The Pew Charitable Trusts not too long ago reported that retirement property in lively auto-IRA packages have reached $1 billion.

Auto-IRAs, which started in 2017 when Oregon launched its OregonSaves program, now are up and working in six different states: Illinois Secure Choice (2018), CalSavers (2019), MyCT Savings (2022), Maryland Saves (2022), Colorado SecureSavings (2023) and RetirePath Virginia (2023).

Auto-IRAs are a response to the issue that solely about half of personal sector employees within the United States are coated by an employer-sponsored retirement plan at any given time, and few employees save with out one.

Under the brand new packages, employers not providing a retirement plan should facilitate payroll deductions from their workers’ paychecks to state-sponsored IRAs. While the worker payroll deductions happen by default, workers have the choice of opting out.

Many monetary providers companies haven’t been massive supporters of auto-IRAs – presumably as a result of they feared that the state-sponsored initiatives would eat into their enterprise. That concern by no means appeared fairly proper. Most of the uncovered employees are with small employers and are on the decrease finish of the earnings scale. That’s probably not the goal marketplace for the monetary providers business. Nor does it appear seemingly that many companies with plans would drop them in favor of auto-enrolling their workers in a state program with no employer match.

More essential, an argument could possibly be made that even the comparatively small administrative prices and trouble related to taking part within the state auto-IRA packages might encourage companies — notably these near the road between providing and never providing a plan — to determine their very own plans. And all of the controversy surrounding the institution of those state retirement packages might make retirement saving extra salient. Indeed, the outcomes of two current research, in addition to earlier analysis, help the notion that this tendency would possibly dominate.

The first piece of proof comes from a survey we not too long ago undertook to find out why small employers don’t provide retirement plans, which included a direct query about how small employers would react to a state auto-IRA.

Read: What’s stopping extra small companies from providing retirement plans?

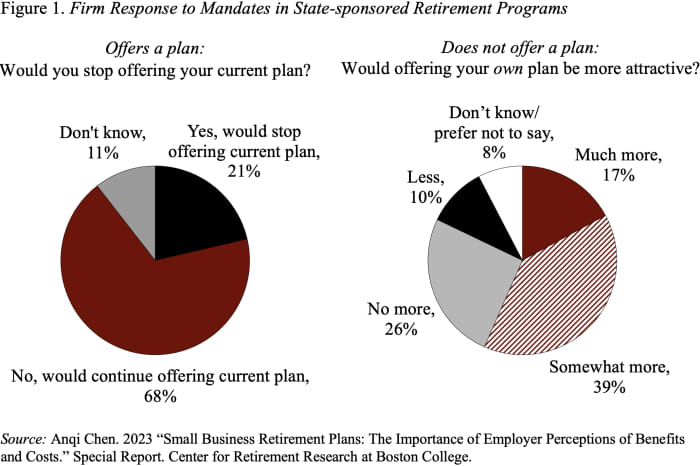

The responses present that the presence of state-sponsored packages doesn’t appear to make companies much less prone to provide their very own retirement plan (see Figure 1). Among companies that already provide a plan, about 70% say they might proceed to supply their very own if their state launched a mandate. Among companies that didn’t provide a plan, virtually 60% stated a mandate would truly make providing their personal retirement plan extra engaging. These outcomes are per a 2017 survey by Pew.

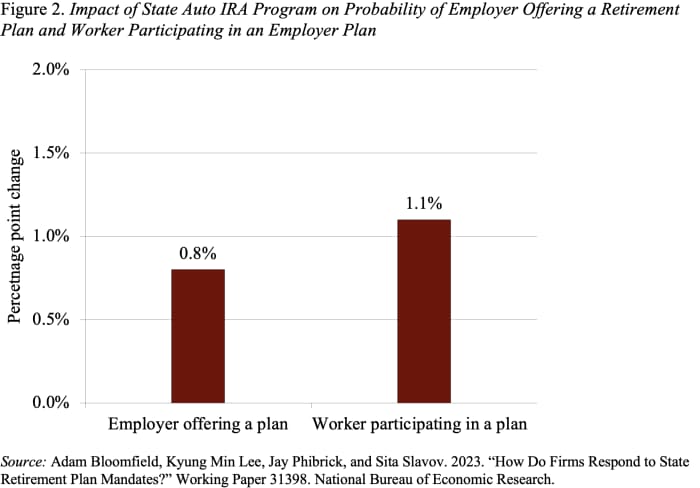

In addition to survey responses, a current research, based mostly on Form 5500 information and individual-level census information, discovered that auto-IRA mandates improve the likelihood of companies providing a retirement plan by 0.8 proportion factors and the likelihood {that a} employee participates in an employer plan by 1.1 proportion factors (see Figure 2).

These statistically vital outcomes affirm earlier research that state auto-IRAs complement — fairly than crowd out — the personal marketplace for retirement plans.

It can be nice if the monetary providers business might get behind these auto-IRA initiatives.

Source web site: www.marketwatch.com