Arm Holdings Ltd. filed for its long-awaited preliminary public providing on Monday, and whereas it’s not the U.Okay.-based chip designer’s first public rodeo, the tech world has modified rather a lot up to now seven years since SoftBank Group Corp. took the corporate non-public.

Arm filed paperwork for its IPO with the Securities and Exchange Commission on Monday to record shares on the Nasdaq beneath the ticker image “ARM,” with Goldman Sachs, J.P. Morgan, and BofA Securities among the many underwriters.

Arm reportedly has been searching for to lift $8 billion to $10 billion at a valuation of $60 billion to $70 billion, which might make its IPO the largest of the 12 months to this point. Quite a lot of massive tech firms, together with Amazon.com Inc.

AMZN,

Intel Corp.

INTC,

and Nvidia

NVDA,

are reportedly within the combine to be anchor traders.

Here are 5 issues to know in regards to the firm from its SEC filings:

We’re right here due to the FTC

Call it considered one of Federal Trade Commission Chairwoman Lina Khan’s success tales in taking over Big Tech: Nvidia Corp.

NVDA,

Chief Executive Jensen Huang formally pulled the plug on his foundering $40 billion supply to purchase Arm outright in February 2022, after the FTC joined the dogpile of regulators opposing the deal by suing to dam it a number of months earlier.

Right after the breakup, SoftBank

9984,

introduced it will take Arm public someday in fiscal 2023, or by March 31, 2024.

Nvidia had hedged its bets early on, nonetheless: In 2020, Nvidia paid Arm $750 million upfront for a 20-year license to its expertise, a license that’s nonetheless in impact practically three years later as Nvidia leads a rollout of AI {hardware}. Since the breakup, Nvidia shares have gained 86%, and are up extra then 200% 12 months so far.

Arm, nonetheless, famous that SoftBank will nonetheless be very a lot in cost after the providing.

“As long as SoftBank Group controls us and/or is entitled to certain rights under the Shareholder Governance Agreement, other holders of our ordinary shares and ADSs will have limited ability to influence matters requiring stockholder approval or the composition of our board of directors,” the corporate mentioned within the submitting.

Arm has but to find out what share of excellent shares SoftBank will personal after the providing. Recent stories mentioned SoftBank was in discussions to buy the 25% stake in Arm that it doesn’t outright personal, which is held by its Vision Fund 1, forward of the IPO.

Read from Feb. 2022: Wall Street’s response to dying of Nvidia-Arm deal: No duh

Apple helped Arm ‘think different’ when it got here to chips

Arm has fairly the pedigree. It began out in 1990 as a three way partnership referred to as Advanced RISC Machines Ltd. between Cambridge, England-based Acorn Computers; San Jose, Calif.-based VLSI Technology; and what was then often called Apple Computer Inc.

AAPL,

years previous to Steve Jobs returning to avoid wasting the corporate he helped create.

Referred to because the British Apple, Acorn was dissolved in 2015 after being acquired by a Morgan Stanley funding subsidiary in 1999, the identical 12 months Philips Electronics purchased VLSI for $1 billion. In 2006, Philips then spun off the enterprise as NXP Semiconductors NV

NXPI,

which went public in 2010.

Arm makes use of an structure that’s totally different from the once-standard x86 one launched by Intel Corp.

INTC,

in 1978, the 12 months earlier than an 18-year-old Pat Gelsinger, Intel’s present CEO, first joined the corporate. He later turned lead engineer on Intel’s fourth-generation x86 chip, the 80486 processor, launched in 1989.

Intel’s x86-based chips use an structure often called “complex instruction set computing,” or CISC, whereas Arm-based chips use one often called “reduced instruction set computing,” or RISC. CISC chips are designed with excessive efficiency and throughput in thoughts, in order that they require a lot of energy and generate loads of warmth. RISC chips, however, had been designed with cell efficiency in thoughts, so the emphasis is on power effectivity to lengthen battery life.

Arm licenses its chip designs, that are used largely in low-power-consuming units like smartphones, tablets and wearables. Apple’s foray into chip making, the M1 and the M2 used within the firm’s laptops, makes use of Arm-based structure.

Arm clients have shipped greater than 250 billion Arm-based chips, together with 30.6 billion of these in fiscal 2023. That newest determine marked a roughly 70% improve relative to fiscal 2016.

More than 260 firms reported that that they had shipped Arm-based chips final fiscal 12 months, the corporate mentioned in its prospectus, calling out clients like Amazon, Alphabet, AMD, Nvidia, Intel, Qualcomm Inc.

QCOM,

and Samsung Electronics Co.

005930,

Arm is worthwhile, however prices are hovering

Arm reported internet earnings of $524 million, or 51 cents a share, on income of $2.68 billion for its March-ended fiscal 2023, in contrast with internet earnings of $549 million, or 54 cents a share, on income of $2.7 billion, in fiscal 2022.

