This isn’t any trivial query as a result of the reply might lead to you having both a bigger or smaller account stability at retirement.

That’s as a result of monetary confidence is strongly linked to the next danger tolerance and the potential for better funding returns, new analysis says.

Individuals who report larger monetary confidence have considerably larger ranges of danger tolerance, in line with Using Confidence and Risk Tolerance to Build Financial Wellness, written by David Blanchett, a managing director and head of retirement analysis for PGIM DC Solutions, Sonya Lutter, the director of economic well being and wellness at Texas Tech University’s School of Financial Planning and Sandra Huston, a professor at Texas Tech University’s School of Financial Planning.

And rising allocations to dangerous property, corresponding to equities, on account of improved monetary confidence, has the potential to considerably enhance retirement financial savings. For instance, utilizing a hypothetical mannequin, the authors estimated that account balances could possibly be 11% larger at retirement amongst buyers who’re financially assured.

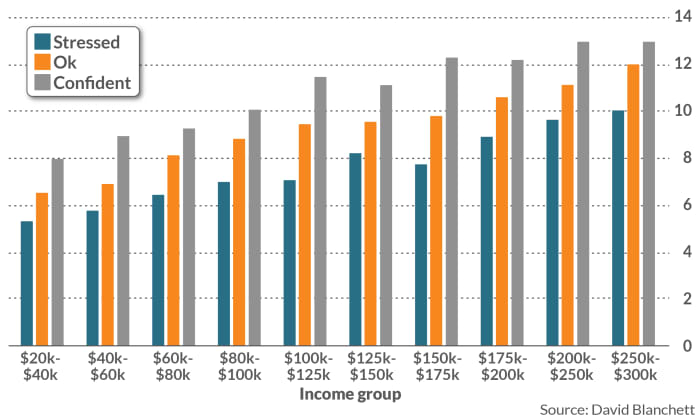

“Improving financial well-being has the potential to improve the long-term wealth of households through not only improving overall financial behaviors but also increasing expected returns on savings to the extent it better enables investors to invest more aggressively (assuming a positive equity risk premium),” the authors famous of their analysis report. Blanchett identifies two key causes for this pattern: First, people with monetary confidence save greater than their “stressed” and “OK” counterparts by about 3 share factors.

Second, they’re extra inclined to put money into riskier property like equities. (See under.)

In an interview, Blanchett mentioned the analysis. Over the previous seven or so years, Prudential Financial has been providing a monetary wellness evaluation and that evaluation now has greater than 300,000 responses. As a part of the evaluation, there are questions on danger tolerance and monetary confidence.

“And I was curious, are they related?” stated Blanchett. “And they are.”

That relationship persists even after controlling demographic variables corresponding to revenue, age, marital standing, gender and the like. This is critical as a result of an individual’s monetary standing can tremendously affect their responses on a danger tolerance questionnaire. Those in a steady monetary place could reply in another way than these going through monetary challenges.

“And advisers might not be thinking about that,” he stated. “They might say, ‘Oh, well, it’s just an effect for folks who have more assets, more income.”

Blanchett and his co-authors discovered a definite correlation of their analysis: Individuals with decrease monetary confidence are likely to have diminished danger tolerance. “And if that isn’t addressed, it could dramatically affect how much wealth someone accumulates over their lifetime,” stated Blanchett. “And so as someone might say, ‘Well, financial confidence isn’t related to making decisions around portfolios.’ It clearly is at least based upon this data… People that feel confident financially are more accepting of risk in their portfolios.”

Of observe, Blanchett and his group give attention to monetary confidence, which is distinct from the behavioral bias termed “overconfidence.”

Research signifies that overconfident buyers typically have interaction in additional frequent buying and selling, face elevated prices, gravitate towards extreme risk-taking, and have a tendency to miss pertinent data. While sure research trace that overconfidence would possibly sometimes improve returns on account of elevated risk-taking, the prevailing proof underscores substantial drawbacks. Contrary to endorsing impulsive or daring funding methods, Blanchett and his group suggest that buyers who’re financially assured undertake a prudent method when rising allocations to dangerous property, corresponding to equities.

Measuring monetary confidence

So how did Blanchett and his colleagues go about measuring monetary confidence?

In their analysis, confidence was measured by a wide range of elements:

· Subjective (self-assessed) monetary wellness (see under)

· Objective monetary wellness scores (See under.)

· Financial stressors (e.g., pupil loans, bank card debt, saving for retirement, and so on.).

