U.S.-listed shares of Arm Holdings PLC surged out of the gate Thursday and closed 25% above their pricing after they started buying and selling on the Nasdaq, following a long-awaited preliminary public providing.

Arm’s American depositary receipts

ARM,

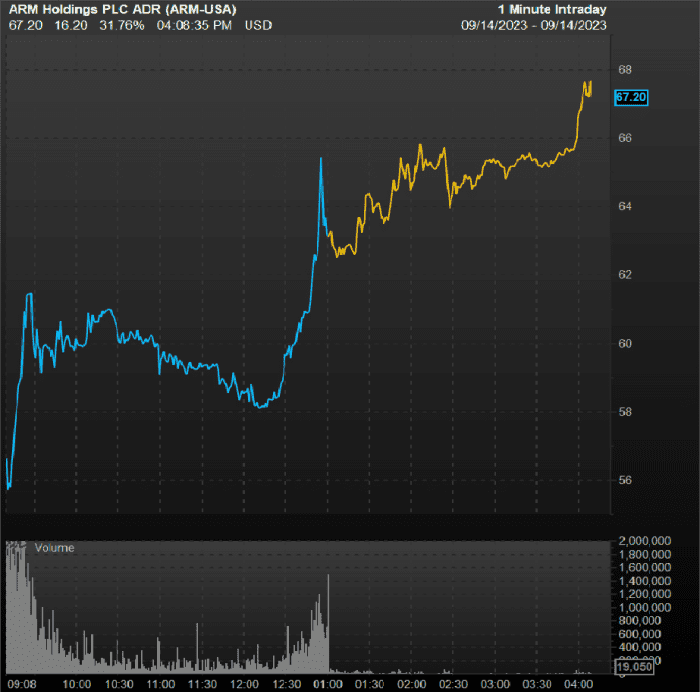

started buying and selling Thursday simply after midday Eastern time, opening at $56.10 and rallying as a lot as 30% above their preliminary public providing value of $51. By the top of the day, shares completed up 24.7% at $63.59. The ADRs appeared to get a second wind after the shut, rising greater than 5% after hours.

Arm priced these shares on the excessive finish of its anticipated vary Wednesday.

ARM rose after hours following its first day of commerce.

FactSet

Chief Financial Officer Jason Child informed MarketWatch on Thursday that Arm’s focus going ahead could be to benefit from the skyrocketing prices of creating smaller and smaller nanometer-sized transistors for chips. As transistors get smaller, the fee for mental property and software program verification has ballooned to take up as a lot as three-quarters of the design value, he stated.

Rather than tackle that value themselves, chip makers are beginning to farm that out to Arm, he stated.

“It’s allowing us to do the work, and then monetize the work that we do — for IP verification, software verification — we do that and sell it to everyone else at a fraction of the price what it would cost for them to do it on their own,” Child informed MarketWatch.

“What it does is it allows us to actually get higher royalty rates over time because of the cost savings folks are getting by using us versus trying to maybe do more of the work on their own,” Child stated.

The CFO stated that is a part of why Arm is getting extra enterprise designing full compute subsystems reasonably than simply offering instruction units for central-programming items.

“As a result, we’re seeing more customers wanting to take us up on that offer, because it’s saving them a lot of time and a lot of money,” Child informed MarketWatch.

While Arm’s IPO was reportedly a number of instances oversubscribed, it was additionally met with nervousness over what seemed to be a excessive vulnerability to geopolitical tensions ought to a commerce battle warmth up between the U.S. and China.

Child informed MarketWatch that a lot of the corporate’s related risk-factor language was on the behest of attorneys mulling over worst case eventualities. In the corporate’s submitting, Arm stated its China enterprise “operates independently of us,” and that uncovered the corporate to “significant risks.”

“That said, it’s China,” Child informed MarketWatch. The CFO stated that having overseen China operations at 4 totally different international corporations, “this is the smoothest of any of my experience with China.”

Read: Arm costs IPO at excessive finish of vary, elevating $4.87 billion

“Generally, the whole thing between China and U.S. is there doesn’t seem to be completely aligned incentives,” Child stated, noting that tensions between the U.S. and China are an issue for the semiconductor business as a complete, and are usually not Arm particular.

“We are a U.K.-based company, and most of our IP is designed outside of the U.S. so we might be a little bit different from that perspective, but for the most part, it’s pretty similar,” Child informed MarketWatch.

Read: Arm IPO: 5 issues to know concerning the chip designer central to the AI transition

Over fiscal years 2023, 2022 and 2021, income from China-based clients accounted for about 25%, 18% and 20%, respectively, of Arm’s complete. Revenue from Taiwan-based clients accounted for 13.4%, 15.9% and 15.1%, respectively.

That appears pretty commonplace, as Nvidia Corp.

NVDA,

derives 21% of its income from China and 25.9% from Taiwan, based on FactSet knowledge. Additionally, Advanced Micro Devices Inc.

AMD,

will get 21.6% of its income from China, and 10% from Taiwan.

With the quarter ending on Sept. 30, Child stated the corporate expects to ship its first earnings report in November. The firm intends to put up outcomes “in conjunction with SoftBank since they own 90% of the company,” he added.

In fiscal 2023, which ended March 31, Arm stated R&D prices amounted to 41% of income, up from 37% in 2022 and 40% in 2021. R&D prices rose 13.9% to $1.13 billion in 2023, as income slipped lower than 1% to $2.68 billion, based on Arm.

A bunch of “cornerstone investors” led by Nvidia, AMD, Apple Inc.

AAPL,

Alphabet Inc.’s

GOOG,

GOOGL,

Google adopted by way of with and acquired about $735 million in American depositary shares on the similar phrases as different purchasers, Arm confirmed.

Plans for an IPO began after Nvidia Chief Executive Jensen Huang formally pulled the plug on his foundering $40 billion supply to purchase Arm outright from SoftBank Group Corp.

9984,

in February 2022, after the FTC joined regulators opposing the deal by suing to dam it just a few months earlier. Right after the breakup, SoftBank introduced it will take Arm public by March 31, 2024.

In 2016, Arm was bought by SoftBank for $32 billion.

Source web site: www.marketwatch.com