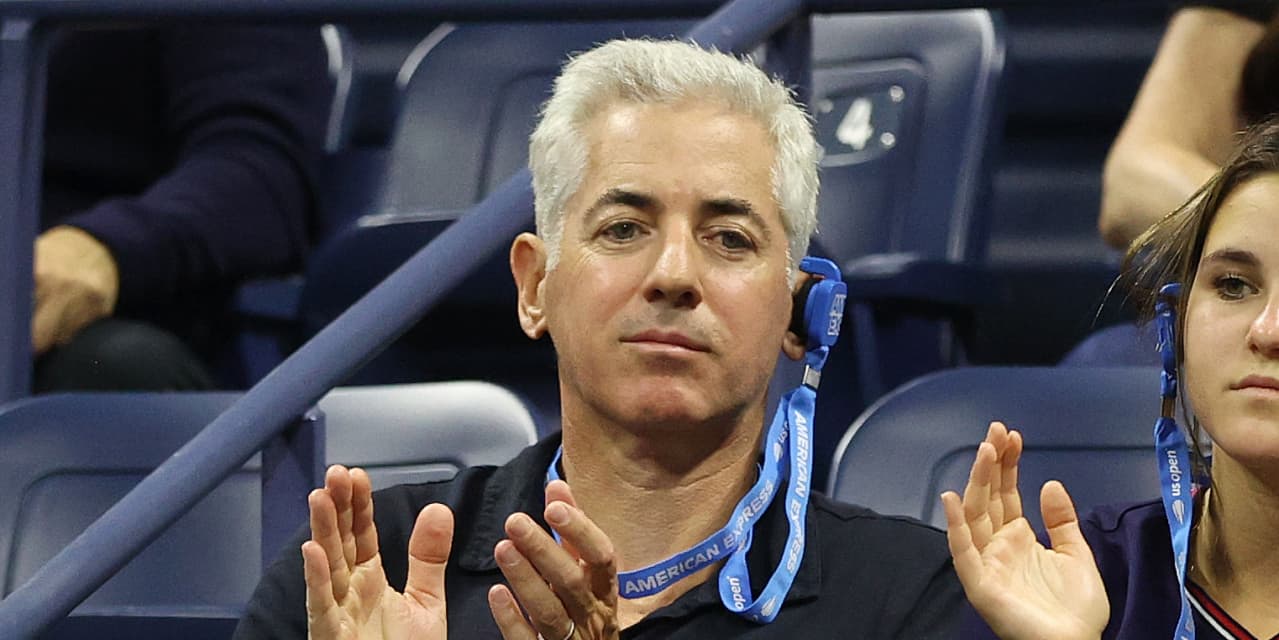

Bill Ackman’s Pershing Square Capital Management has re-entered the ranks of the world’s 20 finest performing hedge funds following a bumper yr for the New York cash supervisor after it beforehand dropped off the record in 2015.

The New York fund, which has $17.9 billion in belongings beneath administration (AUM), generated internet positive factors price $3.5 billion in 2023, bringing its total positive factors since its inception in 2004 as much as $18.8 billion, analysis by LCH Investments exhibits.

Pershing Square’s enormous positive factors noticed it supplant Louis Bacon’s Moore Capital Management to take backside place on LCH’s record of the world’s 20 prime performing hedge funds in what was described as a “remarkable comeback” for the New York agency.

The New York fund beforehand fell off the record 9 years in the past after struggling a sequence of main losses on investments in corporations together with shopper items firm Procter & Gamble

PG,

retail chain JCPenney , and multi-level advertising and marketing firm Herbalife Nutrition

HLF,

Now, Ackman’s fund has re-captured a spot alongside the 20 prime rating funds, having generated returns price $12.3 billion over the previous three years, in sums equal to virtually two thirds of all positive factors it has generated since beginning up in 2004.

