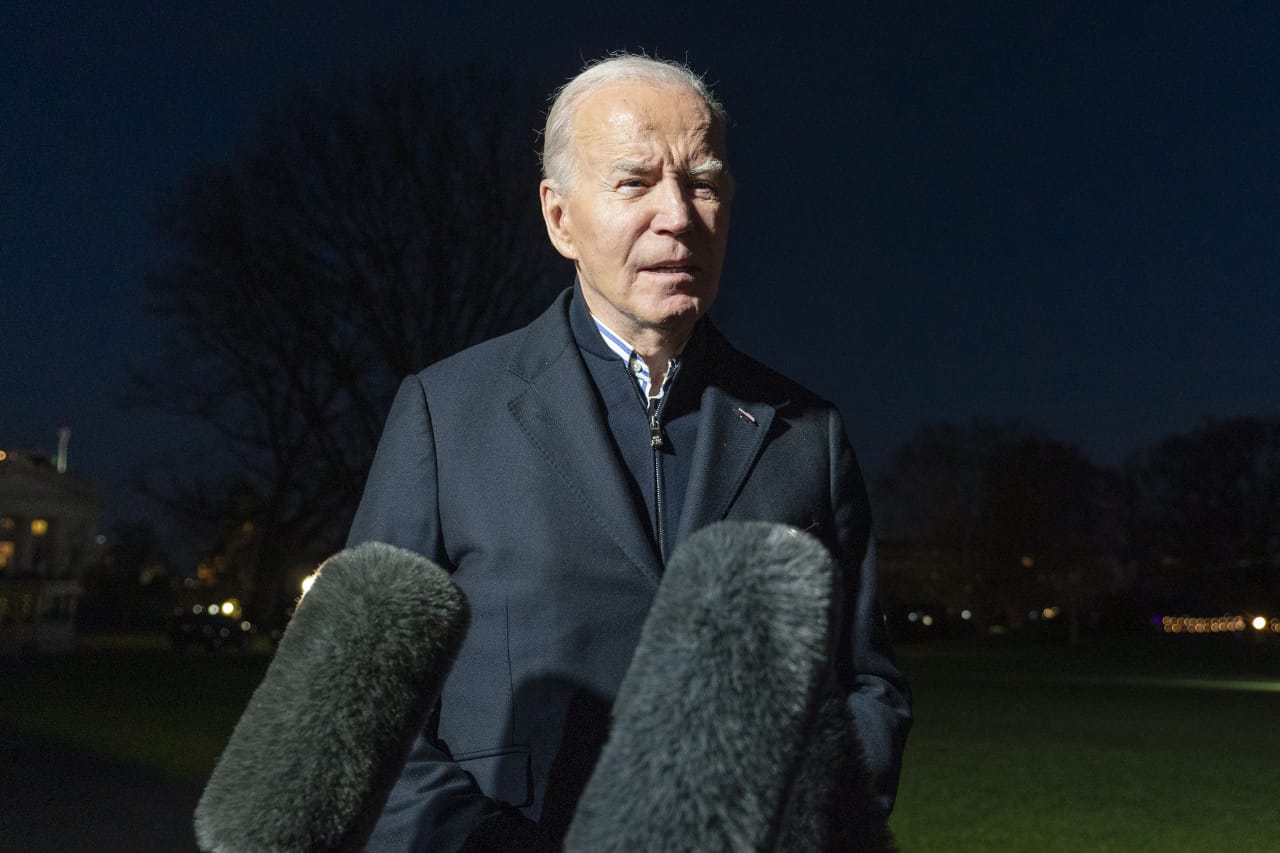

The U.S. financial system has recovered from the COVID pandemic fairly properly, but President Joe Biden is getting little credit score and will even lose his job in 2024.

Third-quarter GDP progress scored at 4.9%; the Federal Reserve has loved appreciable success flattening inflation. Jobs are plentiful, and the distress index — the sum of inflation and unemployment charges — is low by historic requirements. Yet the University of Michigan Consumer Sentiment Index stays extra depressed than previous expertise signifies it must be with circumstances this favorable.

