The inventory market, as measured by the S&P 500 Index

SPX,

has continued to say no after its false upside breakout of early February. February is statistically the worst month of the yr, and this February simply concluded was actually a destructive month – though it stays to be seen if it is going to be the worst month of this yr.

SPX has been underneath strain since that false breakout. There is minor resistance at 4020 after which heavy resistance from 4080 as much as 4200. On the draw back, there’s help at 3900, and stronger help from the late-December buying and selling vary between 3760 and 3850.

Also, the truth that SPX broke out from a triangle formation (blue traces on accompanying chart) solely to fall again beneath the apex of the triangle is an extra destructive.

The McMillan Volatility Band (MVB) promote sign stays in impact. SPX has traded right down to and touched the -3σ “modified Bollinger Band.” The goal for the MVB promote sign is the -4σ Band, which is at the moment at about 3920 and transferring sideways for the second.

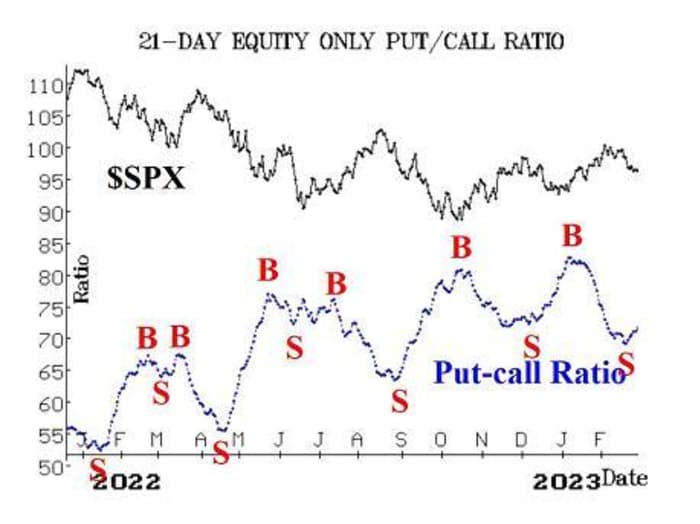

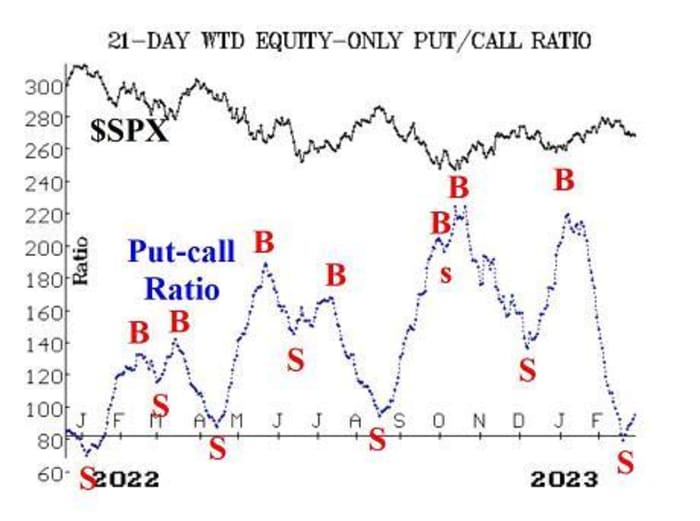

Equity-only put-call ratios stay strongly on promote alerts. They curled over not too long ago and commenced to rise. Our pc evaluation applications affirm that each are on promote alerts now. The weighted ratio’s sign got here from a really low place on its chart — i.e., from an especially overbought situation. That usually signifies a robust sign.

Market breadth has been usually destructive, and each breadth oscillators have suffered. There has been extra harm to the “stocks only” breadth oscillator, although, and it stays on a promote sign (albeit in oversold territory). The NYSE breadth oscillator has accomplished a purchase sign. The two oscillators have unfold aside, and that’s an oversold situation for shares as properly. We are going to attend for some settlement right here earlier than taking a brand new place, for the reason that “stocks only” oscillator is normally the extra dependable sign.