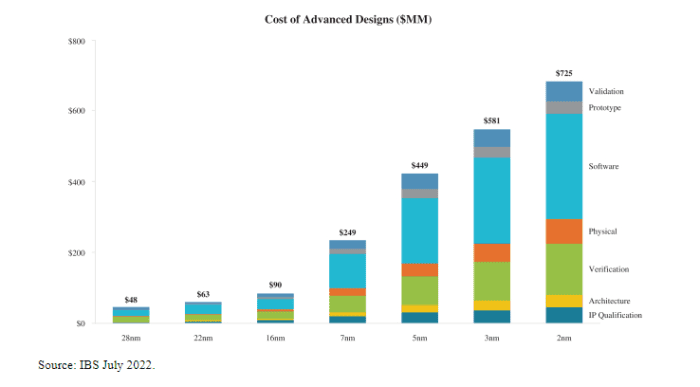

One of the explanations the corporate gave for going public was that the “resources required to develop leading-edge products are significant and continue to increase exponentially as manufacturing process nodes shrink.” Transistors are expressed in scales of nanometers, with design prices working at about $249 million for a 7-nanometer chip and about $725 million for a 2-nanometer chip, the corporate mentioned in its submitting.

Since about 80% of the corporate’s practically 6,000 staff are engineers, who command pretty aggressive salaries, Arm mentioned its analysis and improvement bills are starting to chop extra into its income.

In fiscal 2023, R&D prices accounted for 41% of income, up from 37% in 2022, and 40% in 2021. R&D prices rose 13.9% to $1.13 billion in 2023, as income slipped lower than 1% to $2.68 billion.

As with all issues chip-related, China is a danger issue

Taiwan may as effectively be the middle of the earth in the case of the semiconductor {industry} with the dominance of such third-party chip fabricators like Taiwan Semiconductor Manufacturing Co. producing silicon for chip designers — together with Nvidia, Advanced Micro Devices Inc.

AMD,

and Apple — that don’t have their very own capability.

Given that China nonetheless considers Taiwan a part of China, any flare-up in tensions between the 2 have the potential to inflict big ache on the chip {industry}, and each {industry} that is dependent upon it. The ripple impact of disruptions inside the chip-industry provide chain had been effectively on show through the COVID pandemic, and nonetheless proceed to this present day.

Over fiscal years 2023, 2022 and 2021, income from China-based clients accounted for about 25%, 18% and 20%, respectively, of Arm’s whole. Revenue from Taiwan-based clients was 13.4%, 15.9%, and 15.1%, respectively.

For the primary quarter of fiscal 2024, nonetheless, Taiwan accounted for a big share of gross sales, whereas China’s share declined. In the quarter that ended June 30, Arm reported that Taiwan accounted for 17% of its $675 million in income, whereas China accounted for 20.8%.

That appears to be like pretty customary as Nvidia derives 21% of its income from China and 25.9% from Taiwan, in response to FactSet knowledge. Additionally, AMD will get 21.6% of its income from China, and 10% from Taiwan.

Arm, nonetheless, mentioned it has little to no management over its enterprise in China.

“Despite our significant reliance on Arm China through our commercial relationship with them, both as a source of revenue and as a conduit to the important [People’s Republic of China] market, Arm China operates independently of us,” the submitting mentioned.

Arm additional defined: “The fact that Arm China operates independently of us exposes us to significant risks. Arm China’s value to us as a customer is dependent on Arm China’s business results, which are, in turn, subject to substantial risks that are outside of our control.”

AI won’t pan out, at the very least not for Arm’s licensed designs

While Arm mentioned its licensed merchandise had been “central” to the world’s transition to AI and machine studying, the expertise might not reside as much as the hype, or if it does, Arm’s designs won’t match the ensuing paradigm.

As Bernstein Research not too long ago identified in a survey of the AI market, when firms like Lucent within the Nineties spent billions to construct out fiber networks to accommodate dial-up networks, they didn’t anticipate that cable firms like Comcast Corp.

CMCSA,

would be capable to supply superior broadband companies over their current cable.

“New technologies, such as AI and ML, may use algorithms that are not suitable for a general purpose CPU, such as our processors,” Arm mentioned. “Consequently, our processors may become less important in a chip based on our products, thus eroding its value to the customer and resulting in lower revenue for us.”

“In addition, the introduction of new technologies, such as AI and ML, into our processors may increase IP, cybersecurity, operational, data protection and technological risks and result in new or enhanced governmental or regulatory scrutiny, litigation, ethical concerns, or other complications that could materially and adversely affect our business,” Arm mentioned in its submitting. “As a result of the complexity and rapid development of new technologies, it is not possible to predict all of the legal, operational or technological risks related to use of such technologies.”

Source web site: www.marketwatch.com