Inflation posted its largest month-to-month improve this yr in August as customers confronted larger costs on vitality and quite a lot of different objects.

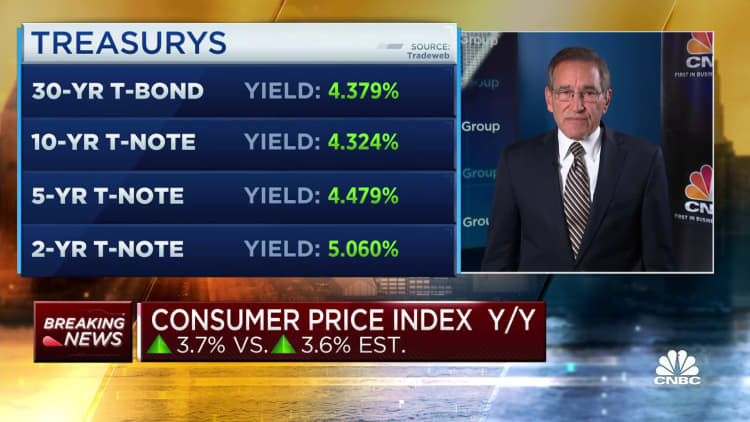

The shopper value index, which measures prices throughout a broad number of items and providers, rose a seasonally adjusted 0.6% for the month, and was up 3.7% from a yr in the past, the U.S. Department of Labor reported Wednesday. Economists surveyed by Dow Jones have been in search of respective will increase of 0.6% and three.6%.

However, excluding unstable meals and vitality, core CPI elevated 0.3% and 4.3% respectively, towards estimates for 0.2% and 4.3%. Federal Reserve officers focus extra on core because it offers a greater indication of the place inflation is heading over the long run.

Energy costs fed a lot of achieve, rising 5.6% on the month, a rise that included a ten.6% surge in gasoline.

Food costs rose 0.2% whereas shelter prices, which make up about one-third of the CPI weighting, elevated 0.3%. Within shelter, the hire of shelter main residence index rose 0.5% and elevated 7.8% from a yr in the past. Owners equal hire, a key measure that gauges what householders consider they may get in hire, elevated 0.4% and seven.3% respectively.

Elsewhere within the report, airfares jumped 4.9% however have been nonetheless down 13.3% from a yr in the past. Used automobile costs, an essential contributor to inflation throughout its rise in 2021 and 2022, declined 1.2% and are down 6.6% yr over yr. Transportation providers rose 2% on the month.

Excluding shelter from CPI would have resulted in an annual improve of solely about 1%, in line with Lisa Sturtevant, chief economist at Bright MLS.

“Housing continues to contribute an outsized share to the inflation measures,” Sturtevant stated. “Rent growth has slowed considerably and median rents nationally fell year-over-year in August. … However, it takes months for those aggregate rent trends to show up in the CPI measures, which the Fed must take into account when it takes its ‘data driven’ approach to deciding on interest rate policy at their meeting … later this month.”

Stock market futures initially fell following the report then rebounded. Treasury yields have been larger throughout the board.

The leap in headline inflation hit employee paychecks. Real common hourly earnings declined 0.5% for the month, although they have been nonetheless up 0.5% from a yr in the past, the Labor Department stated in a separate launch.

The knowledge comes as Federal Reserve officers need to stake out a longer-term method to fixing the inflation downside.

In a sequence of will increase that started in March 2022, the central financial institution has boosted its benchmark borrowing fee by 5.25 share factors in an effort to deal with inflation that had been operating at a greater than 40-year excessive in the summertime of 2022.

Recent remarks from officers have indicated a extra cautious method forward. Whereas policymakers had most popular to overdo financial coverage tightening, they now see dangers extra evenly balanced and seem extra cautious about future hikes.

“Overall, there is nothing here to change the Fed’s plans to hold interest rates unchanged at next week’s [Federal Open Market Committee] meeting,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics.

Markets largely anticipate the Fed to skip a hike at subsequent week’s assembly. Futures pricing has been unstable past that, with merchants placing a few 40% likelihood of a ultimate hike in November, in line with CME Group knowledge.

Source web site: www.cnbc.com