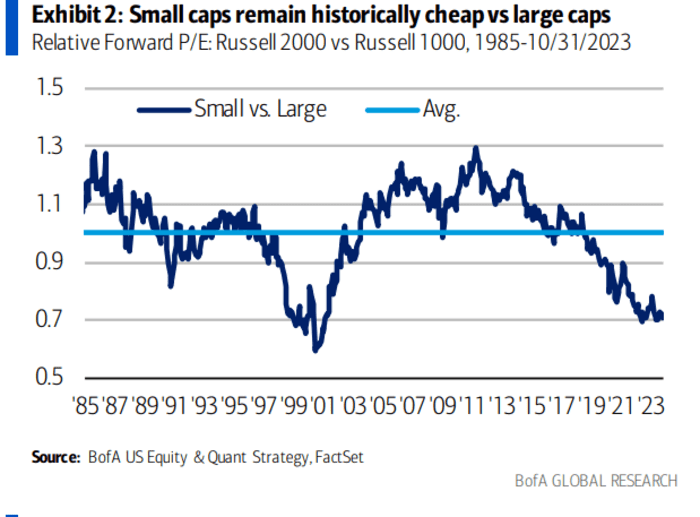

Small-cap shares have hit their most cost-effective stage in 14 months, making them less expensive than their large-cap friends, based on BofA Global.

While that doesn’t essentially imply battered small-cap inventory costs will rise quickly, it might probably level to higher returns for the phase within the longer-term, analysts on the financial institution wrote, in a Monday shopper notice.

Small-cap shares have considerably underperformed their large-cap friends thus far this 12 months, with the Russell 2000

RUT,

a small-cap benchmark made up of the two,000 smallest firms by market capitalization within the Russell 3,000

RUA,

shedding 3.1% year-to-date, versus a 15% acquire of the large-cap benchmark S&P 500

SPX,

and a 32% return of the tech-heavy Nasdaq Composite

COMP,

based on FactSet knowledge.

With a current fairness selloff, the value per earnings ratio of the Russell 2000 fell to 12.3, a 14-month low, based on BofA Global.

BofA Global Research

Meanwhile, small-caps stay the most cost effective measurement phase by market capitalization, buying and selling at a 19% low cost to historic averages, whereas midcap shares are buying and selling at a 4% low cost, based on BofA Global. Large-cap shares have been buying and selling at a 12% premium to historic averages, whereas megacap shares, represented by Russell Top 200

XX:RT200,

have been buying and selling at a 18% premium, their knowledge confirmed.

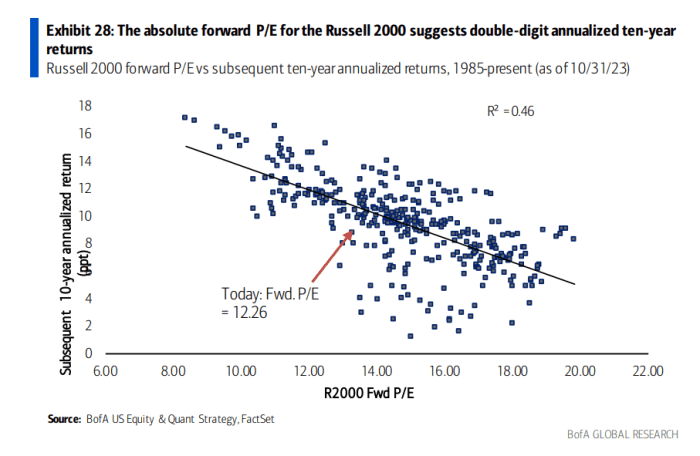

The comparatively low valuation of small-cap shares doesn’t essentially imply their costs will rise quickly, as valuation tends to be a poor short-term timing indicator, however it has extra explanatory energy over the long run, based on the analysts.

Read: Tempted to go bargain-hunting for small-cap shares? Why you would possibly wish to wait.

Over the following decade, the Russell 2000’s worth per earnings ratio implies a 12% annualized return, versus a 7% acquire every year for the Russell 1000, the analysts famous.

BofA Research

Source web site: www.marketwatch.com