News {that a} uncommon tropical storm could hit the Southwestern United States within the subsequent few days ought to function a reminder that the vitality market should still see important disruptions with hurricane season within the Atlantic having simply entered its peak.

Several growing climate methods having the potential to disrupt oil and natural-gas manufacturing, in addition to refining exercise, within the Gulf of Mexico.

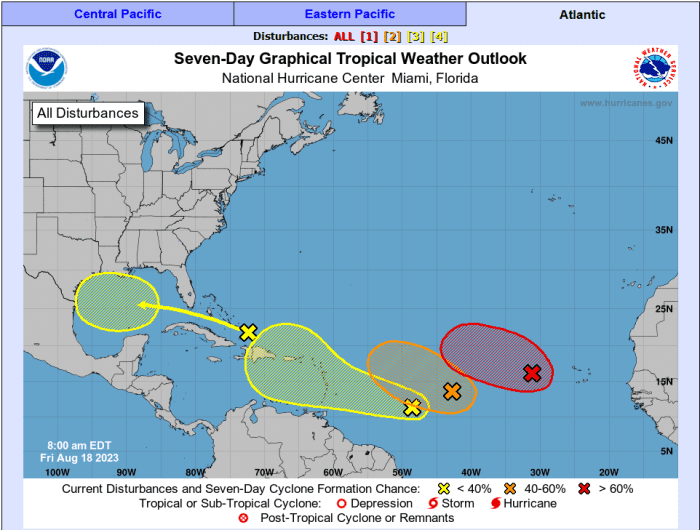

“There are growing concerns that the weather in the Atlantic could get ugly very quickly,” stated Phil Flynn, senior market analyst at The Price Futures Group, in a Friday report. “We have had a relatively quiet hurricane season so far, but now we’re getting into the high point of the season and the tropical storm map from the National Hurricane Center is again looking like somebody spilled some coffee on it.”

U.S. National Hurricane Center’s 7-day graphical tropical climate outlook as of Friday, Aug. 18 at 8 a.m. Eastern time.

U.S. National Hurricane Center

““…the tropical storm map from the National Hurricane Center is again looking like somebody spilled some coffee on it.” ”

Atlantic hurricane season runs from June 1 to Nov. 30, with most exercise taking place between mid-August and mid-October — and Sept. 10 marking the height of the season, in keeping with the U.S. National Oceanic and Atmospheric Administration.

As of Friday, there are at least 4 tropical waves to keep watch over — with not less than two of them with a reasonably good likelihood to get into the Gulf of Mexico and disrupt oil-and-gas operations, stated Flynn.

So far this yr, oil and natural-gas costs haven’t see a lot affect from the dangers to operations within the Gulf.

As of Friday, U.S. benchmark West Texas Intermediate crude

CL.1,

CLU23,

primarily based on the front-month contract, traded round 0.7% decrease month so far and has climbed by 1.2% for the yr, in keeping with Dow Jones Market Data. U.S. natural-gas futures

NG00,

NGU23,

have misplaced almost 3.2% this month and dropped by 43% yr so far.

Meanwhile, Hurricane Hilary was within the headlines on Friday because it reached Category 4 power off Mexico’s Pacific coast and threatened to return to tropical storm standing because it nears Southern California this weekend.

Read: Hurricane Hilary anticipated to drench California as a tropical storm, first in 84 years

The storm is anticipated to make landfall on the U.S. West Coast this weekend, however its affect on refining in Southern California will possible be “mostly from flash flooding rather than wind,” Debnil Chowdhury, head of Americas fueling and refining, at S&P Global Commodity Insights, wrote in emailed commentary Friday.

Richard Joswick, head of worldwide oil at S&P Global Commodity Insights stated greater than 1 million barrels per day of refinery capability is doubtlessly in danger in Los Angeles/Bakersfield space.

Hilary, nonetheless, is a uncommon climate phenomenon on the Pacific coast. A tropical storm hasn’t made landfall in Southern California since 1939.

For the Atlantic area, NOAA on Aug. 11 up to date its 2023 hurricane season outlook report, elevating its prediction to an “above normal” degree of exercise from a “near normal” degree. It now sees a 70% likelihood of 13-21 named storms, with six to 11 of them doubtlessly turning into hurricanes and two to 5 of these doubtlessly turning into main hurricanes.

The 2023 Atlantic hurricane season began early this yr, with the National Hurricane Center on Jan. 16 issuing a tropical climate outlook for a low-pressure system north of Bermuda. “Don” briefly turned the primary hurricane of the season on July 22.

Monitoring Atlantic hurricanes are vital to the oil and natural-gas market on condition that the Gulf of Mexico federal offshore oil manufacturing accounts for 15% of whole U.S. crude-oil output, whereas federal offshore natural-gas manufacturing within the Gulf accounts for five% of the nation’s whole dry manufacturing, in keeping with the U.S. Energy Information Administration. More than 47% of U.S. petroleum refining capability and 51% of whole U.S. natural-gas processing plant capability are situated alongside the Gulf coast.

“Whereas onshore wells in East Texas and Louisiana are designed to withstand hurricanes, the same cannot be said of offshore Gulf of Mexico operations, which must be suspended at the drop of a hat,” Manish Raj, managing director at Velandera Energy Partners, instructed MarketWatch.

“More problematic are infrastructure facilities such as pipelines, processing plants and terminals [which] are more likely to sustain damages due to their larger footprint,” he stated.

“Damage to infrastructure is really bad news because such repairs take weeks if not months,” stated Raj. “To add insult to injury, infrastructure damage affects the entire production in that area that must all be suspended.”

With oil within the U.S. Strategic Petroleum Reserve at a multidecade low, the U.S. has “limited capacity to absorb a multiweek curtailment,” Raj stated.

““ Ignorance is bliss in the oil business, until a hurricane actually comes to town.” ”

For now, nonetheless, the vitality market is “happy to look the other way and give hurricanes the cold shoulder, since the likelihood of a catastrophic hurricane remains slim, and the market is having too much of a good time,” he stated.

“Ignorance is bliss in the oil business, until a hurricane actually comes to town,” stated Raj.

Source web site: www.marketwatch.com