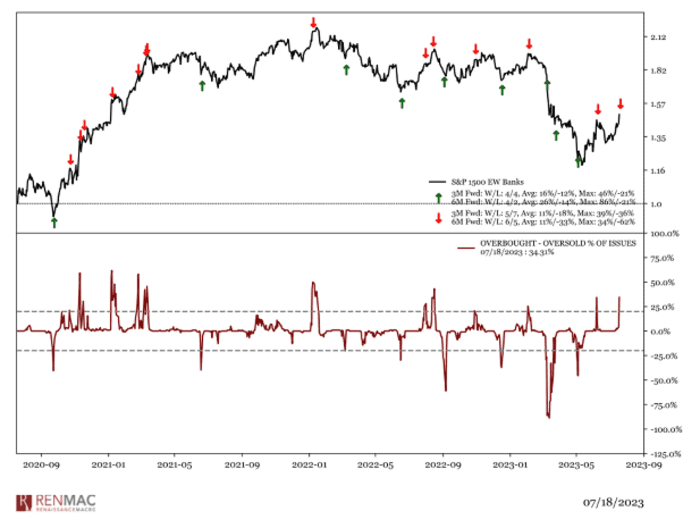

A giant July bounce for beforehand pummeled regional financial institution shares, in addition to different monetary names, has seemingly gone too far, too quick, a intently adopted technical analyst warned in a Wednesday word.

“Banks are in the danger zone,” wrote Jeff deGraaf, founding father of Renaissance Macro Research.

“Their relative trends turned negative in our work late in 2022, but their oversold condition this spring made them vulnerable to a bounce,” he mentioned. Bank shares plummeted in March after the collapse of Silicon Valley Bank and different regional lenders stirred fears of a broad banking disaster.

In March, the SPDR S&P Regional Banking ETF

KRE,

tumbled to ranges final seen in September 2020. It’s rallied greater than 8% thus far this week and simply over 14% in July. It stays down greater than 20% for the 12 months thus far. Other banks have additionally rebounded strongly in July.

See: Bank ETFs bounce, with this fund heading for probably greatest month since 2021

Renaissance Macro Research

“That bounce has now created an overbought condition, though many remain 10-15% away from natural resistance levels. This move is probably close to exhausting itself, though we’re more comfortable with that call being accurate than precise,” deGraaf mentioned.

Within financials, capital market names are at an excessive, in line with the agency’s three-year rolling measure of extreme returns, “and now look vulnerable to an aerodynamic stall,” he wrote. “Trees don’t grow to the sky,” so tapping the brakes on enthusiasm for the group is traditionally justified.

KRE was up 1.5% close to noon on Wednesday, whereas the equalweight measure of the S&P 500 financials sector superior 1.6%.

U.S. shares had been larger general Wednesday, with the S&P 500

SPX,

up 0.3% after ending Tuesday at its highest since April 4, 2022, and simply 5% under its document shut from Jan. 3, 2021. The Dow Jones Industrial Average

DJIA,

rose round 140 factors, or 0.4%, on observe for an eighth straight acquire.

Stock Market Today: Dow heads for eighth day by day acquire as Wall St. extends rally

Shares of Dow element Goldman Sachs Group Inc.

GS,

reversed earlier losses to commerce up greater than 1% after it delivered the one profit-target miss among the many six largest U.S. banks as earnings season strikes into full swing.

Read: Banks are doing higher than feared as shares rally and Bank of America builds money

Source web site: www.marketwatch.com