Implications for people

Blanchett and his colleagues’ analysis confirmed that there’s a transparent hyperlink between monetary confidence and revenue, with lower-income people typically being the least financially assured. Given that, Blanchett prompt that lower-income people contemplate investing in target-date funds, which take away the necessity to make advanced funding selections. Without such funds, Blanchett famous that lower-income people would possibly select overly conservative portfolios, creating a further impediment of their wealth accumulation and retirement planning.

Implications for monetary advisers

The analysis additionally means that advisers ought to think about a shopper’s monetary confidence when asking them to fill out a danger tolerance questionnaire.

“A lot of advisers, in my opinion, don’t proactively address financial confidence,” he stated, noting that there’s a profit to serving to folks make higher near-term monetary decisions that aren’t at all times included in a danger tolerance questionnaire. “Your risk preference could really be predicated on your overall financial situation,” Blanchett added.

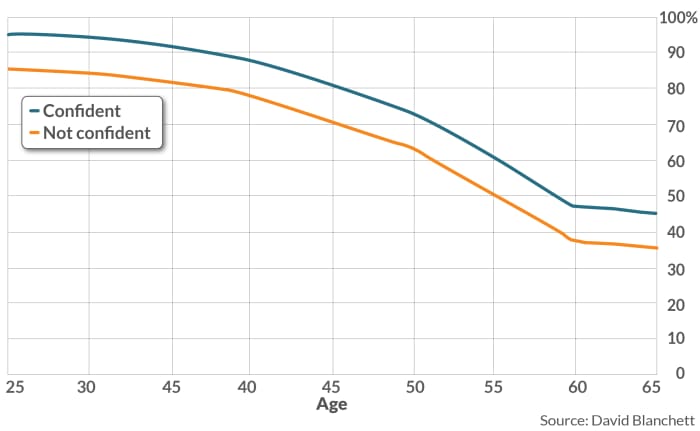

And what’s particularly troubling to Blanchett is that an adviser doesn’t revisit a shopper’s danger tolerance for 5 or 10 years and that might lead to asset allocations that don’t sync up with the shopper’s monetary confidence in addition to their objectives and time horizon. “Risk tolerance changes over time, especially for older investors.”

Read analysis: Who Exhibits Time Varying Risk Aversion?

This highlights two key factors: First, advisers who depend on danger tolerance questionnaires (RTQs) for portfolio selections ought to recurrently revisit them. Second, monetary confidence can impression long-term wealth accumulation if they’re utilizing conservative portfolios as a result of they don’t seem to be in a very good place financially.

Actionable recommendation

Given the results of the examine, Blanchett stated buyers would possibly contemplate taking the next motion:

1. It’s greater than doubtless that you realize your monetary confidence stage. It’s a subjective query, in any case, says Blanchett. So, extra essential than assessing your monetary confidence stage and figuring out areas inflicting stress is that this: “Take stock of where you are and figure out what you can do to get on track if you aren’t in good shape,” says Blanchett.

For some, this may imply turning to their employer’s monetary wellness applications.

For others who don’t have entry to a monetary wellness program at work, it would imply in search of out options corresponding to monetary literacy websites and apps, such because the National Endowment for Financial Education (NEFE), Khan Academy’s Personal Finance course, and the Consumer Financial Protection Bureau (CFPB).

2. Take steps to enhance monetary behaviors corresponding to budgeting, planning for bills, and paying off debt. This can also increase monetary confidence. Again, for some, this may imply turning to their employer’s monetary wellness program. Blanchett famous that many lower-income households are unlikely to have entry to a monetary adviser who may also help them enhance their monetary confidence so turning to an employer’s monetary office program presents one of the best probability of success.

Employers, Blanchett famous, have the means to do that they usually have the dimensions. And these monetary wellness instruments might have “benefits that are both obvious and not obvious,” he stated.

For others, it would imply utilizing apps corresponding to YNAB (You Need a Budget) or Mvelopes.

Blanchett additionally famous it might take years for lower-income people to enhance their monetary confidence. “There’s probably lots of things you’re going to have to do and it’s going to require a number of good choices,” he stated.

3. Increase retirement contributions and, should you’re not financially assured, contemplate investing in your 401(ok)’s certified default funding various, corresponding to a target-date fund.

“And if you’re investing conservatively, try to understand why,” stated Blanchett. “If you’re not financially well, you’re not going to save for retirement.” But there may be a insecurity that might lead to asset allocations that don’t sync up.

4. Seeking steerage from a monetary adviser to create a custom-made monetary plan could possibly be helpful but it surely’s not obligatory, stated Blanchett. Yes, they will think about confidence ranges when offering funding suggestions. But extra essential, it is advisable perceive your monetary state of affairs and determine your focus areas. “You need to get a handle on your situation and what you need to focus on,” stated Blanchett.

Source web site: www.marketwatch.com