Roughly 74,000 scholar mortgage debtors will obtain $4.9 billion in debt cancellation, the Biden administration introduced Friday.

The debtors who’re a part of this announcement have both been in compensation on their loans for at the very least 20 years or are public servants who’ve been working for the federal government or sure nonprofits for at the very least 10 years and been paying on their loans throughout that interval.

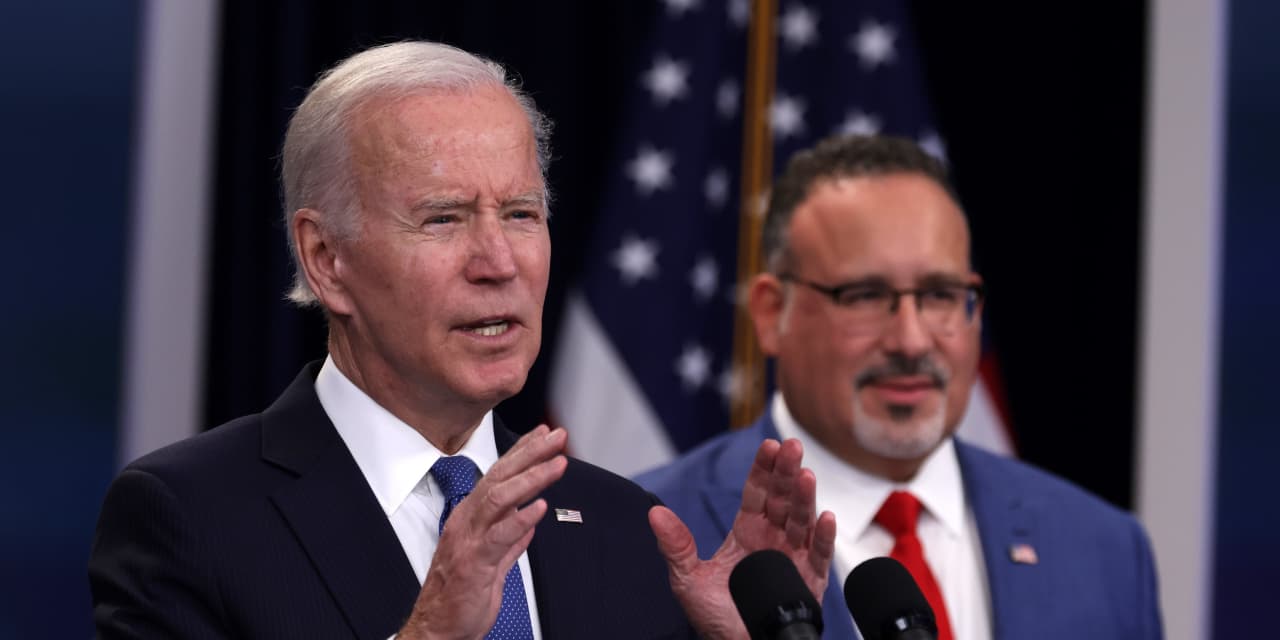

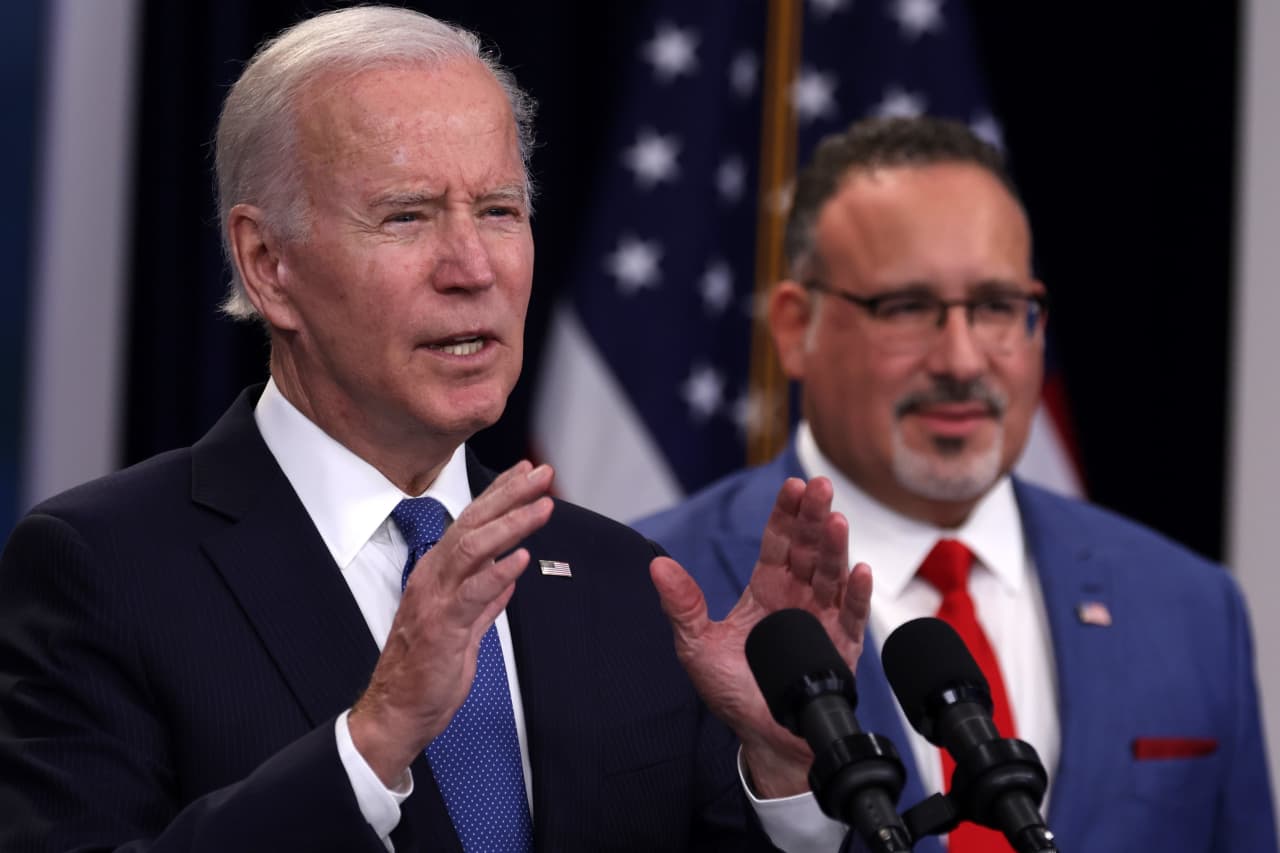

“From Day One of my Administration, I vowed to improve the student loan system so that a higher education provides Americans with opportunity and prosperity – not unmanageable burdens of student loan debt,” President Joe Biden mentioned in a press release saying the aid. “I won’t back down from using every tool at our disposal to get student loan borrowers the relief they need to reach their dreams.”

Friday’s announcement is a part of a broader suite of Biden administration initiatives geared toward streamlining debtors’ path to aid below present forgiveness packages. So far, the administration has accepted $136.6 billion in debt cancellation for greater than 3.7 million debtors by these efforts.

Fixes to PSLF, income-driven compensation

Nearly 44,000 debtors who’re a part of Friday’s announcement are receiving aid by the Public Service Loan Forgiveness program. Under that initiative debtors who’ve labored for the federal government and sure nonprofits for at the very least 10 years and paid on their loans throughout that point are eligible to have their remaining debt cancelled.

But for years, debtors, stymied by paperwork points and technicalities, struggled to truly entry aid below this system. In 2021, the Biden administration took steps geared toward eliminating a few of these obstacles in the best way of debtors receiving forgiveness by PSLF.

The different 29,700 debtors who’re a part of Friday’s announcement have been paying on their loans for at the very least 20 years. A collection of packages referred to as income-driven compensation, permit debtors to pay their debt as a share of their earnings and have the rest forgiven after at the very least 20 years of funds.