New 52-week highs on the NYSE have been simply robust sufficient to keep away from a promote sign. On a few days, New Lows have exceeded New Highs, however not on back-to-back days. So, for the second, this indicator stays on its purchase sign.

VIX

VIX,

has generated a brand new “spike peak” purchase sign. It peaked on Feb. 22 in in a single day buying and selling. It then took 5 buying and selling days for it to fall three factors beneath that peak, which is the criterion for a brand new purchase sign. This purchase sign will stay in impact for 22 buying and selling days, however could be stopped out if VIX had been to shut above that peak — i.e., above 23.63.

The pattern of VIX intermediate-term purchase sign stays in impact. It started final November (circled space on the accompanying VIX chart). It could be stopped out if VIX had been to shut above its 200-day transferring common, which is at the moment at 24.80 and declining.

The assemble of volatility derivatives stays modestly bullish for shares. That is, the time period buildings of each the VIX futures and of the CBOE Volatility Indices proceed slope upwards. Furthermore, the VIX futures are all buying and selling at premiums to VIX.

Overall bullish arguments appear to trip on kind of obscure statistics. Here’s one which was making the rounds: When January is up by greater than 4% and February is down by greater than 2% (each of which occurred this yr), that’s bullish for shares. Apparently this has occurred a handful of instances. Even if you wish to commerce on a statistic with such a brief monitor document, how would one even commerce that? I’d relatively use the indications with monitor data, which is able to get us lengthy on shares if the market does reverse upward.

In abstract, we’re sustaining a “core” bearish place due to the false upside breakout skilled by SPX in February and due to the equity-only put-call ratio promote alerts. We will commerce different confirmed alerts round that “core.”

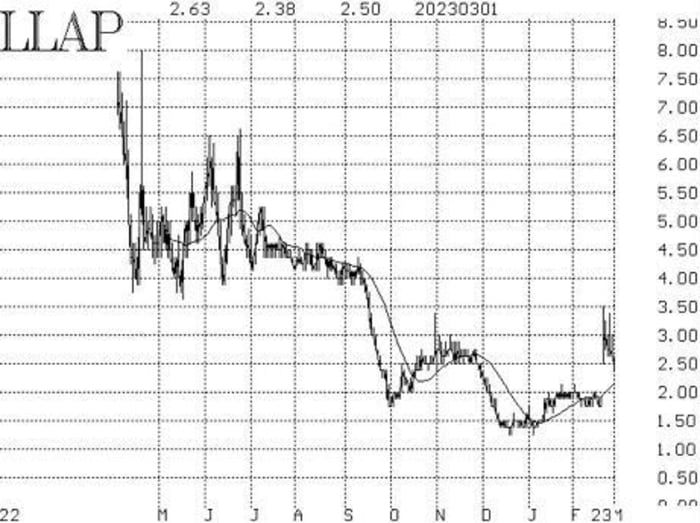

New suggestion: Terran Orbital (LLAP)

Option quantity in Terran Orbital

LLAP,

rose sharply on Feb. 22 and has remained fairly robust since them. Moreover, inventory quantity patterns are extraordinarily robust. One may think about merely shopping for the inventory and never bothering with an choice, however we’re going to use calls right here:

Buy 10 LLAP Apr (21st) 2 calls

At a value of 0.70 or much less.

LLAP: 2.40 Apr (21st) 2 calls: 0.55 bid, supplied at 0.70.

Stop out if LLAP closes beneath 1.90.