This places Pershing Square again on the record of prime performing funds that collectively generated outsized internet positive factors price $67 billion in 2023 alone – equal to 31% of all positive factors made throughout the hedge fund sector final yr.

| Hedge fund | AUM $bn | 2023 positive factors $bn | Overall positive factors $bn | Year began |

| Citadel | 56.8 | 8.1 | 74.0 | 1990 |

| D.E. Shaw | 43.8 | 4.2 | 56.1 | 1988 |

| Millennium | 61.9 | 5.7 | 56.1 | 1989 |

| Bridgewater | 72.5 | (2.6) | 55.8 | 1975 |

| Elliott | 62.2 | 5.5 | 47.6 | 1977 |

| Soros | N/A | N/A | 43.9 | 1973 |

| TCI | 50.0 | 12.9 | 41.3 | 2004 |

| Viking | 30.5 | 6.0 | 40.9 | 1999 |

| Baupost | 27.4 | 3.8 | 37.0 | 1983 |

| Farallon | 40..4 | 2.6 | 35.7 | 1987 |

| Lone Pine | 15.9 | 4.2 | 35.6 | 1996 |

| Appaloosa | 17 | 2.7 | 35.0 | 1993 |

| SAC/Point 72 | 31.0 | 3.0 | 33.0 | 1992 |

| Och Ziff/Sculptor | 28.7 | 2.3 | 32.2 | 1994 |

| Brevan Howard | 35.6 | 0.4 | 28.5 | 2003 |

| Egerton | 14 | 2.3 | 23.9 | 1995 |

| Davidson Kempner | 37 | 1.8 | 21.0 | 1983 |

| King Street | 9.5 | 0.9 | 19.5 | 1995 |

| Caxton | 13.4 | (0.3) | 19.5 | 1983 |

| Pershing Square | 17.9 | 3.5 | 18.8 | 2004 |

For reference, the highest 20 funds handle simply 18.9% of all belongings managed throughout the sector, managing belongings price $665.5 billion in comparison with the $2.85 trillion in belongings managed by all different remaining funds.

These enormous positive factors have, nevertheless, seen the highest 20 generate 83% of all positive factors generated by hedge funds over the previous three years.

In financial phrases, this has seen the highest 20 generate internet positive factors price $775.4 billion since their inception in comparison with the $862 billion positive factors made by all remaining hedge funds within the sector.

In share phrases, the highest 20 produced common returns of 10.5% in 2023 in comparison with the 6.4% common returns throughout the sector.

Sir Chris Hohn’s The Children’s Investment Fund Management (TCI Fund) achieved the best positive factors in 2023, producing internet positive factors price $12.9 billion final yr, bringing its total internet positive factors since inception as much as $41.3 billion since beginning in 2004.

TCI Fund’s enormous positive factors in 2023 noticed it soar seven locations within the rankings of these hedge funds which have made the most important quantities of cash since beginning, rising from 14th place in 2022 to seventh place on this yr’s record.

Ken Griffin’s Citadel LLC has, in the meantime, generated larger positive factors since its inception than any rival hedge fund on the planet, in attaining internet positive factors price $74 billion since beginning in 1990, on the again of positive factors price $8.1 billion in 2023.

Citadel’s huge $74 billion positive factors over the previous three a long time noticed it sit properly out in entrance forward of joint second placers D.E. Shaw & Co and Millennium Management, which have each generated internet positive factors price $56.1 billion since beginning in 1988 and 1989 respectively.

Together these prime three hedge funds have generated virtually two fifths (38.3%) of all positive factors achieved by the hedge fund sector over the previous three years, in reaping internet positive factors price $71.2 billion, regardless of controlling simply 4.6% of all belongings managed by the sector.

Edmond de Rothschild CEO Rick Sopher defined the outsized positive factors made by the world’s prime hedge funds was partly a results of their willingness to pay enormous quantities of cash for entry to prime expertise. “These firms are clearly also able to pay more aggressively to attract the best talent,” Sopher stated.

Ray Dalio’s Bridgewater Associates trailed intently behind the highest three companies, having generated $55.8 billion since beginning in 1975, regardless of making a $2.6 billion loss in 2023 which noticed it drop from 2nd to 4th place on LCH’s record.

Elliott Investment Management jumped a single place within the rankings, from sixth to fifth place, having generated internet positive factors price $47.6 billion since its inception in 1977, on the again of internet positive factors price $5.5 billion in 2023.

Source web site: www.marketwatch.com