Despite this promise of cancellation, within the interval earlier than the pandemic hundreds of thousands of debtors who had been in compensation for at the very least 20 years have been nonetheless paying on their loans. That was partially as a result of servicers steered struggling debtors in the direction of forbearance as a substitute of enrolling them in income-driven compensation plans that allowed them to construct credit score in the direction of forgiveness, in line with advocates and lawsuits.

In 2022, the Biden administration introduced it might overview debtors’ accounts and modify them in order that debtors’ credit score in the direction of forgiveness was really mirrored. The 29,700 debtors are receiving cancellation by this initiative.

Separate from mass debt forgiveness

Friday’s announcement is separate from a plan the Biden administration shared earlier in January to hurry up the timeline for some debtors who’ve been in compensation for at the very least 10 years to obtain forgiveness.

Through SAVE, an income-driven compensation plan the Department of Education launched final yr, debtors who’ve money owed of $12,000 or much less are eligible to have their loans forgiven after 10 years of funds. Originally officers mentioned they might launch this profit in July. But final week, the Biden administration introduced that it might begin cancelling debt by this program in February.

The $4.9 billion in debt forgiveness introduced Friday can be separate from the Biden administration’s mass scholar debt aid plan that the Supreme Court knocked down final yr. The Department of Education is at present within the means of creating a brand new plan and is below strain from advocates to prioritize latest graduates, low-income debtors and others as a part of the plan.

The headlines surrounding forgiveness come as debtors and the scholar mortgage system are working by the kinks of returning to compensation after a greater than three yr pause. Borrowers have struggled to get ahold of their mortgage servicers and get correct and well timed billing info. The Department mentioned that roughly 40% of debtors with a scholar mortgage invoice due in October, the month funds resumed, didn’t make a cost.

Source web site: www.marketwatch.com