Early futures motion signifies Friday may even see the S&P 500

SPX

get well a small portion of the two.8% misplaced over simply the final three periods.

Equities buckled as implied borrowing prices of various period shot up. The yield on 2-year Treasurys

BX:TMUBMUSD02Y

hit their highest since 2006, and for 10-years

BX:TMUBMUSD10Y

it was probably the most since 2007.

Investors may even lock in a 4.55% yield from the 30-year U.S. bond, or lengthy bond,

BX:TMUBMUSD30Y,

the most effective since 2011, ought to they need to take action.

But they need to not, warns hedge fund titan Bill Ackman: “I believe that long-term rates, e.g, 30-year rates, will rise further from here. As such, we remain short bonds through the ownership of swaptions.” (A swaption is a kind of choices contract that permits patrons to enter right into a swap settlement at a specified rate of interest for a particular interval.)

In a protracted message posted on on X late Thursday, the boss of Pershing Square Capital Management introduced a litany of the reason why longer period authorities paper shall be pressured in coming years.

Let’s begin with inflation, which significantly hurts longer-maturity mounted earnings, and which Ackman reckons goes to be stubbornly greater than individuals presently suppose.

“The world is a structurally different place than it was,” Ackman says. “The peace dividend is no more. The long-term deflationary effects of outsourcing production to China are no more. Workers and unions’ bargaining power continues to rise. Strikes abound, with more likely to come as successful walkouts achieve substantial wage gains,” he provides.

Rising vitality costs additionally will proceed to construct inflationary pressures. The U.S. must refill its strategic petroleum reserve whereas OPEC and Russia curb manufacturing, and “the green energy transition is and will remain incalculably expensive,” he says.

Furthermore, with the U.S financial system outperforming expectations, recession predictions have been pushed again to 2024. “The long-term inflation rate is not going back to 2% no matter how many times Chairman Powell reiterates it as his target. It was arbitrarily set at 2% after the financial crisis in a world very different from the one we live in now,” says Ackman.

Then there’s provide. The U.S. nationwide debt is $33 trillion and rising quickly with no signal of fiscal self-discipline by both occasion, Ackman observes. Major authorities infrastructure spending is including to the debt load. The authorities is promoting lots of of billions of payments, notes and bonds weekly, whereas the Fed can also be offering provide by beginning its quantitative tightening.

“Imagine trying to do a massive IPO where the underwriter, insiders and short sellers are all selling at once, competing to hit every bid on the way down while the analysts downgrade their ratings to ‘Sell’,” says Ackman.

Which brings us to demand. Ackman notes that China and different international nations, traditionally main patrons of U.S debt, at the moment are promoting, maybe scared off by Washington’s finances machinations.

“Each debt ceiling is an opportunity for our divided government and its most extreme actors to get media attention, and for our nation to threaten default. This is not a good way to recruit the many new buyers we need for our bonds,” Ackman bemoans.

He describes lately assembly the chief funding officer of one of many world’s largest mounted earnings asset managers and asking the way it was going: “He looked like he had had a tough day. He greeted me by saying: ‘There are just too many bonds’ — a veritable tsunami of new issuance each week. I asked him what he was going to do about it. He said: ‘The only thing you can do is step away’.”

Ackman reckons that the most effective clarification for long-term charges being as little as they nonetheless are is that as a result of bond yields hadn’t been above 4% for practically 15 years, that degree appeared enticing. “When investors saw the ‘opportunity’ to lock in 4% for 30 years, they grabbed it as a ‘once-in-their-career opportunity,’ but today’s world is very different from the one they have experienced up until now,” he says.

So, the place ought to yields be? “The long-term inflation rate plus the real rate of interest plus term premium suggests that 5.5% is an appropriate yield for 30-year Treasurys. And [I] query whether 0.5% is a sufficient real long term rate in an increasingly risky world,” says Ackman.

“It wasn’t that long ago that a previous generation thought five percent was a low rate of interest for a long-term, fixed-rate obligation. But I could be wrong. AI might save us.”

