Apple Inc. executives have lengthy maintained that the don’t speak about forthcoming choices earlier than they’re prepared, and so they talked about that view once more Thursday afternoon.

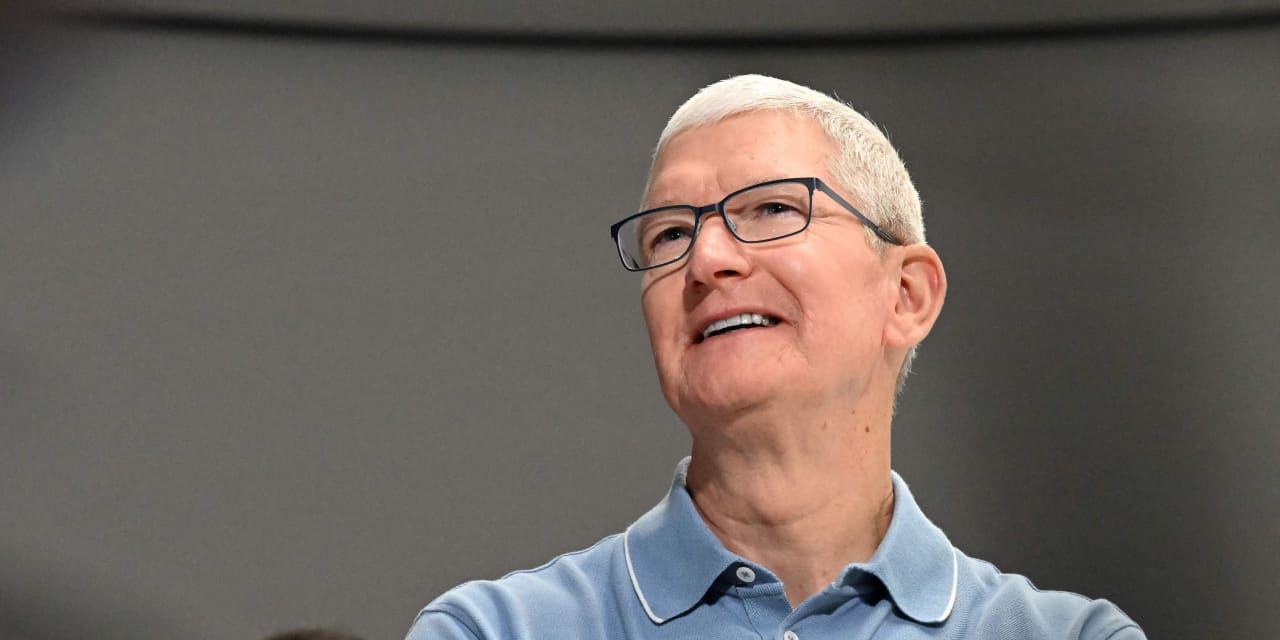

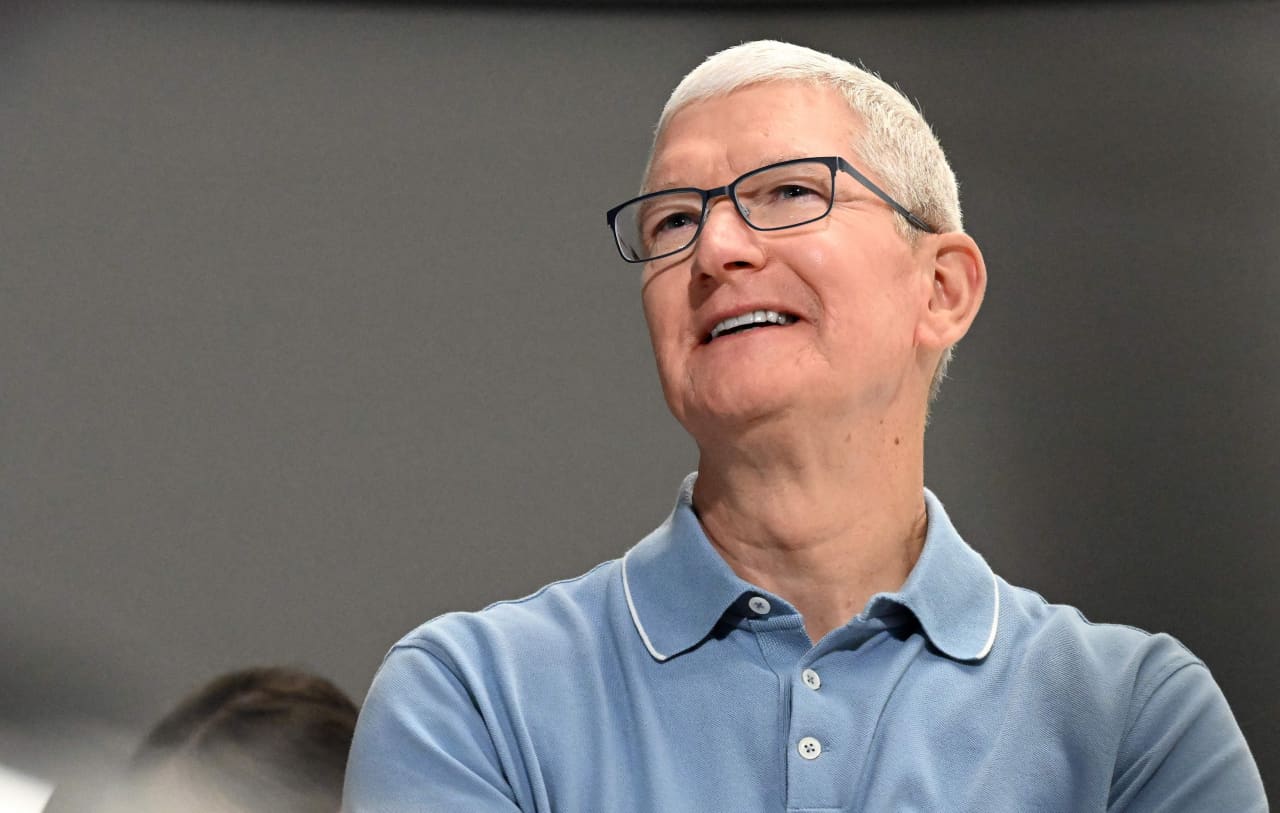

“Our M.O., if you will, has always been to do work and then talk about work and not to get out in front of ourselves,” Chief Executive Tim Cook stated on the corporate’s earnings name. Apple

AAPL,

was going to “hold that” commonplace to the subject of generative AI as nicely, he added, in response to an analyst’s query on the corporate’s AI plans.

See extra (from August 2023): Apple’s Tim Cook explains why he gained’t showboat round AI

But there was a little bit of a twist this time, as Rosenblatt Securities analyst Barton Crockett famous. Cook went on to say that the corporate had some “things” happening with generative AI “that we’re incredibly excited about that we’ll be talking about later this year.”

While the corporate “didn’t provide any detail,” it was an “unusual move for this company” to tease an upcoming product occasion, wrote Crockett, who has a impartial ranking and $189 goal worth on Apple’s inventory.

Apple has been far quieter about AI than it’s Big Tech friends, and maybe administration realized that traders had been in search of somewhat extra. “A muted AI storyline at Apple, versus explosive developments elsewhere, has been a sentiment headwind for the shares,” Crockett wrote.

Those shares had been trying to be underneath strain once more Friday, after the corporate missed expectations with China income for its newest quarter, feeding into one other investor concern. Apple additionally gave general steering for the March quarter that disenchanted. The inventory was off about 3% in premarket buying and selling.

