A trio of financial institution collapses final month put some economists and buyers on the alert for a full-fledged “credit crunch” — a sudden and sharp slowdown in lending —able to pushing the U.S. financial system into recession.

The squeeze is already being felt, in response to Torsten Slok, chief economist at Apollo Global Management. He penned a Thursday be aware, titled, “The credit crunch has started.”

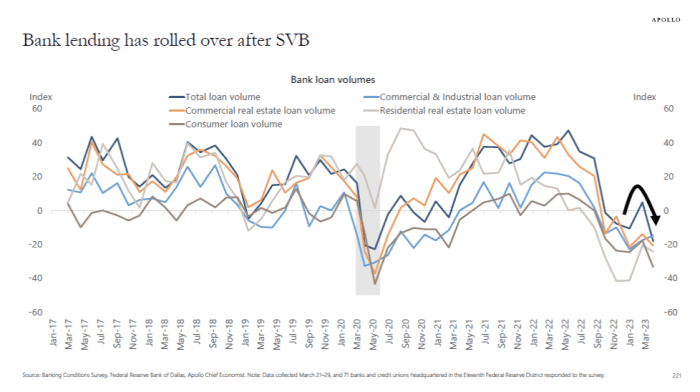

Slok cited a survey of 71 banks within the Dallas Federal Reserve Bank district accomplished March 21-29, after the March 10 collapse of Silicon Valley Bank, which, he mentioned, “shows a dramatic reversal in loan volumes.” (See chart under.)

Apollo Global Management

The Dallas Fed, in the month-to-month survey launched Monday, mentioned mortgage demand declined for the fifth interval in a row as bankers reported worsening enterprise exercise. Loan volumes fell, pushed largely by a pointy contraction in client loans, the survey discovered.

“The macro impact of the failures of Silicon Valley Bank, Signature Bank and Credit Suisse plus the downgrades of several regional banks has resulted in a crisis of confidence in our banking system,” one survey respondent mentioned, in response to the Dallas Fed.

A credit score crunch isn’t a foregone conclusion. St. Louis Federal Reserve Bank President James Bullard on Thursday was skeptical {that a} lending slowdown would tip the financial system into recession.

“Only about 20% of lending is going through the banking system and only a fraction of the banks are small or regional banks,” Bullard mentioned. ““I just don’t think it is big enough by itself to send the U.S. economy into recession.”

Bullard, talking at an occasion in Arkansas, mentioned he doubted there could be a pullback of lending by small and medium sized banks as a result of mortgage demand stays strong.

Slok final month modified his view on the financial system. After beforehand warning of a “no-landing” state of affairs by which a resilient financial system would initially keep away from a recession altogether, forcing the Fed to double down on tighter financial coverage, the veteran Wall Street economist known as for a “hard landing” within the wake of the collapse of Silicon Valley Bank.

Slok subsequently warned that SVB’s collapse was more likely to have a extra unfavorable influence on the financial system than some previous monetary crises, together with the 1994 chapter of Orange County, California, the 1998 collapse of hedge-fund Long Term Capital Management, and final yr’s U.Ok. gilt troubles. That as a result of the conduct of regional banks was set to alter after SVB’s collapse, he mentioned.

“Most important, the costs of capital have increased, and underwriting standards have tightened,” Slok mentioned in a March 21 be aware.

While the U.S. inventory market weathered the instant aftermath of the banking mess, with main indexes scoring stable month-to-month beneficial properties in March, Treasury yields have pulled again sharply and fed-funds futures merchants now see Federal Reserve coverage makers delivering a collection of charge cuts by year-end.

The previous week has seen the inventory market wobble in response to knowledge providing preliminary indicators a scorching labor market is starting to chill. Investors are weighing whether or not long-awaited indicators the Fed’s aggressive collection of charge will increase over the previous yr are starting to gradual the financial system is a constructive in that it’s going to permit coverage makers to again off on additional tightening, or a unfavorable in that it might presage a sharper slowdown than beforehand anticipated.

The S&P 500

SPX,

was on observe for a 0.2% fall in a holiday-shortened week. U.S. inventory exchanges will probably be closed on Good Friday. The Dow Jones Industrial Average

DJIA,

was up 0.6% for the week, whereas the Nasdaq Composite

COMP,

was headed for a 1.1% decline.

Recent instability within the U.S. banking system may make for a extra extreme and longer recession, mentioned Ryan Sweet, chief U.S. economist at Oxford Economics, in a Wednesday be aware. The agency sees a recession starting within the third quarter.

He argued that the financial prices of stress within the banking system “won’t be fully felt for several months as banks tighten lending standards and reduce the availability of credit to households and businesses.”

Oxford Economics sees a sudden tightening in lending requirements posing a peak drag of 0.7 share level on gross home product development later this yr, he mentioned. The Fed’s Senior Loan Officer Opinion Survey, set for launch in May, “will help us determine the fallout from the recent turmoil in the banking system,” Sweet mentioned.

Source web site: www.marketwatch.com