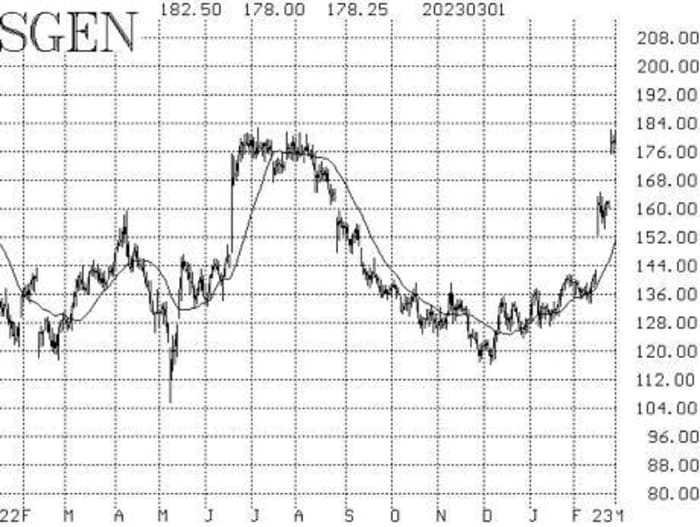

New suggestion: Seagen Inc. (SGEN)

Option quantity in Seagen

SGEN,

has been elevated for the previous three days. There is speak that Pfizer

PFE,

is in early-stage dialogue to amass SGEN. Stock quantity patterns are very robust, as properly. Since these are costly choices, we’re going to suggest a diffusion right here:

Buy 1 SGEN Apr (21st) 180 name

And Sell 1 SGEN Apr (21st) 200 name

For a debit of seven.00 or much less.

SGEN: 177.03

We will maintain and not using a cease initially whereas this takeover rumor performs out.

Follow-up motion:

We are utilizing a “standard” rolling process for our SPY spreads: in any vertical bull or bear unfold, if the underlying hits the brief strike, then roll your complete unfold. That could be roll-up within the case of a name bull unfold, or roll-down within the case of a bear put unfold. Stay in the identical expiration, and maintain the space between the strikes the identical until in any other case instructed.

Long 1 SPY

SPY,

Mar (17th) 410 name and Short 1 SPY Mar (17th) 425 name: This unfold was purchased in keeping with the “New Highs vs. New Lows” purchase alerts. It was rolled up on January 26th, when SPY traded at 404, after which it was rolled up once more at expiration. Stop your self out of this place if New Lows on the NYSE exceed New Highs for 2 consecutive days.

Long 3 XM

XM,

Mar (17th) 15 calls: Continue to carry whereas the takeover rumors play out.

Long 1 SPY Mar (17th) 410 put and Short 1 SPY Mar (17th) 385 put: This bear-spread was purchased in keeping with the McMillan Volatility Band (MVB) promote sign. This commerce could be stopped out if SPX had been to shut again above the +4σ Band. SPX touched the -3σ Band this week, however not the -4σ. Roll the unfold down 16 factors on all sides, staying the March (17th) expiration.

Long 2 CTLT

CTLT,

Mar (17th) 70 calls: This takeover rumor continues to be “in play,” though the inventory has fallen again barely. Continue to carry whereas these rumors play out.

Long 3 MANU

MANU,

Mar (17th) 25 calls: The potential takeover has hit a snag, in that the present homeowners suppose the crew is price way over analysts can justify. We are going to carry.

Long 2 GRMN

GRMN,

April (21st) 95 places: These had been purchased on Feb. 21, when GRMN closed beneath 95. We will stay on this place so long as the GRMN weighted put-call ratio stays on a promote sign.

Long 2 SPY April (21st) 390 and brief 2 SPY April (21st) 360 places: This is our “core” bearish place. Initially, we’ll set a cease to shut out this place if SPX closes above 4200.

Long 1 SPY Apr (6th) 395 name and Short 1 SPY Apr (6th) 410 name: This name bull unfold was purchased in keeping with the VIX “spike peak” purchase sign. It was confirmed on the shut of buying and selling on Wednesday, March 1st. Stop out if VIX subsequently closes above 23.73. Otherwise, we’ll maintain for 22 buying and selling days.

All stops are psychological closing stops until in any other case famous.

Send inquiries to: lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan might maintain positions in securities advisable on this report, each personally and in shopper accounts. He is an skilled dealer and cash supervisor and is the writer of the best-selling e-book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The info on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness should not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals might have positions within the securities advisable within the advisory.

Source web site: www.marketwatch.com