Evercore ISI analyst Amit Daryanani, nevertheless, suggested traders to “look past the March noise” and focus as a substitute on components like the approaching generative AI announcement and the expansion in Apple’s put in base of gadgets.

Though he may see why traders discovered Apple’s outlook underwhelming, he sees “largely flat” iPhone models gross sales when excluding sure one-time components.

“More importantly, we see a host of tailwinds stacking up in [Apple’s] favor

ranging from Gen AI product launches to Vision Pro adoption to sustained [free-cash-flow] generation/uptick to capital allocation,” he wrote, whereas reiterating his outperform ranking and $220 worth goal.

Don’t miss: Amazon says the ‘magic words.’ They may spur a $100 billion market-cap enhance.

Needham’s Laura Martin wrote that over the long run, she and her crew “believe companies that use [generative AI] to cut costs and accelerate new product launches will replace those that don’t.” Her query now: “Which is AAPL?”

She additional famous that due to the corporate’s “very sticky” ecosystem, Apple “historically has been able to be a fast follower of other companies’ innovations.”

“We do not expect this to change, although annual product upgrades feel like slow motion in an environment where [generative AI] is rapidly changing the basis of competition,” she added, whereas sustaining her purchase ranking and $220 goal worth on the inventory.

Raymond James analyst Srini Pajjuri was optimistic about what newer areas may do for Apple.

“Any contribution from Vision Pro,” the corporate’s just-launched $3,499 mixed-reality headset, “is essentially upside to our model,” he wrote. “In addition, commentary suggests that Apple will unveil Gen AI features later this year, which could help shorten replacement cycles and drive incremental Services opportunities.”

He has an outperform ranking and $195 goal worth on the inventory.

Source web site: www.marketwatch.com