That’s unhealthy news for Biden. According to latest polls tracked by Real Clear Politics, Americans disapproving of his dealing with of the financial system outnumber these approving by about 22.5 proportion factors. On inflation alone, the rating is even worse — 32 factors.

Since Biden took workplace, actual incomes have fallen. Both the CPI and hourly wages are up 17% and 14%, respectively. That just isn’t a giant hole contemplating the physique blow dealt by the COVID recession, however some costs have popped sufficient to trigger actual ache. Consumers don’t need inflation simply to cease — they need costs rolled again considerably.

Giving them that want would probably require the Fed to instigate one other Great Depression. From 1930 to 1933, costs fell every year by a median of seven%. I doubt many people want to relive the biography of the Forgotten Man.

More broadly, the macroeconomic outlook is underwhelming. Economists are forecasting slower U.S. progress for 2024. Meanwhile, staff are in a wrestle with their bosses over work-from-home and are typically extra dissatisfied with their jobs.

As importantly, nominal wage positive factors and actual wage losses are uneven. Prior to the UAW strike, the typical autoworker earned $37 an hour vs. $27 for manufacturing staff total. Now autoworkers have gained a 25%-plus inflation elevate over 4 years. Maybe a server at a diner close to a Ford manufacturing unit will get greater suggestions, however these positive factors gained’t do the common employee exterior the auto sector a lot good. Moreover, consumers now will face increased automobile costs.

Beyond the U.S. financial system, a lot else goes badly.

On international coverage, the Hamas assault on Israel discredited Biden’s efforts to courtroom Tehran and encourage normalized relations between Saudi Arabia and Israel, whereas tolerating Israeli Prime Minister Netanyahu’s resistance to a Palestinian State.

In Ukraine, counting on sanctions and limiting Kyiv’s entry to weapons which may overly antagonize President Vladimir Putin have resulted in stalemate, maybe worse, and the potential to endlessly tax each EU and U.S. budgets.

More Americans disapprove of Biden’s dealing with of international coverage than approve by 25 factors. On crime in U.S. cities, by 21 factors and the flood of unauthorized immigrants by 30 factors.

Things the president promised to repair — the excessive price of school, dwelling possession and childcare — usually are not bettering. Colleges are promoting less-aggressive tuition hikes however boosting dorm charges prodigiously.

Biden laid out a sweeping agenda in his Build Back Better program — starting from free group school tuition and pupil mortgage reduction to enhancements to Medicare, common pre-Ok schooling and federally funded childcare. But he can level to solely a handful of restricted accomplishments — for instance, regulating a restricted variety of prescription drug costs.

It’s arduous to say that Biden has made sufficient individuals blissful. His restricted pupil mortgage forgiveness has left a plurality of Generation Z voters in swing states dissatisfied as a result of he has achieved too little, whereas many older voters assume he has achieved an excessive amount of.

On the general course of the nation, the sum is larger than its components. Americans who say the nation is heading the unsuitable manner outnumber those that are happy by about 43 factors.

It’s straightforward to write down off voter assessments of Biden by noting that the majority different U.S. presidents suffered low scores at this level of their tenure. However, as polled by Gallup, Biden’s approval scores are decrease than all former presidents going again to Ronald Reagan.

With the efficiency of the Biden administration getting unhealthy grades almost in all places else, it’s not stunning Americans are so bitter about an bettering financial system. Yet with inflation coming underneath management and the financial system not sinking right into a recession, that’s unlucky — and a bit shortsighted. The job market will not be pink sizzling however stays sturdy, and wages ought to broadly outpace inflation in 2024.

Peter Morici is an economist and emeritus enterprise professor on the University of Maryland, and a nationwide columnist.

Also learn:

Health of U.S. labor market looms giant on markets’ radar this coming week

‘My sunny outlook doesn’t come with out some dangers.’ What to count on after the Santa Claus rally

Source web site: www.marketwatch.com