Seventy-one years in the past, Harry Markowitz revolutionized how people and establishments make investments by drawing consideration away from particular person safety choice and focusing it on portfolio building extra broadly. To Markowitz, which inventory a portfolio held mattered far lower than the combo of shares, bonds and different broad asset lessons.

Moreover, long-term advantages might be gained by holding a mixture of property that carried out otherwise beneath completely different financial situations. With the long run inherently unsure, buyers must be ready for no matter may come subsequent. As others acknowledged and appreciated these advantages, covariance — how one asset class performs relative to a different over time — moderately than absolute return, took middle stage.

Since then, relative correlation has grow to be a principal consideration as asset managers decide the particular composition of their portfolios. Armed with many years of historic covariance knowledge, buyers attempt to decide on simply the correct mix of shares, bonds, actual property and different asset lessons to optimize long-term returns over financial cycles.

History exhibits that whereas well-intentioned and well-grounded up to now, these thought-to-be-well-diversified portfolios often fail to carry out as anticipated. The covariances which buyers presume may be extrapolated into the long run break down.

Balanced buyers skilled this firsthand throughout 2022 when shares and bonds fell collectively. The market habits defied the assurances buyers had acquired that bonds carry out effectively when shares carry out poorly.

What these buyers and their advisers each missed is that underpinning asset class efficiency and covariance extra broadly is investor sentiment. What leads buyers to purchase or promote particular asset lessons over time isn’t financial cycles, per se, however buyers’ willingness to take sure sorts of threat — that’s, how assured buyers are within the prospects of what they personal. As we’ve all witnessed, this modifications often, typically with out warning.

Ahead of the 2022 fairness and stuck revenue downturns, buyers had a seemingly insatiable urge for food for each shares and bonds. Prices for each had risen collectively and had been at or close to file highs. At the identical time as fairness buyers had been stampeding into extremely futuristic expertise shares, there have been trillions of {dollars} of negative-yielding bonds.

Interestingly, U.S. buyers within the early Eighties witnessed simply the reverse. Then, curiosity in each shares and bonds was ice chilly. With inflation hovering, the economic system weakening, and stagflation making headlines, few noticed a purpose to personal both. To a far lesser diploma, this was additionally the case within the fall of 2022.

While historic covariances could assist as a place to begin when establishing a strategic asset allocation for a portfolio, buyers must pay nearer consideration to the present sentiment relationships in what they personal. Holding a portfolio during which every thing is scorching in buyers’ eyes could also be fantastic on the way in which up, however its draw back will likely be punishing when temper inevitably peaks and reverses. It’s investment-confidence diversification, not asset diversification, that issues.

For this purpose, buyers ought to think about proudly owning a mixture not of property per se, however of moods. Hold each the reviled and the beloved, together with property with clear up and down traits. Today, that may imply pairing crowd favorites like Big Tech shares with unloved property like vitality shares.

There is extra to this type of confidence diversification than meets the attention. How we really feel has an impression on our preferences. When confidence is excessive, buyers naturally crave extremely summary, futuristic alternatives. When we really feel good, we take a look at ideas like AI as representing limitless chance.

On the opposite hand, when our confidence is low, we abhor abstraction. We demand certainty. Not surprisingly then, when our temper is low, we attain for money, gold, and different actual property. As a end result, a pairing of Big Tech and vitality represents not only a barbell commerce in present sentiment, however one in present investor preferences, too.

Portfolio

There are different advantages to confidence diversification. It forces buyers to take particular actions that run counter to their behavioral biases. They should purchase out of favor property they wouldn’t in any other case contact as a result of the thought can be laughable, whereas on the similar time promote these investments they might in any other case pour cash into at larger and better costs.

Confidence diversification fosters emotional self-discipline. Rather than being swept up by mania or panic, buyers take a look at sentiment objectively after which act on this data. They search to personal slices of all moods always. In a world awash in social media and the extremely emotional and impulsive habits that accompanies it, confidence diversification prevents buyers from getting swept up by the group. As a end result, they’re far much less more likely to overbuy on the prime and promote out on the backside.

Markowitz was appropriate that covariance issues and that there are advantages to diversification. But historic correlations and asset allocation solely take us to date. In actual time, relative asset efficiency is pushed by the relative preferences of the group. By higher understanding what buyers need — and don’t need — buyers can create portfolios which can be extra resilient and which transfer with and towards right this moment’s quick appearing crowd.

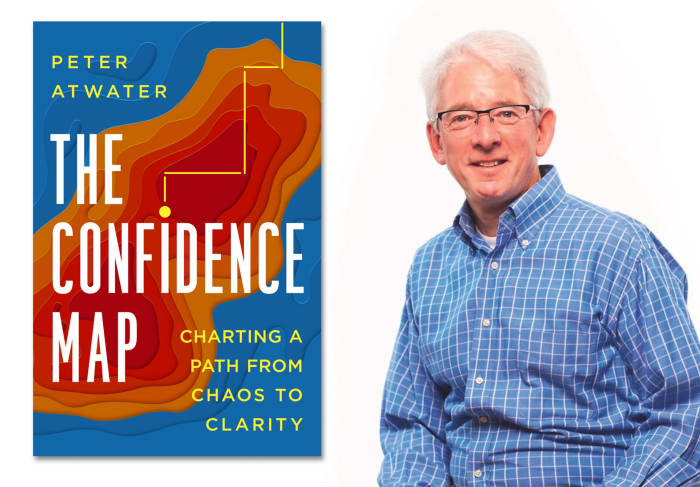

Peter W. Atwater is an adjunct professor of economics at William and Mary, and president of Financial Insyghts, a consulting agency that advises institutional buyers, main companies and international policymakers on how social temper impacts resolution making, the economic system,and the markets. This article is customized from Atwater’s new ebook, The Confidence Map: Charting a Path from Chaos to Clarity (Penguin/Portfolio, 2023).

Also learn: ‘I like Warren Buffett’s strategy — hold investing and simply imagine in America’: I’m about to retire. How do I make investments a $400K windfall?

More: ‘No chance we’re having a smooth touchdown’: Stock-market strategist David Rosenberg provides Powell’s Fed no credit score — and no mercy

Source web site: www.marketwatch.com