The rotation into know-how shares and different pandemic winners as banking jitters rattled markets in March makes it tough to inform if traders assume the U.S. financial system seems headed for a recession or not.

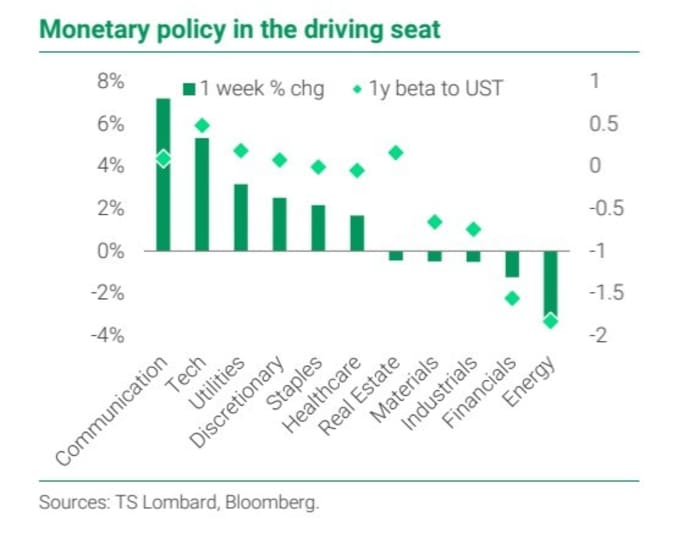

TS Lombard’s strategists Skylar Montgomery Koning and Andrea Cicione stated the transfer into rate-sensitive shares like tech and communications (see chart) seems misguided, in a Wednesday shopper observe.

Pressure on vitality, financials and extra displays investor considerations that financial coverage will sink the U.S. financial system right into a recession

TS Lombard

While traders appeared much less frightened a couple of full-blown banking disaster unfolding than per week in the past after regulators within the U.S. and Europe stepped in to shore up confidence within the banking system, the TS Lombard staff stated the next rally in know-how shares is “largely ignoring” the strain of tighter lending requirements on the U.S. financial system.

“The main implication of banking-sector distress is the accelerated tightening of lending standards that was already under way, squeezing the economy and weighing on growth,” the TS Lombard staff wrote.

The monetary sector of the S&P 500 index

SPX,

was up 2.9% for the week by Wednesday afternoon, in keeping with FactSet, though shares of First Republic Bank

FRC,

have been 33.9% decrease for a similar stretch.

Concerns a couple of potential U.S. recession, the TS staff argued, has been mirrored in current downward strain in commodity markets, with vitality commodities down about 10% and industrial metals down roughly 3% up to now week-and-a-half.

Prices for the U.S. benchmark West Texas Intermediate crude

CL00,

have been greater Wednesday, however nonetheless 8.6% decrease in March, in keeping with FactSet.

Meanwhile the TS staff pointed to communication and know-how shares which have gained greater than 5% over the identical stretch, as traders contemplate the potential of “deep” interest-rate cuts from the Fed within the second half of this yr, however not the probably impression a recession would have on earnings and development.

Technology shares boomed through the easy-money days of 2020 to 2021 as a bazooka of financial and financial assist was fired off to assist stabilize households and the financial system. They have been hit arduous final yr because the Fed started to boost charges on the quickest tempo in many years.

Against that backdrop, Treasury yields, together with the benchmark 10-year fee

TMUBMUSD10Y,

for the financial system have climbed, up 3.6% on Wednesday from a 1-year low of two.3%.

The tech-heavy Nasdaq Composite Index

COMP,

was up 3.6% in March by Wednesday, however up 13.4% on the yr, outperforming the 2 different essential inventory indexes, in keeping with FactSet.

See: First Republic inventory is getting battered. Here’s how the financial institution’s tailspin began and why it hasn’t stopped.

Source web site: www.marketwatch.com