Markets

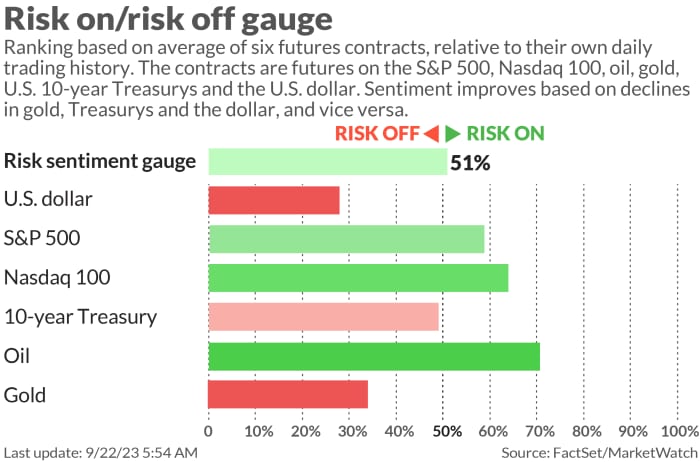

U.S. stock-index futures

ES00,

YM00,

NQ00,

are largely mildly firmer as benchmark Treasury yields

BX:TMUBMUSD10Y

inch decrease. The greenback

DXY

is greater, whereas oil costs

CL.1,

acquire and gold

GC00,

rises.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

U.S. financial knowledge on Friday, embrace S&P flash manufacturing and providers PMIs for September, due at 9:45 a.m. Eastern.

Now the Federal Reserve has made its September coverage determination the members are free to begin chatting publicly once more. Fed Governor Lisa Cook will communicate at 8:50 a.m., Boston Fed President Susan Collins will make feedback at 10 a.m., whereas Minneapolis Fed President Neel Kashkari and San Francisco Fed President Mary Daly speak at 1 p.m..

The Bank of Japan stored rates of interest in detrimental territory and stated it might keep its ultra-loose financial coverage till inflation sustainably hits its 2% goal. Data launched earlier confirmed core annual inflation of three.1% in August, the seventeenth consecutive month that inflation has been sustained above the BoJ’s goal.

The U.Ok’s competitors regulator stated it might provisionally approve Microsoft’s

MSFT,

$75 billion acquisition of Activision Blizzard

ATVI,

Shares of Scholastic Corp.

SCHL,

are dropping 19% in premarket motion after the kids’s ebook writer reported a worse-than-expected second-quarter loss.

Amazon.com

AMZN,

says it is going to add restricted promoting to Prime Video service beginning in early 2024.

Best of the online

How Xi Jinping is taking management of China’s inventory market.

The U.S. could possibly be in a recession and we simply don’t realize it but.

Amazon’s new problem: discount retailers who’re enjoying a special recreation.

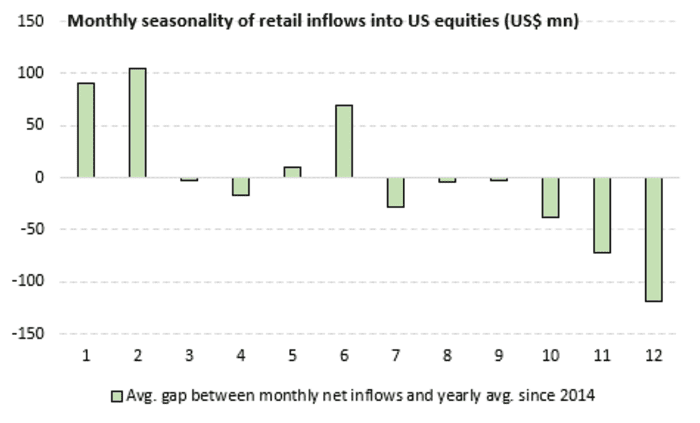

The chart

Markets are quick approaching the fourth quarter, towards the top of which tends to be an excellent time for shares. Intriguingly, although, that’s simply when retail traders pull again from the motion, based on this chart of web inflows from Vanda Research.

“[H]istorical data indicates that retail investors typically exhibit reduced buying activity during the fourth quarter…While pinpointing the precise cause remains elusive, the recurrent nature of this pattern is clear,” says Vanda.

Source: Vanda Research

Top tickers

Here have been probably the most energetic stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

NIO, |

NIO |

|

TTOO, |

T2 Biosystems |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

GME, |

GameStop |

|

NKLA, |

Nikola |

|

MULN, |

Mullen Automotive |

Random reads

Fake cricket — as if it’s not difficult sufficient.

World’s largest – and stinkiest – flower in peril of extinction.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton

Source web site: www.marketwatch.com