Wall Street’s expectations for 2023 have been diving as forecasts for the brand new 12 months are available gentle, and the news may worsen as soon as they consider disappointing outcomes from Big Tech. But no less than Bob Iger is coming again for a sequel.

Google, Facebook, Amazon and Apple all upset with vacation earnings this week. Their forecasts ranged from nonexistent to piecemeal to meh, and the fallout will solely add to the most important dive in Wall Street’s expectations by means of the start of a 12 months since 2016.

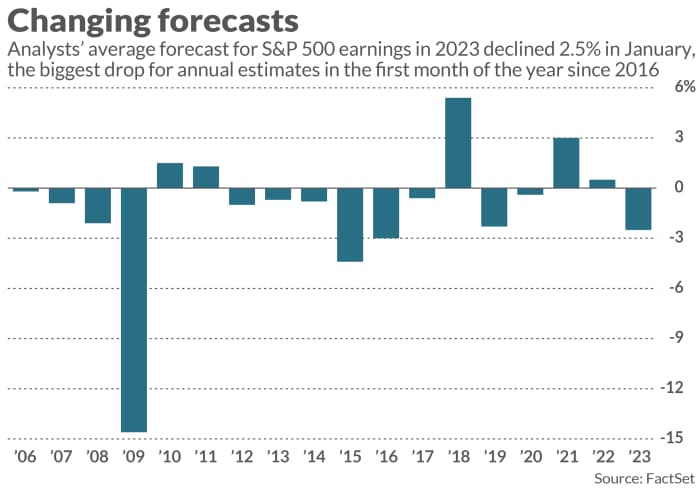

Analysts’ common forecast for 2023 earnings from the S&P 500 index

SPX

dropped by 2.5% in January, in accordance with FactSet Senior Earnings Analyst John Butters, the worst in seven years. Those projections started heading decrease final 12 months, and the decline is simply steepening — analysts are actually projecting 3% earnings progress in 2023, and that’s contingent on a giant vacation rebound from the outcomes being launched this quarter.

Uncredited

The news was even worse for the primary quarter, for which projections declined 3.3% in January as firms whiffed on their forecasts at a speedy tempo: 86% of the 43 firms which have guided for first-quarter earnings have missed projections, Butters reported. Earnings are actually anticipated to say no 4.2%, which might be the primary year-over-year earnings decline for the reason that third quarter of 2020, when the COVID-19 pandemic write-offs began to return in.

Big Tech solely added to the downward trajectory in latest days. Amazon.com Inc.

AMZN

missed on its vacation earnings in addition to its forecast for the primary quarter, and that firm may decide if S&P 500 income rise in 2023 all by itself. Amazon’s worst vacation earnings since 2014 may additionally contribute to the buyer discretionary sector’s first earnings decline for the reason that starting of the pandemic, with vacation sector earnings now anticipated to drop greater than 5%.

Google mother or father Alphabet Inc.

GOOGL

GOOG

and Facebook mother or father Meta Platforms Inc.

META

additionally missed their respective earnings targets amid issues with the digital-advertising business, resulting in the communications-services sector having the worst earnings season within the S&P 500. Profit has declined 25.2% in that sector thus far, the worst among the many 11 S&P 500 sectors, however could be down simply 6.5% with out the results of Meta and Alphabet, Butters reported.

Apple Inc.

AAPL

additionally didn’t do projections any favors, reporting its largest gross sales lower since 2016 and an earnings miss Thursday afternoon. In a piecemeal forecast, executives projected the same gross sales decline within the calendar first quarter, although unofficially.

This week in earnings

After the busiest week in earnings season wrapped up, don’t anticipate a lot of a breather — 95 S&P 500 firms are anticipated to report within the week forward, the third consecutive week with no less than 90 firms reporting. There might be loads of intrigue amongst firms not within the S&P 500 too, together with Robinhood Markets Inc.

HOOD

and Affirm Holdings Inc.

AFRM

reporting collectively on Wednesday afternoon.

Only one Dow Jones Industrial Average

DJIA

inventory will report, however that’s the Wednesday name you’ll want to tune in for: Bob Iger’s return to the Walt Disney Co.

DIS

earnings present.

The calls to place in your calendar

- Disney: The final time Disney introduced earnings, Bob Chapek’s efficiency was so unhealthy that the Disney board introduced Iger again aboard to redirect the corporate. While he’s already needed to combat with activist investor Nelson Peltz— there have been dueling letters this week as Peltz seeks a seat on the Disney board — this might be Iger’s true return to the Wall Street stage. The longtime CEO has all the time had a knack for taming buyers, typically showing dwell on CNBC between the bell and the convention name on earnings day, typically dropping secret nuggets of information for followers all through the afternoon. Listen for him on Wednesday to see what he expects to alter after changing Chapek. For extra: Wall Street reveals love for Bob Iger, ‘perhaps the best leader in media’

-

Take-Two: Any hints on when we’re going to see “Grand Theft Auto VI?” Analysts try to time the sport’s launch, as it would possible result in a flood of revenue that might…simply carry on going, if “GTA V” — nonetheless one of many largest sellers yearly and the most important ever — is any indication. Take-Two Interactive Software Inc.

TTWO

experiences Monday, after its inventory fell greater than 40% in 2022 amid a merger with Zynga. Results will possible depend on vacation gross sales of “NBA 2K23″, however analysts will need news concerning the pipeline. The similar afternoon, videogame writer Activision Blizzard Inc.

ATVI

will announce earnings, however once more not host a convention name because it awaits its acquisition by Microsoft. Read: As players await ‘Grand Theft Auto VI,’ Take-Two possible has ‘major announcements right around the corner,’ analyst says

The numbers to look at

-

Food costs: Groceries, ready meals and even snacks have seen larger costs in waves of inflation, and executives will give clues about their plans for pricing going ahead almost daily of the week: Tyson Foods Inc.

TSN

on Monday, Chipotle Mexican Grill Inc.

CMG

on Tuesday, Yum Brands Inc.

YUM

on Wednesday and wrapping up with PepsiCo Inc.

PEP,

Kellogg Co.

Okay

and Flowers Foods Inc.

FLO

on Thursday. Listen out for a number of the phrases they used to recommend they may nonetheless elevate costs in the event that they needed to final season: “pricing power,” “strong pricing” or “price realization.” -

Ride-hailing costs and demand: In their most up-to-date outcomes, Lyft Inc.

LYFT

upset with its variety of rides, however confirmed a lot larger income per trip, whereas Uber Technologies Inc.

UBER

rides elevated 19% as gross bookings ran up 45% on a constant-currency foundation. Both of these recommend rising costs, which may have an effect on demand that has been steadily rising within the third 12 months of the COVID-19 pandemic. Compare bookings and income progress with riders and rides growths when Uber experiences Wednesday morning and Lyft on Thursday afternoon. Read extra: Food costs hold rising. Food-company execs are betting Americans will hold paying.

Source web site: www.marketwatch.com